PARKING STRUCTURE COST OUTLOOK FOR

RAYMOND SMITH, PE, VICE PRESIDENT, WGI

WGI has specialized in parking structure planning and design since

1983, and our annual parking structure construction cost report

provides an important planning tool for owners, contractors, and

design teams.

WGI maintains a database of completed parking structure projects and

developed a methodology to analyze the historical cost information

to assist our clients and the industry. Our construction cost database

contains hundreds of completed parking structure projects of varying

size, scope, and geographic location. For this forecast, we only omit

the cost of parking structures that are completely or significantly

below grade, since their cost is much higher. The cost data is assigned

factors based on the time of bidding and location of the parking

structure. The time factor is based on the Building Cost Index (BCI),

published by Engineering News-Record (ENR). The location factor is

taken from the yearly edition of the RS Means Building Construction

Cost Data. Applying these two factors to actual construction cost data

adjusts the cost to a current national basis and from that we determine

the national median. The national median can then be re-adjusted to

reflect a median construction cost in almost every city in America.

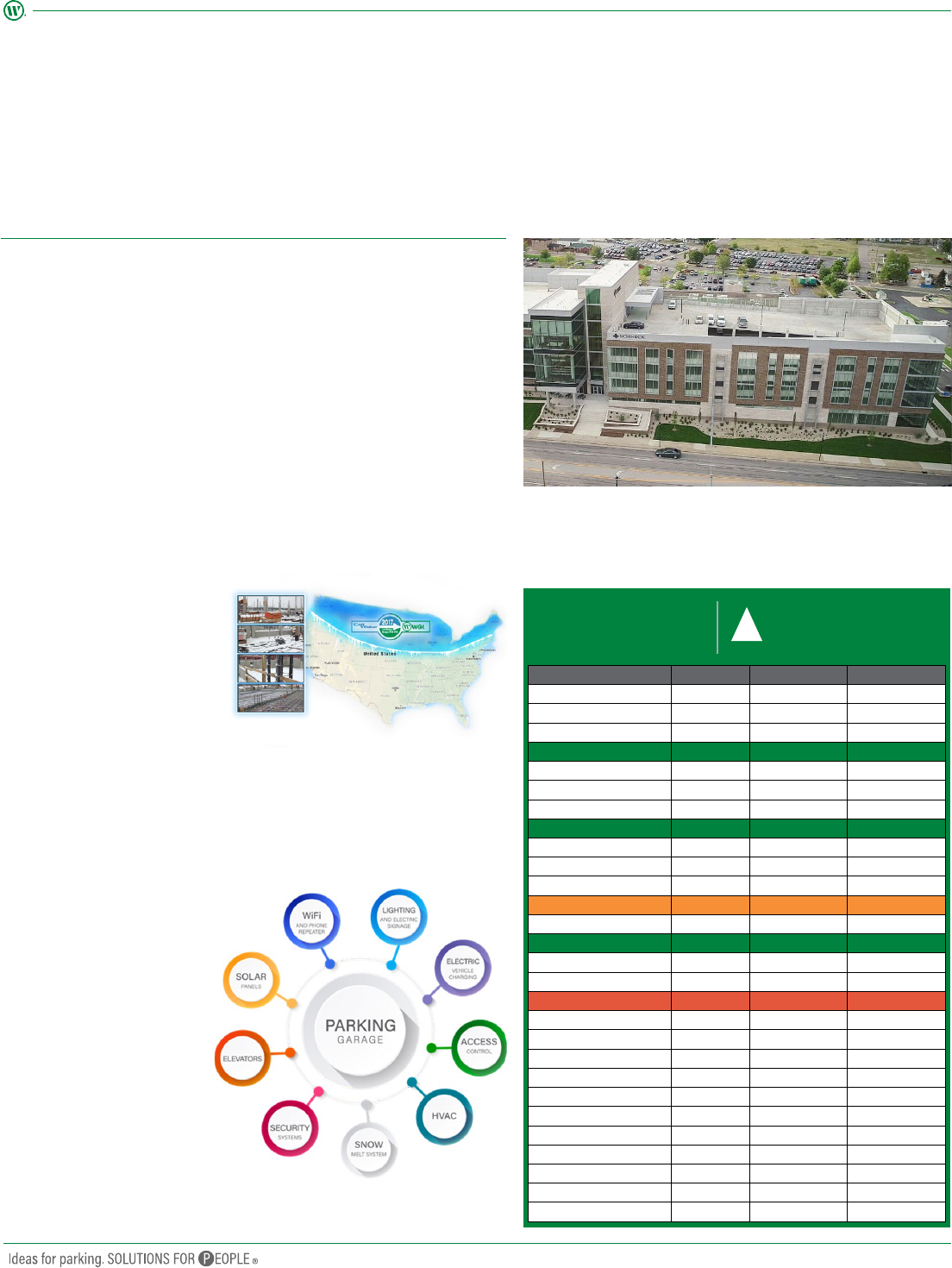

As of May 25, 2020, our statistical data indicates that the median

construction cost for a new parking structure is $22,200 per space,

or $66.34 per square foot; a 3.3% increase from 2019 when the

median cost was $21,500 per space. The table below lists the 2020

median parking structure construction costs in various U.S. cities with

the lowest cost shared by Charlotte, Dallas, and Miami, the highest in

New York, and Kansas City, MO at the national median of 100.0.

It should be noted that the construction cost data does not include

costs for items such as land acquisition, architectural and engineering

fees, environmental evaluations, materials testing, special inspections,

geotechnical borings and recommendations, financing, owner

administrative and legal, or other project soft costs. Soft costs are

typically about 15% to 20% of construction costs, but can be higher

for owners who allocate their internal costs directly to the project.

Four-level parking structure constructed entirely of precast concrete with integrally

colored precast and face brick.

Oices Nationwide // 800.394.7275 // WGInc.com

THE STRONG MUSEUM OF PLAY PARKING STRUCTURE, ROCHESTER, NY

Oices Nationwide // 800.394.7275 // WGInc.com

FOR COMPARISON, A MEDIANCOST PARKING STRUCTURE TODAY TYPICALLY INCLUDES:

384-space parking structure with brick and stone façade that complements the

main building on the medical campus. The project is part of a multi-year, multi-

phase expansion which includes a five-story medical oice. Additional surgical

areas will also be developed with the main hospital to better serve patients.

City Index Cost/Space Cost/SF

Atlanta 88.0 $19,536 $58.38

Baltimore 94.0 $20,868 $62.36

Boston 116.0 $25,752 $76.95

Charlotte – Lowest 85.0 $18,870 $56.39

Chicago 119.0 $26,418 $78.94

Cleveland 96.0 $21,312 $63.68

Denver 91.0 $20,202 $60.37

Dallas – Lowest 85.0 $18,870 $56.39

Detroit 101.0 $22,422 $ 67. 00

Houston 87.0 $19,314 $5 7. 7 1

Indianapolis 92.0 $20,424 $61.03

Kansas City, MO – Median 100.0 $22,200 $66.34

Los Angeles 112.0 $24,864 $74.30

Miami – Lowest 85.0 $18,870 $56.39

Minneapolis 106.0 $23,532 $70.32

Nashville 87.0 $19,314 $5 7. 7 1

New York – Highest 132.0 $29,304 $87. 5 7

Philadelphia 11 7.0 $25,974 $7 7. 61

Phoenix 89.0 $19,758 $59.04

Pittsburgh 102.0 $22,644 $67.66

Portland 102.0 $22,644 $67.66

Richmond 88.0 $19,536 $58.38

St. Louis 101.0 $22,422 $ 67.00

San Diego 109.0 $24,198 $72.31

San Francisco 129.0 $28,638 $85.58

Seattle 109.0 $24,198 $72.31

Washington, D.C. 95.0 $21,090 $63.02

National Median 100 $22,200 $66.34

TODAY’S PARKING STRUCTURE CONSTRUCTION COST

WOULD BE HIGHER THAN THE MEDIAN IF IT INCLUDES THESE

ENHANCED FEATURES:

• 9’-0” wide parking spaces for improved user comfort

• Cast-in-place post-tensioned concrete superstructure for lower

maintenance costs

• Attractive façade with adorned precast, brick, metal panels, and

other materials

• Storm-water management including on-site retention / detention

• Deep foundations such as caissons or piling

• Below-grade construction

• Enclosed stair towers due to local code requirements

• Enclosed parking structure without natural ventilation where

mechanical ventilation and fire sprinklers are required

• Flexibility for future

parking / building

expansion, or

incorporation of roof-level

solar panels

• Service life in northern /

coastal regions beyond a

standard 50 to 60 years

• Grade-level commercial

space

• Mixed-use development where the parking is integrated with

oice, retail, residential, or other uses

• Custom wayfinding and signage system

• ParkSmart® Certification following the Green Business

Certification, Inc. (GBCI) program

• Energy eicient LED lighting

with occupancy and

photocell computer-

control system

• Enhanced parking

technology

– License plate

recognition

– Parking-guidance

system

– Car-count system with

variable-message LED

signs

– WiFi and cellular services

– Solar-energy collection

– Building Management System

• 8’-6” to 8’-9” wide parking spaces

• Precast concrete superstructure

• Precast concrete façade with a basic reveal pattern

• Glass-backed elevators and unenclosed stairs clad with

exterior glass curtain wall

• Standard wayfinding and signage

• Shallow-spread footing foundations

• All above-grade construction

• Open parking structure with natural ventilation; without

mechanical ventilation or fire sprinklers

• Minimal or no grade-level commercial space

• Standard parking access and revenue-control system

• Standard energy eicient LED lighting

Building Management Systems are

often used to help manage technology

2020 3.3%

CONSTRUCTION COST

FROM 2019

Oices Nationwide // 800.394.7275 // WGInc.com

FIRST QUARTER PREPANDEMIC

Heading into 2020 and prior to the Coronavirus (COVID) pandemic,

the key concerns were still labor shortages in construction trades,

taris, and trade relationships. The construction market showed

signs of slowing down, but growth was expected to continue into

2020. Likewise, construction of mixed-use and stand-alone parking

structures was to remain steady. Prior to the COVID pandemic industry

experts reported the following regarding construction activity:

• The American Institute of Architects (AIA) chief economist Kermit

Baker, PhD stated that, “design activity at architecture firms,

historically a very accurate leading indicator of future construction

activity, showed unexpected weakness earlier in 2019. However,

design billings improved during the fourth quarter, and new projects

coming into architecture firms saw strong growth toward the end

of the year. So, while 2020 and 2021 are expected to see only very

modest gains in construction spending nationally, the prospects of

a more significant downturn over this period have dimmed recently.”

The article also reported that, “The American Institute of Architect’s

Consensus Construction Forecast Panel is projecting just a 1.5%

increase in spending on nonresidential buildings this year and less

than 1% increase in 2021, according to recently released results.”¹

• Turner Construction’s Turner Building Cost Index, which tracks

construction costs, indicated 1.29% increase in the fourth quarter

of 2019 and a 4.84% increase during 2019. Its 2019 Fourth Quarter

Forecast states that, “We continue to see the construction market

fairly busy with several large projects starting in the fourth quarter

of 2019.”²

• ENR reported in its 2019 Fourth Quarter Cost Report a forecasted

1.6% increase in the Building Cost Index for 2020.³

• ENR reported in its 2020 First Quarter Cost Report that, “The concern

about the emergence of COVID-19, as the disease caused by the virus

is known, has had surprisingly little impact on industry executives’

views of the construction market in the near term, at least as seen in

the latest results of ENR’s latest Construction Industry Confidence

Index (CICI) survey. It rose four points to 56 in the first quarter of

2020 from the fourth quarter of 2019 – an especially surprising result

given that 44% of the surveys came in after the media began heavy

coverage of the health crisis.”⁴

PARKING INDUSTRY CONSTRUCTION ECONOMIC FORECAST

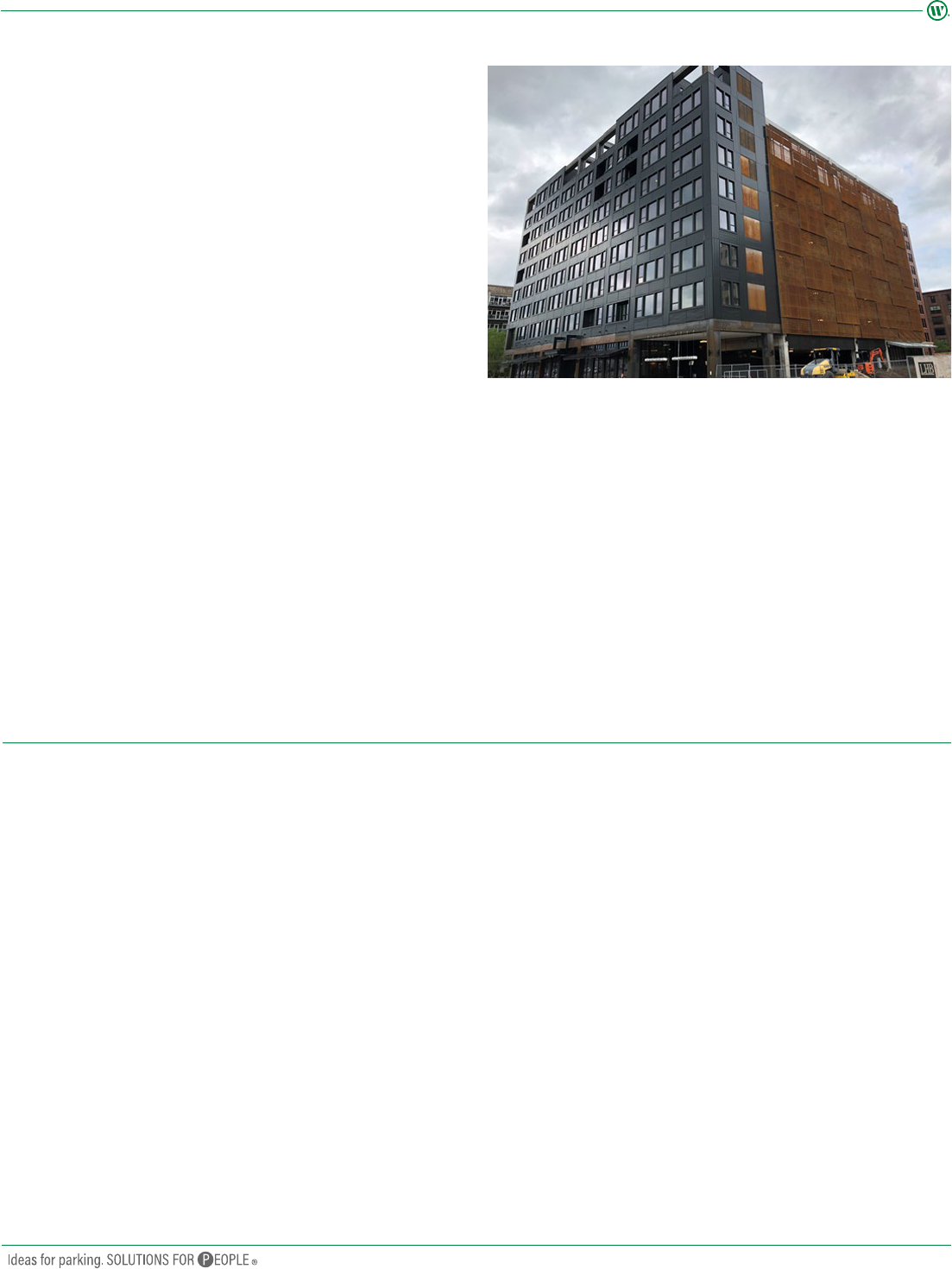

Eight-level, 400-space CIP PT parking structure. The development includes street-level

retail, a nine-story residential building, and a 10-story oice building.

SECOND QUARTER PANDEMIC

During the pandemic shutdown, the AIA Architecture Billings Index

(ABI) score plummeted to 29.5 in April, a new all-time low. Any

number below 50 indicates a decrease in billing. The ABI serves as

a leading economic indicator that leads non-residential construction

activity by approximately 9-12 months. The northeast region was hit

the hardest followed by the south region. Firms in the west region

reported somewhat less dramatic losses than the other regions in

April, but overall, all the regions had significant declines in billings.⁵

This decrease in billings resulted in approximately 11,000 positions, or

approximately 5.5%, lost in architectural firms in April. The construction

industry also lost 995,000 jobs in April, 13% of the workforce.

The AIA published an April 6 update to its 2020 projections for the non-

residential construction industry. The article stated, “The American

Institute of Architect’s Consensus Construction forecast panel is now

projecting an 11% decline, with the sharpest decline predicted to occur

in the commercial construction sector. While a slight 0.6% growth was

originally forecast for 2020, it has now been revised down to a loss of

14%. Institutional construction spending will also be hard hit, although

not quite as seriously as commercial with losses of 7% now projected

versus 2.9% growth predicted in December.”⁶

An article published by For Construction Pros on April 10, 2020,

noted, “Dodge forecasts the square footage of parking garage starts

this year falling 29%, oice starts dropping 13%, retail space down

33%, and hotels and motels down 31%. The biggest commercial

building sector — warehouses — however, is only expected to slip

1%.”⁷

As the world tries to recover from this global pandemic and the

economy here in the United States starts to open up, there remains

uncertainty in the design and construction industry. AIA Chief

Economist Kermit Baker, PhD noted, “A large portion of the design

and construction industry remains mired in steep cutbacks as many

businesses and organizations are still trying to figure out what actions

make sense in this uncertain economic environment.” He went on

to add, “There are growing signs of activity beginning to pick up in

some areas, but others are seeing a pause as pandemic concerns

continue to grow.”⁸

However, there are some positive signs out there. The housing

sector seems to be quickly recovering. The AIA Architecture Billings

Index (ABI), which plummeted to 29.5 in April, rose to 32.0 in May.

Construction employment in May increased by 464,000 jobs.

TOMORROW’S INFRASTRUCTURE SOLUTIONS, TODAY

Oices Nationwide // 800.394.7275 // WGInc.com

SUMMARY

What does all this mean for the construction of new parking structures

and the median construction cost for these facilities in 2020? Before the

COVID pandemic hit, the American Institute of Architect’s Consensus

Construction Forecast Panel was projecting just a 1.5% increase in

spending on non-residential buildings and the Engineering News-Record

forecasts a 1.6% increase in the Building Cost Index. As the economy

starts to reopen, there is just too much ambiguity and not enough data

yet to fully understand the complete impacts of the pandemic, but

early indications point to a significant decline in the institutional (14%

loss) and commercial (7% loss) sectors that traditionally build parking

structures. With the potential reduction in material costs, the reduced

labor shortages, and increased competition, parking structure costs in

2020 may actually decrease in some regions.

The parking professionals at WGI are happy to assist with the budgeting

of your next parking structure. If you have any questions or would like

specific cost information for your area, contact Raymond Smith at

[email protected] or call us at 800.FYI.PARK (800.394.7275).

WGI is an ENR Top 500 engineering and consulting firm specializing

in Land Development and Municipal Engineering, Traic and

Transportation Engineering, Parking Solutions, Geospatial Services,

Subsurface Utility Engineering, Structural Engineering, Landscape

Architecture, Environmental Sciences, Architecture, Land Planning,

MEP Engineering, New Mobility Services, and Water Resources. The

WGI Parking Solutions group specializes in parking structure design;

structural engineering; parking studies; parking operations consulting;

and restoration of parking structures, plazas, facades, and other

buildings just as Carl Walker did for 33 years.

REFERENCES

1. “A marked slowdown, but no projected decline for

nonresidential building”, by Kermit Baker, Hon. AIA, PhD. The

American Institute of Architects, from AIA website: https://

www.aia.org/articles/6260039-a-marked-slowdown-but-no-

projected-decline.

2. Turner Construction Company. “Turner Building Cost Index –

2019 Fourth Quarter Forecast,” Turner Construction Company

website: http://www.turnerconstruction.com/cost-index.

3. “Analysts See Oil and Steel Price Drops as Growth Slows”,

by Alisa Zevin, Engineering News Record, December 23/30,

2019.

4. “Will the Coronavirus Stunt Construction’s Rising Market”, by

Gary J. Tulzcz, Engineering News Record. March 16/23, 2020.

5. “ABI April 2020: Business conditions at architecture firms

weaken even further” The American Institute of Architects,

from AIA website: https://www.aia.org/pages/6296537-abi-

april-2020-business-conditions-at-arch.

6. “An update on 2020 projections for the nonresidential

construction industry”, The American Institute of Architects,

from AIA website: http://www.aia.org/pages/6287230-an-

update-on-2020-projections-for-the-nonr.

7. “Dodge Reforecast: COVID-19 Impact on 2020 Construction

Starts”, For Construction Pros Website: https://www.

forconstructionpros.com/business/news/21128029/dodge-

data-analytics-dodge-reforecast-covid19-impacts-on-2020-

construction-starts.

8. “Architecture billings downward trajectory moderates”, The

American Institute of Architects, from AIA website: https://

www.aia.org/press-release/6306192-architecture-billings-

downward-trajectory-.

STUDIO PARK MIXED-USE DEVELOPMENT, GRAND RAPIDS, MI