Staff Report: Initial Statement of Reasons

Date of Release: April 12, 2022

Date of Hearing: June 9, 2022

California Air Resources Board

Public Hearing to Consider the Proposed

Advanced Clean Cars II Regulations

Staff Report: Initial Statement of Reasons

Date of Release: April 12, 2022

Scheduled for Consideration:

Board Hearing Date – June 9, 2022

This report has been reviewed by the staff of the California Air Resources Board and

approved for publication. Approval does not signify that the contents necessarily reflect the

views and policies of the California Air Resources Board, nor does mention of trade names or

commercial products constitute endorsement or recommendation for use.

Staff Report: Initial Statement of Reasons

Date of Release

: April 12, 2022

Date of Hearing: June

9, 2022

Table of Contents

Executive Summary ................................................................................................................... 4

I. Introduction and Background ................................................................................................. 0

A. Regulatory History .......................................................................................................... 1

II. The Problem the Proposal is Intended to Address ............................................................... 3

A. Need for Emission Reductions ....................................................................................... 5

B. Advancing Environmental Justice ................................................................................... 9

C. California has unique authority under federal law to regulate vehicle emissions ......... 10

D. California has broad authority under California law to regulate vehicle emissions ...... 11

III. Summary of Staff’s ZEV Regulation Proposal ..................................................................... 12

A. Background .................................................................................................................. 12

1. ZEV Technologies ......................................................................................................... 12

2. ZEV Technology is Rapidly Improving .......................................................................... 13

3. Expansion of the ZEV Market ....................................................................................... 18

4. Importance of the Used Vehicle Market ...................................................................... 21

5. Consumer Challenges Exist and Must be Addressed .................................................. 21

6. Complementary Policies: Equitably Building a Successful ZEV Market ....................... 24

B. Need for Proposed ZEV Regulations ............................................................................ 35

C. Proposed Requirements and Feasibility ....................................................................... 36

1.

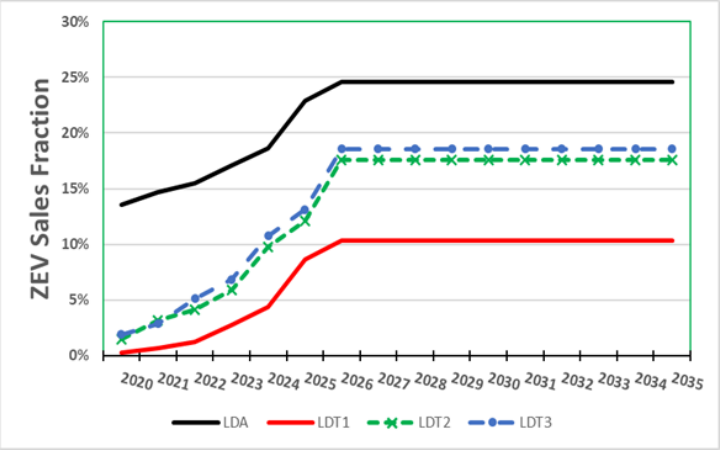

ZEV Stringency: Annual ZEV Percentage Requirements ............................................ 36

2. Proposed ZEV Requirement Structure and Compliance Rules .................................. 42

3. Minimum Technical Requirements for ZEVs ............................................................... 46

4. PHEV Allowance and Minimum Technical Requirements ........................................... 56

5.

Environmental Justice Allowances ............................................................................. 60

6.

Early Compliance Values ............................................................................................ 66

7.

SVM treatment ........................................................................................................... 67

8.

Summary of ZEV Regulation Proposals ...................................................................... 67

D. ZEV Assurance Measures .............................................................................................. 69

1. On-Vehicle Data Standardization ................................................................................. 71

2. Durability ...................................................................................................................... 72

3. Warranty ....................................................................................................................... 77

4. Service Information ...................................................................................................... 83

5. Battery Labeling ........................................................................................................... 84

6. Summary of ZEV Assurance Measure Proposals .......................................................... 88

IV. Summary of Staff’s LEV Proposals ...................................................................................... 89

A. Background .................................................................................................................. 90

1. Certification Requirements for Light-Duty Vehicles .................................................. 90

2. Emission Bins and Fleet-Average Standards ................................................................ 90

3. Cold-Start Emissions .................................................................................................... 91

4. High-Powered Starts for PHEVs ................................................................................... 91

5. PM Standards for Aggressive Driving Conditions ........................................................ 92

6. Medium-Duty Vehicles ................................................................................................. 92

7. Conforming amendments to related regulations ......................................................... 93

B. Need for LEV Proposals ................................................................................................ 94

1. Need to Prevent Backsliding of ICEVs as ZEVs Significantly Increase in the New Vehicle

Fleet ................................................................................................................................. 94

2. Need to Reduce High-Powered Cold-Start Emissions from PHEVs ............................. 95

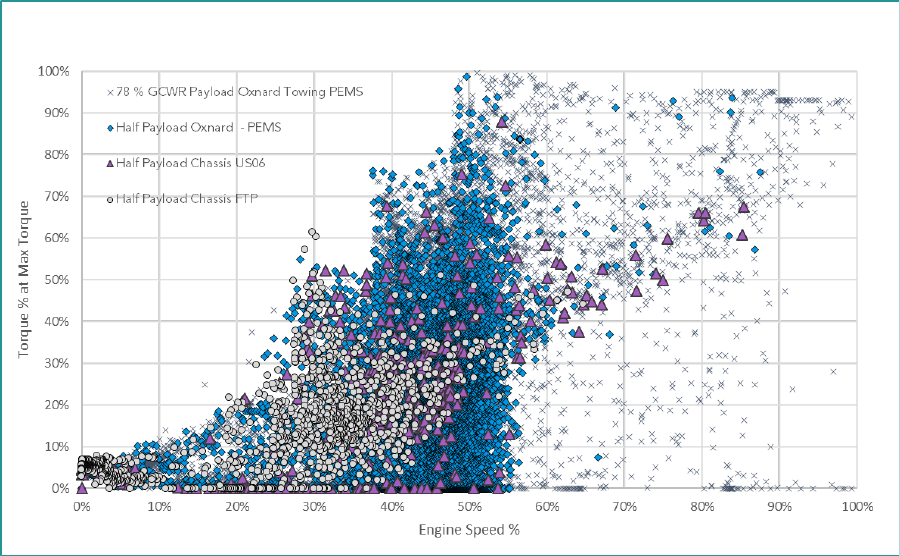

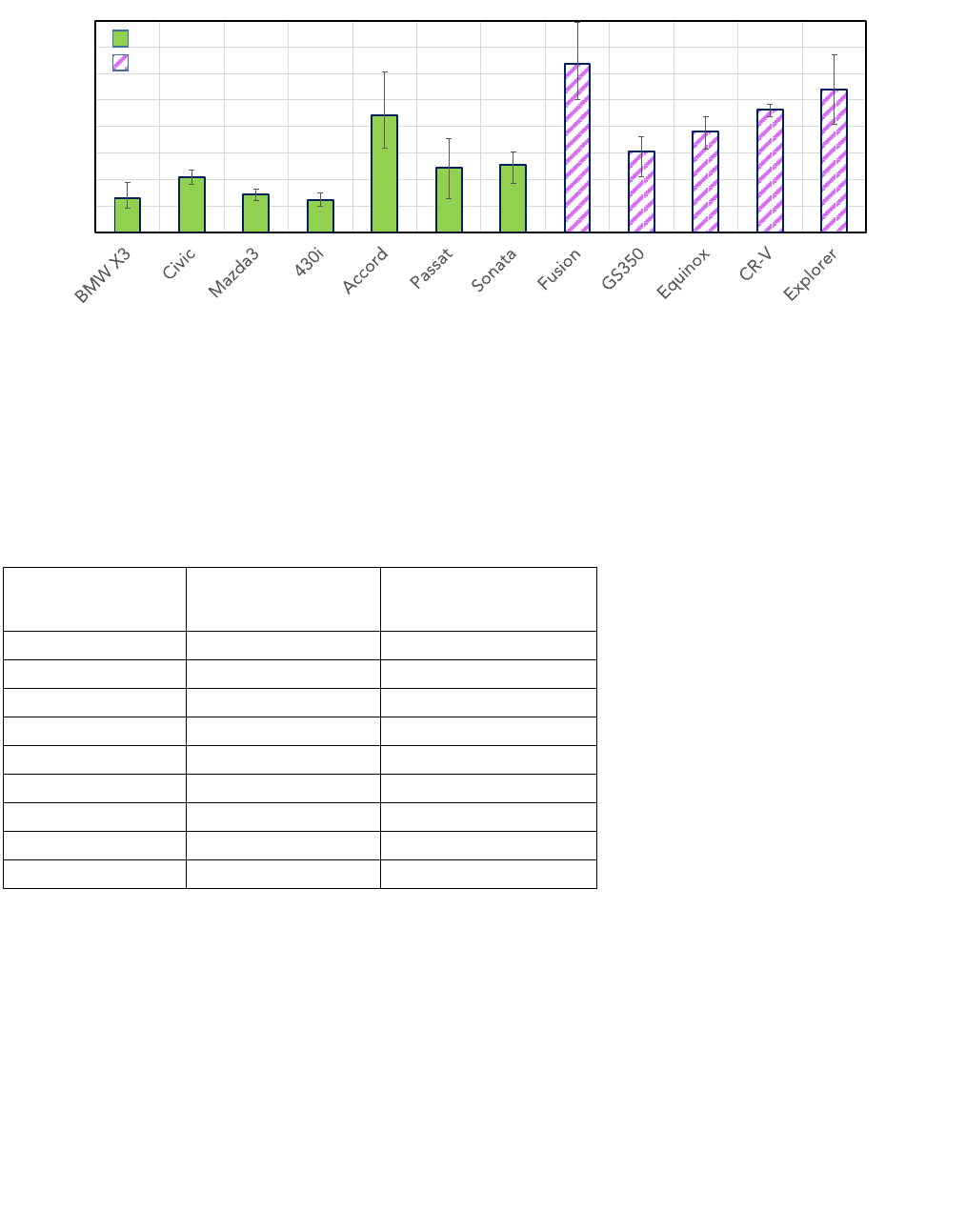

3. Need to Address Cold-Start Emissions Under Real-World Driving Conditions ........... 96

4. Need for More Stringent PM Standards for Aggressive Driving Cycle ...................... 100

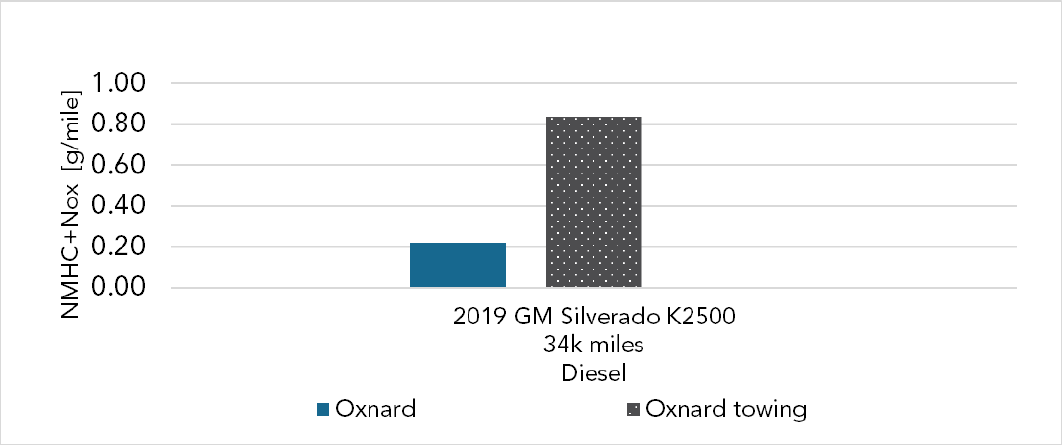

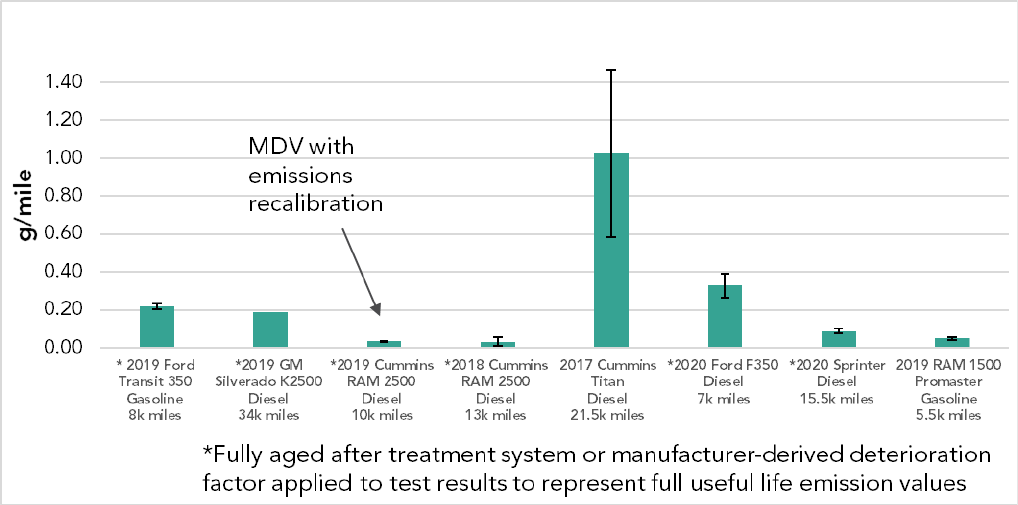

5. Need for In-Use Standards for Medium-Duty Vehicles .............................................. 100

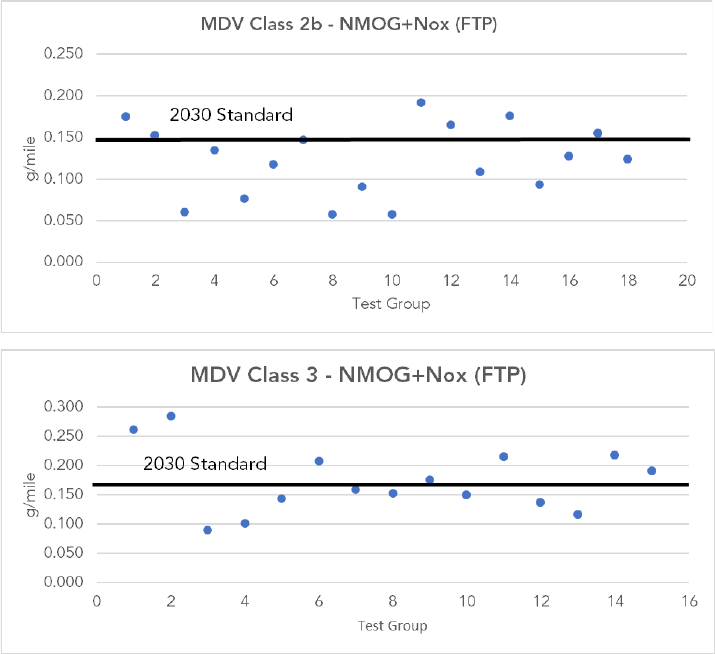

6. Need for More Stringent Standards for Medium-Duty Vehicles ................................ 102

7. Need to amend the OBD regulations ........................................................................ 103

C. LEV Proposals and Feasibility ..................................................................................... 104

1. Proposal: Fleet Average Standard without ZEVs ....................................................... 104

2. Proposal: Stand-Alone Standards for Aggressive Driving .......................................... 105

3. Proposal: PM Standard for Aggressive Driving .......................................................... 109

4. Proposal: Cold-Start Emission Control ....................................................................... 110

5. Proposal: PHEV High-Power Cold-Start Emission Standard ...................................... 116

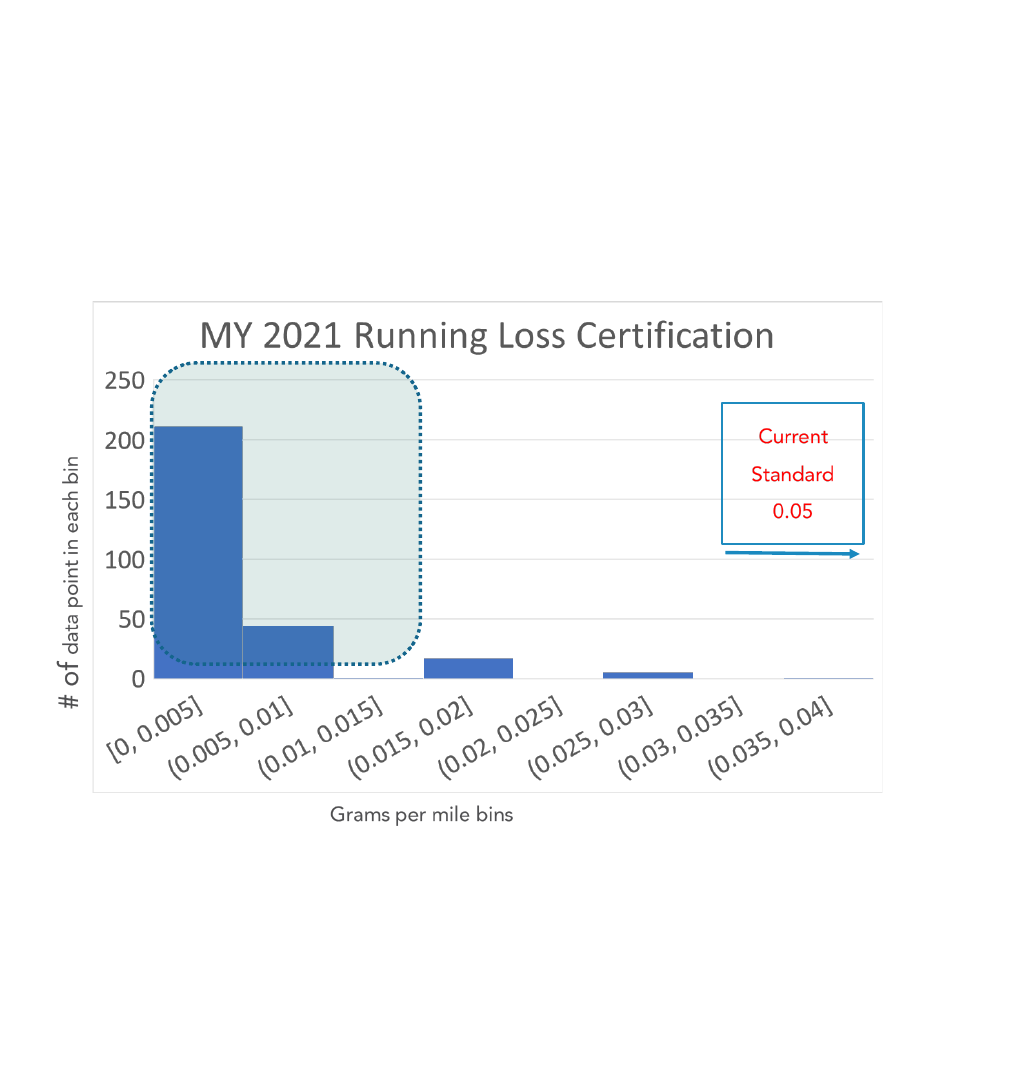

6. Proposal: Lower Running Loss Standard .................................................................... 120

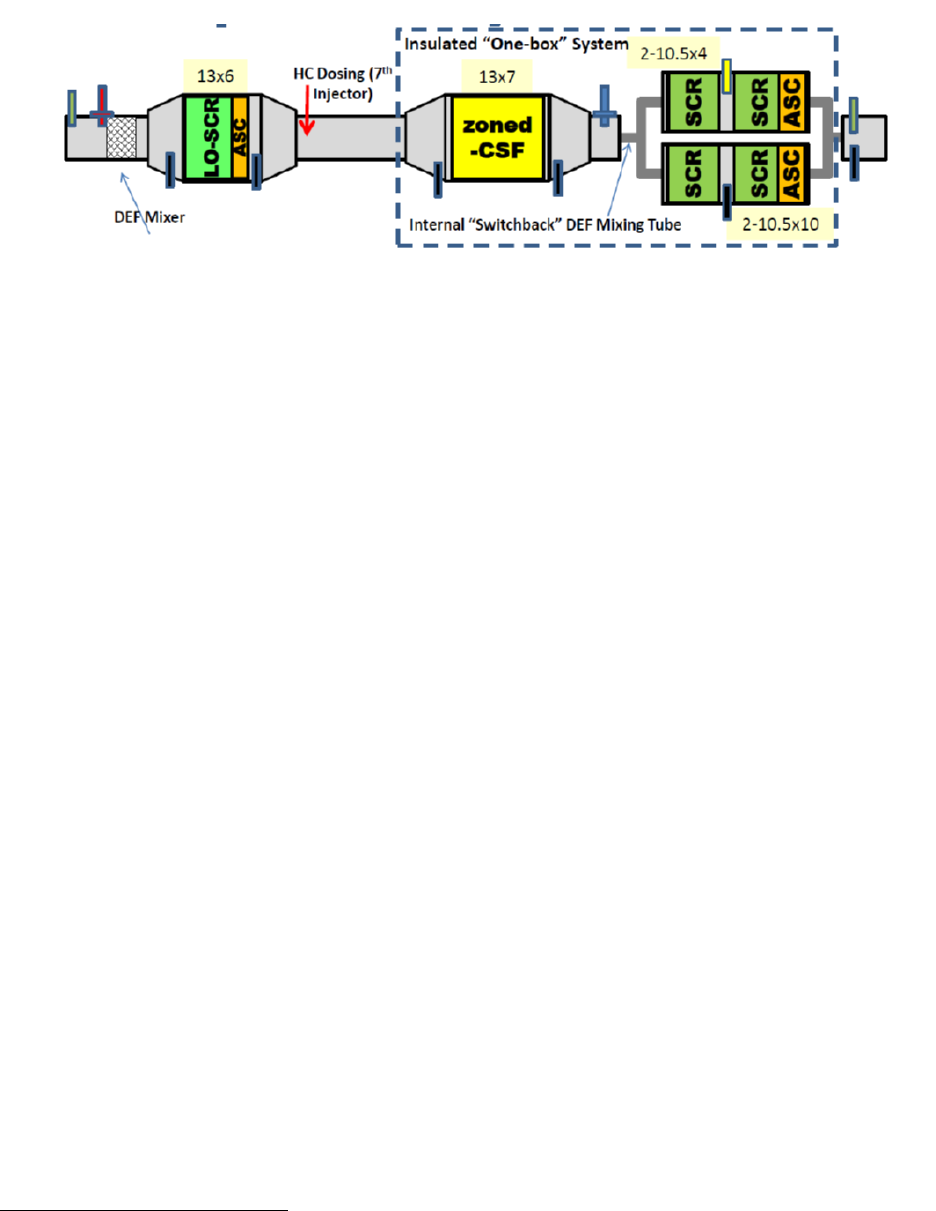

7. Proposal: PEMS In-use Standards for MDVs greater than 14,000 GCWR ................. 121

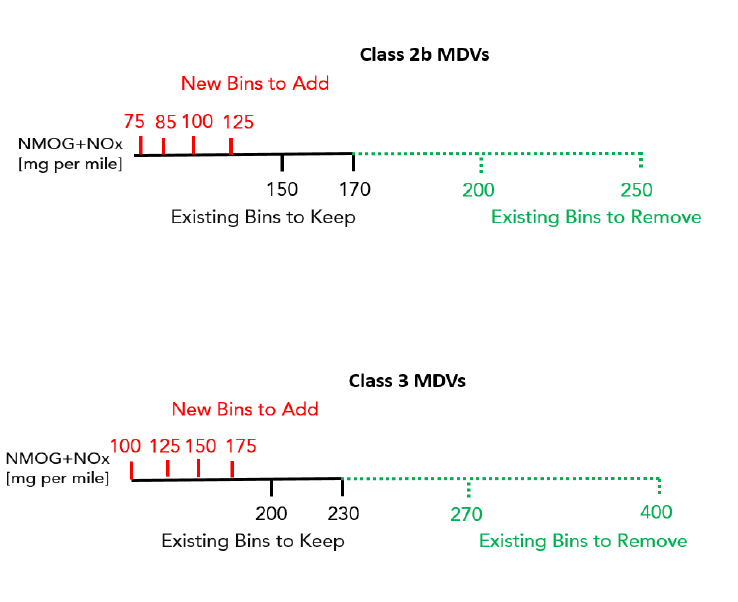

8. Proposal: Lower Emission Standards for MDV ........................................................... 124

9. Proposal: Standalone Standards for MDV for Aggressive Driving Cycles .................. 128

10. Summary of OBD Proposal ...................................................................................... 131

D. Other Test Procedure Modifications .......................................................................... 132

1. Proposed Split of California’s Light- and Medium-Duty Vehicle Test Procedure ...... 132

2. Proposed Split of California’s Evaporative Emissions Test Procedure ....................... 132

3. Proposed Amendments to California’s Non-Methane Organic Gas Test Procedure 133

4. Proposed Amendments to California’s Test Procedures for Evaluating Substitute Fuels

and New Clean Fuels ..................................................................................................... 133

V. The Specific Purpose and Rationale of Each Adoption, Amendment, or Repeal ............. 133

VI. Benefits Anticipated from the Regulatory Action, Including the Benefits or Goals Provided

in the Authorizing Statute ..................................................................................................... 134

A. Summary of Emission Benefits .................................................................................... 134

B. Summary of Health Benefits ....................................................................................... 135

1. Incidence-Per-Ton Methodology ............................................................................... 135

2. Reduction in Adverse Health Impacts ........................................................................ 136

3. Uncertainties Associated with the Mortality and Illness Analysis ............................... 138

4. Monetization of Health Impacts ................................................................................. 138

C. Greenhouse Gas Reduction Benefits - Social Cost of Carbon .................................... 141

D. Benefits to Manufacturers Making ZEVs ..................................................................... 143

E. Benefits to Individuals – Total Cost of Ownership...................................................... 143

VII. Air Quality – Emission Benefits........................................................................................ 145

F. Baseline Assumptions ................................................................................................. 145

G. Total Emission Benefits ............................................................................................... 146

VIII. Environmental Analysis ................................................................................................... 148

IX. Environmental Justice ...................................................................................................... 150

X. Standardized Regulatory Impact Analysis ......................................................................... 155

A. Changes since the release of the SRIA ....................................................................... 156

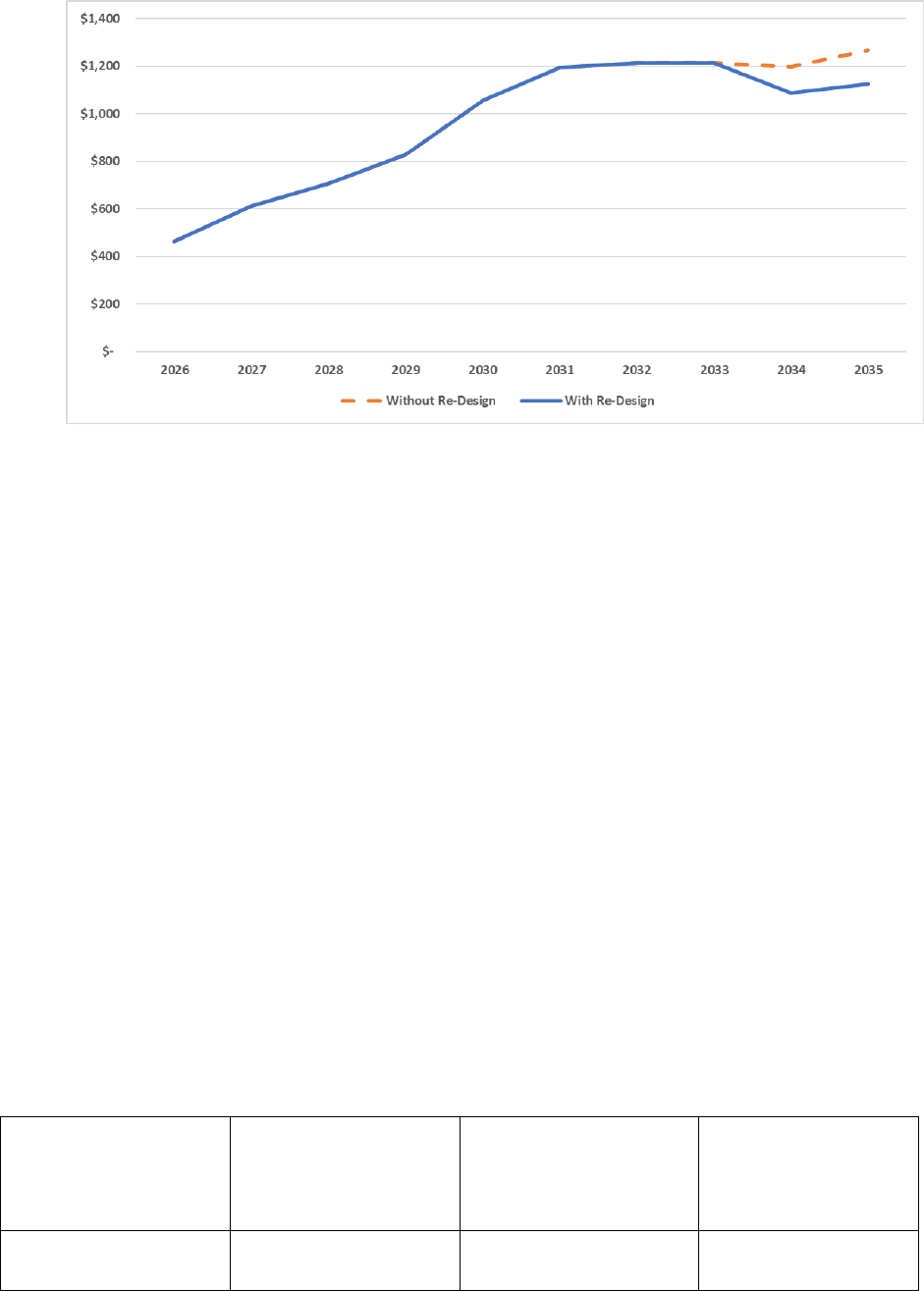

1. Updated Technology Package Cost ........................................................................... 156

2. Updated Baseline Assumptions ................................................................................. 163

3. Updated Minor Assumptions for Fleet Modeling ...................................................... 165

4. Changes to ZEV Sales Requirements ......................................................................... 167

5. Total Costs to the Manufacturer ................................................................................ 167

B. The creation or elimination of jobs within the State of California. ............................. 168

C. The creation of new business or the elimination of existing businesses within the State

of California. ...................................................................................................................... 170

D. The expansion of businesses currently doing business within the State of California. 171

E. Significant Statewide Adverse Economic Impact Directly Affecting Business, Including

Ability to Compete ............................................................................................................ 172

F. The competitive advantages or disadvantages for businesses currently doing business

within the state .................................................................................................................. 172

G. The increase or decrease of investment in the state .................................................. 172

H. The incentives for innovation in products, materials, or processes ............................ 173

I. The benefits of the regulation to the health and welfare of California residents, worker

safety, and the state’s environment. .................................................................................. 173

XI. Evaluation of Regulatory Alternatives .............................................................................. 173

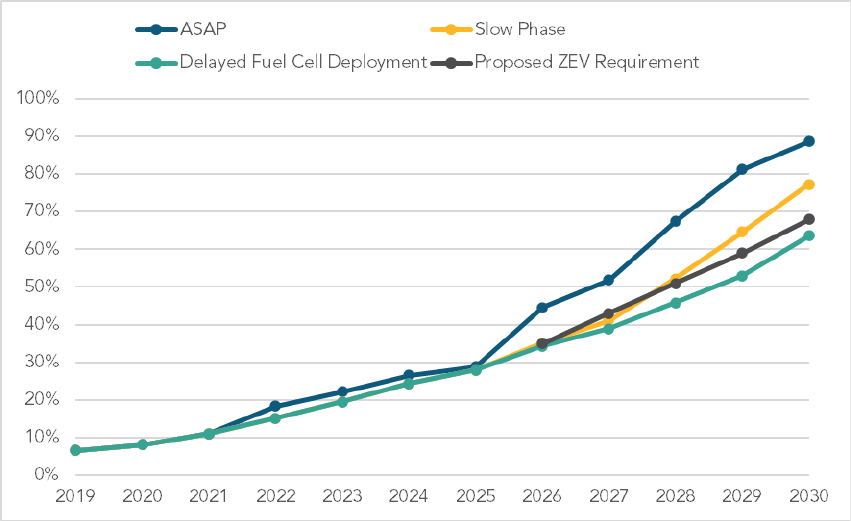

A. Alternative Considered with Different Sales Percentage Requirements Than the

Proposal ............................................................................................................................. 174

1. Description of Alternatives ......................................................................................... 174

2. Total Manufacturer Costs for Alternatives ................................................................. 175

3. Emission Benefits for the Alternatives ........................................................................ 176

4. Health Benefits ........................................................................................................... 177

5. Monetized Health Benefits for Alternatives and Social Cost of Carbon for Alternatives

....................................................................................................................................... 177

6. Reason for Rejection for Alternatives ......................................................................... 180

B. Small Business Alternative .......................................................................................... 180

C. Performance Standards in Place of Prescriptive Standards ........................................ 180

D. Health and Safety Code section 57005 Major Regulation Alternatives...................... 181

XII. Justification for Adoption of Regulations Different from Federal Regulations Contained in

the Code of Federal Regulations .......................................................................................... 181

XIII. Public Process for Development of the Proposed Action .............................................. 183

XIV. Next Steps ..................................................................................................................... 185

XV. References ...................................................................................................................... 186

4

Executive Summary

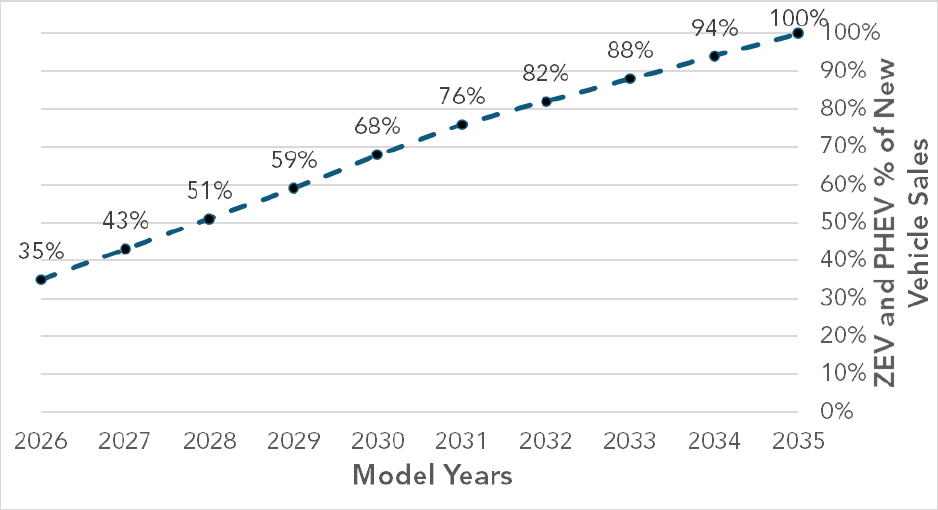

The Advanced Clean Cars II (ACC II) regulatory proposal will drive the sales of zero emission

vehicles (ZEV) to 100-percent ZEVs in California by the 2035 model year, including battery

electric vehicles (BEV) and hydrogen fuel cell electric vehicles (FCEV) and the cleanest-

possible plug-in hybrid-electric vehicles (PHEV), while reducing smog-forming emissions from

new internal combustion engine vehicles (ICEVs). Additionally, the proposed charging and

ZEV assurance measures, which include proposals to set minimum warranty and durability

requirements, increase serviceability, and facilitate battery labeling, will help ensure

consumers can successfully replace their ICEVs within California households with new or used

ZEVs and PHEVs that meet their needs for transportation and protect the emission benefits

of the program. These standards will also reduce the total cost of ownership for passenger

cars and light trucks, saving drivers money in the long term and further promoting consumer

adoption.

ACC II is critical to meeting California’s public health and climate goals and meeting State

and federal air quality standards. Mobile sources are the greatest contributor to emissions of

criteria pollutants

1

and greenhouse gases (GHG) in California, accounting for about 80-

percent of ozone precursor emissions and approximately 50-percent of statewide GHG

emissions, when accounting for transportation fuel production and delivery.

2

The National

Ambient Air Quality Standards (NAAQS) for two of these criteria pollutants—ozone

(sometimes referred to as smog) and fine particulate matter (PM2.5, sometimes referred to

as soot)—are particularly relevant in California. California suffers some of the worst air

pollution in the nation. The South Coast and San Joaquin Valley air basins are the only two

regions in the country classified as ‘Extreme’—the worst category—for nonattainment of the

federal ozone standard of 70 parts per billion (ppb). These areas also suffer some of the

worst levels of PM2.5 pollution. This proposal is an integral part of California’s strategy to

address these pressing public health needs, in compliance with state and federal law.

Emissions from motor vehicle engines hurt public health, welfare, the environment, and the

climate in multiple interrelated ways. Reducing emissions of one kind supports reducing

emissions of others and contributes to decreasing the severity of their impacts, as discussed

below.

3

In particular, as the climate warms, ozone becomes harder to control and more

particulate matter is released from wildfires. Reducing the emissions that cause climate

change will lead to greater reductions in ozone from the efforts to reduce the pollutants that

cause it, which are primarily oxides of nitrogen (NOx) and hydrocarbons (HC) from fuel

combustion. These emission reductions will help stabilize the climate and reduce the risk of

severe drought and wildfire and its consequent fine particulate matter pollution.

1

The federal Clean Air Act, 42 U.S.C. §7401, et seq., requires the United States Environmental Protection

Agency (U.S. EPA) to set National Ambient Air Quality Standards (NAAQS) for six “criteria” pollutants. The

Clean Air Act also requires states to develop and enforce implementation plans for “nonattainment” areas, i.e.,

areas of the State that do not meet the NAAQS or contribute to a nearby area that does not meet the NAAQS.

Nonattainment areas have air pollution surpassing levels the federal government has deemed requisite to

protect public health and the environment

2

CARB 2021a. 2020 Mobile Source Strategy. Released September 2021.

(https://ww2.arb.ca.gov/sites/default/files/2021-09/Proposed_2020_Mobile_Source_Strategy.pdf, accessed

January 31, 2022)

3

Infra, Chapter II.A.

5

The emission reductions from the ACC II proposal are critical to achieving carbon neutrality

by 2045, an essential target established by the Governor’s Executive Order B-55-18

4

, and

being evaluated in the draft 2022 Scoping Plan Update, which is set to be heard by the

Board in June 2022. The 2022 State Strategy for the State Implementation Plan (SIP)

Strategy also relies on reducing emissions of oxides of nitrogen (NOx) from passenger

vehicles to attain the latest federal ambient ozone standards by 2037 in the South Coast

5

(as

has been further emphasized in previously adopted SIPs). Moreover, communities burdened

by transportation pollution throughout the state, including near-roadway communities, will

benefit from declines in pollution at the local level.

California’s Long History of Emission Regulations

The proposal builds upon the California Air Resources Board’s (CARB or the Board) long

history of controlling emissions from mobile sources. Over 30 years ago, the Board

established the Low-Emission Vehicle (LEV) regulation, which contained aggressive exhaust

emission regulations for light-duty passenger cars and trucks and the first requirement for

manufacturers to build ZEVs.

In 2004, following the adoption of Assembly Bill (AB) 1493,

(Pavley, Chapter 200, Statutes of 2002), CARB approved a landmark greenhouse gas (GHG)

exhaust standard, more commonly known as “the Pavley regulation” for the statute’s author,

to require automakers to control GHG emissions from new passenger vehicles beginning with

the 2009 model year. These were the first regulations in the nation to control greenhouse gas

emissions from motor vehicles, one of the largest contributors to climate change emissions in

the state.

Continuing its leadership role in developing innovative and groundbreaking emission control

programs and advancing ZEV technologies, California developed the Advanced Clean Cars

(ACC) program, which the Board finalized in 2012. The ACC program incorporated three

elements that combined the control of smog-causing pollutants and GHG emissions into a

single coordinated package of requirements for model years 2015 through 2025, assuring

the development of environmentally superior vehicles that will continue to deliver the

performance, utility, and safety vehicle owners have come to expect. These three elements

included the LEV III regulations to reduce criteria pollutants and GHG emissions and another

phase of ZEV requirements.

6

When the Board adopted ACC in 2012, it committed to conducting a comprehensive

midterm review (MTR) of three elements within the ACC program. At completion of the

MTR, the Board concluded the following, among other things, at its March 2017 hearing:

• California’s GHG tailpipe standards remain appropriate and achievable for the 2022

through 2025 model years;

• California’s ZEV requirements as adopted in 2012 are appropriate and will remain in

place to develop the market;

4

GO 2018. Governor Jerry Brown. Executive Order B-55-18. https://www.ca.gov/archive/gov39/wp-

content/uploads/2018/09/9.10.18-Executive-Order.pdf September 2018. Accessed March 7, 2022.

5

CARB 2022a. California Air Resources Board. 2022. “Draft 2022 State Strategy for the State Implementation

Plan.” Released January 31, 2022. Accessed February 1, 2022. https://ww2.arb.ca.gov/sites/default/files/2022-

01/Draft_2022_State_SIP_Strategy.pdf.

6

Although the Clean Fuels Outlet regulation update was adopted by the Board as part of the ACC package, it

was not finalized in response to Assembly Bill 8 (AB 8, stats. 2013, ch. 401), which included dedicated funding

for hydrogen fueling infrastructure to support the market launch of FCEVs.

6

• Complementary policies are needed and should be expanded to help support an

expanding ZEV market;

• California’s particulate matter (PM) standard is feasible but further action is needed to

ensure robust control; and

• Staff are directed to immediately begin rule development for more stringent standards

for the 2026 and subsequent model years.

7

Following the Board’s direction in 2017, staff developed these proposed ACC II regulations.

The proposals go beyond the existing State and federal GHG emission standards, which have

been adopted by CARB and the U.S. Environmental Protection Agency (EPA), respectively,

and which will remain in effect

8

. Staff’s proposal aims to further curb criteria, toxic, and GHG

emissions by increasing stringency of emission standards for ICEVs, ensuring emissions are

reduced under real-world operating conditions, and accelerating the transition to ZEVs

beginning with the 2026 model year through both increased stringency of ZEV sales

requirements and associated requirements to support wide-scale adoption and use.

Considering Equity in Advanced Clean Cars

Improving access to clean transportation and mobility options for low-income households

and communities most impacted by pollution supports equity and environmental justice and

is key in achieving emission reductions.

9

CARB’s statewide strategy to address these goals,

known as the Community Air Protection Program Blueprint, identifies ACC II in helping to

reduce exposure to criteria pollution and toxic air contaminants in burdened communities.

The significant pollution reductions from the proposal as a whole, when accounting for

cleaner ICEVs as well as ZEVs, will reduce exposure to vehicle pollution in communities

throughout California, including in low-income and disadvantaged communities that are

often disproportionately exposed to vehicular pollution.

10

Further, the proposed ZEV

assurance measures, discussed in Chapter III.D., will ensure these emissions benefits are

realized and long-lasting, while supporting more reliable ZEVs in the used vehicle market,

where the cost of ZEVs become more affordable to lower-income households. Staff have also

proposed provisions, discussed in Chapter IX, to encourage manufacturers to take actions

that improve access to ZEVs for disadvantaged, low-income, and other frontline

communities, including by investing in community car share programs, producing affordable

ZEVs, and keeping used vehicles in California to support CARB’s complementary equity

incentive programs.

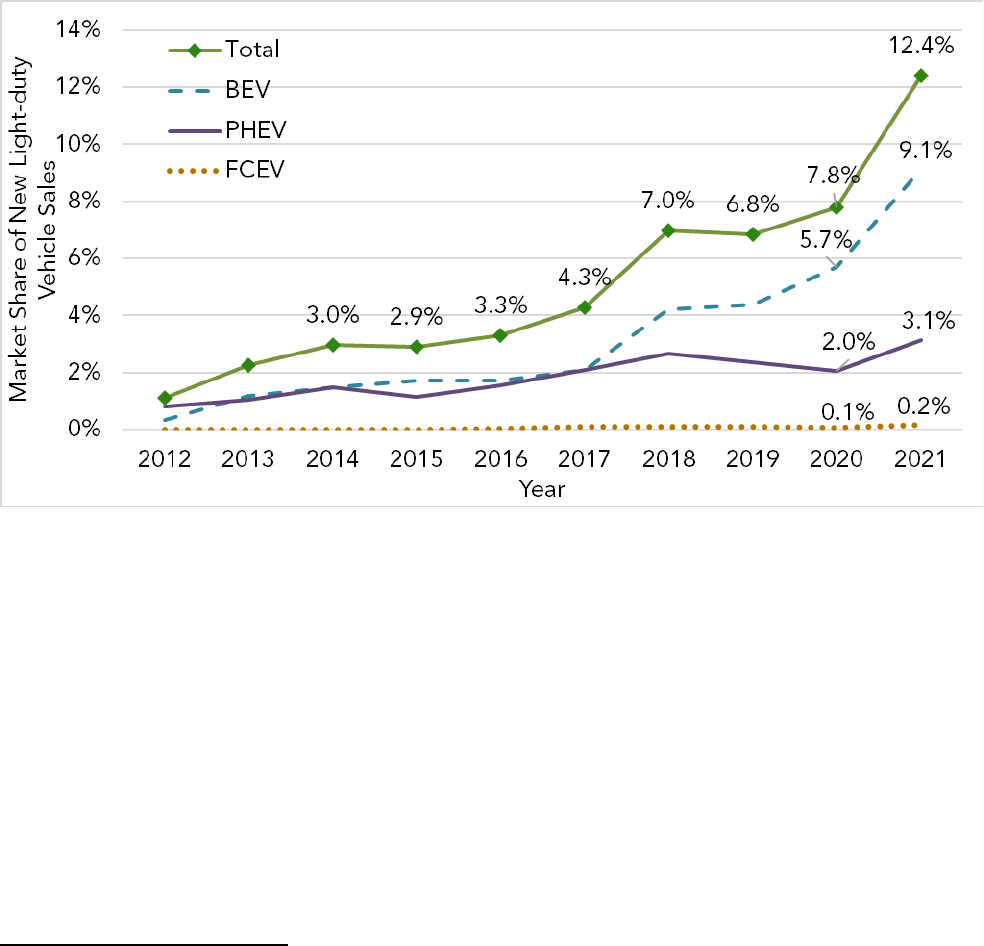

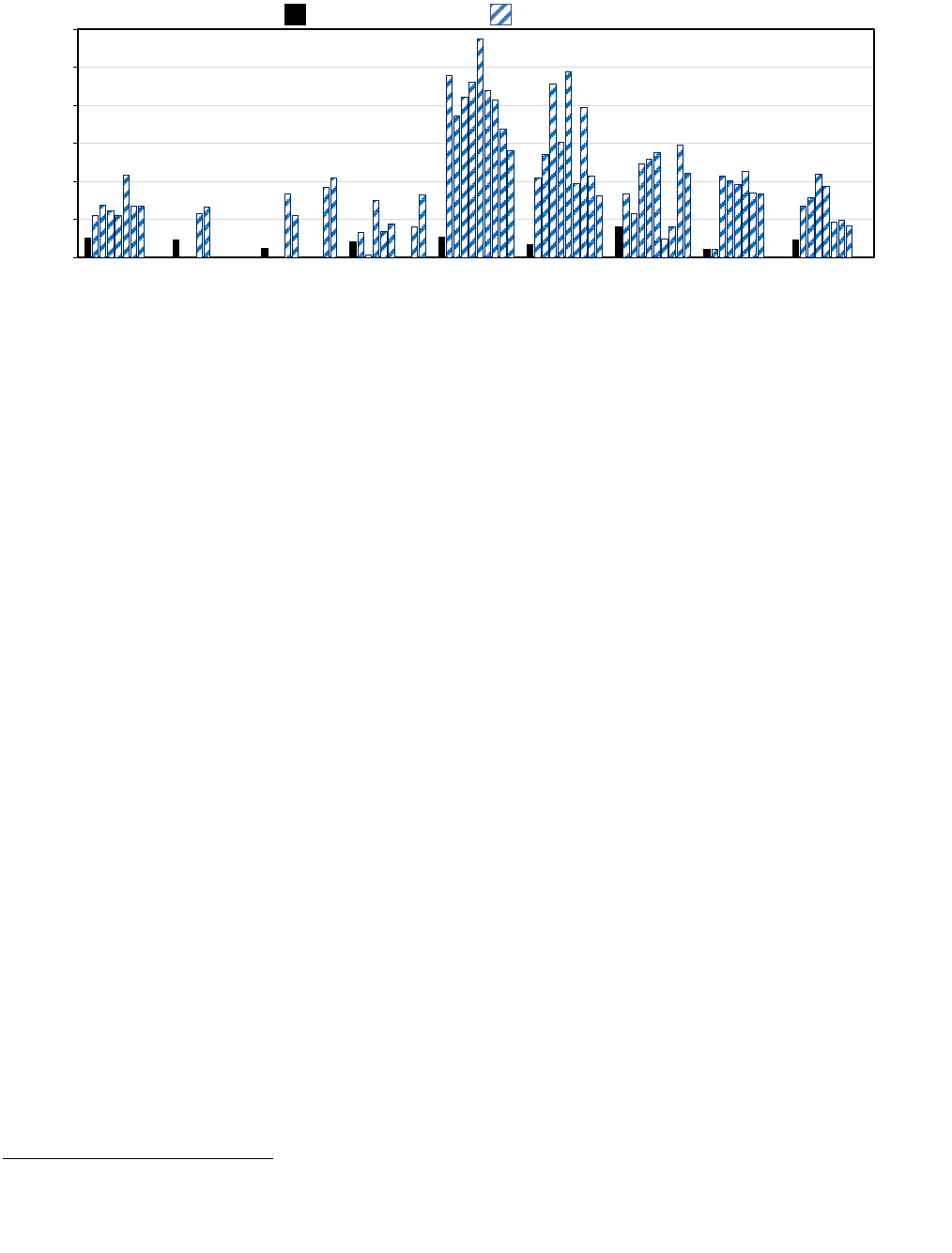

A Growing ZEV Market

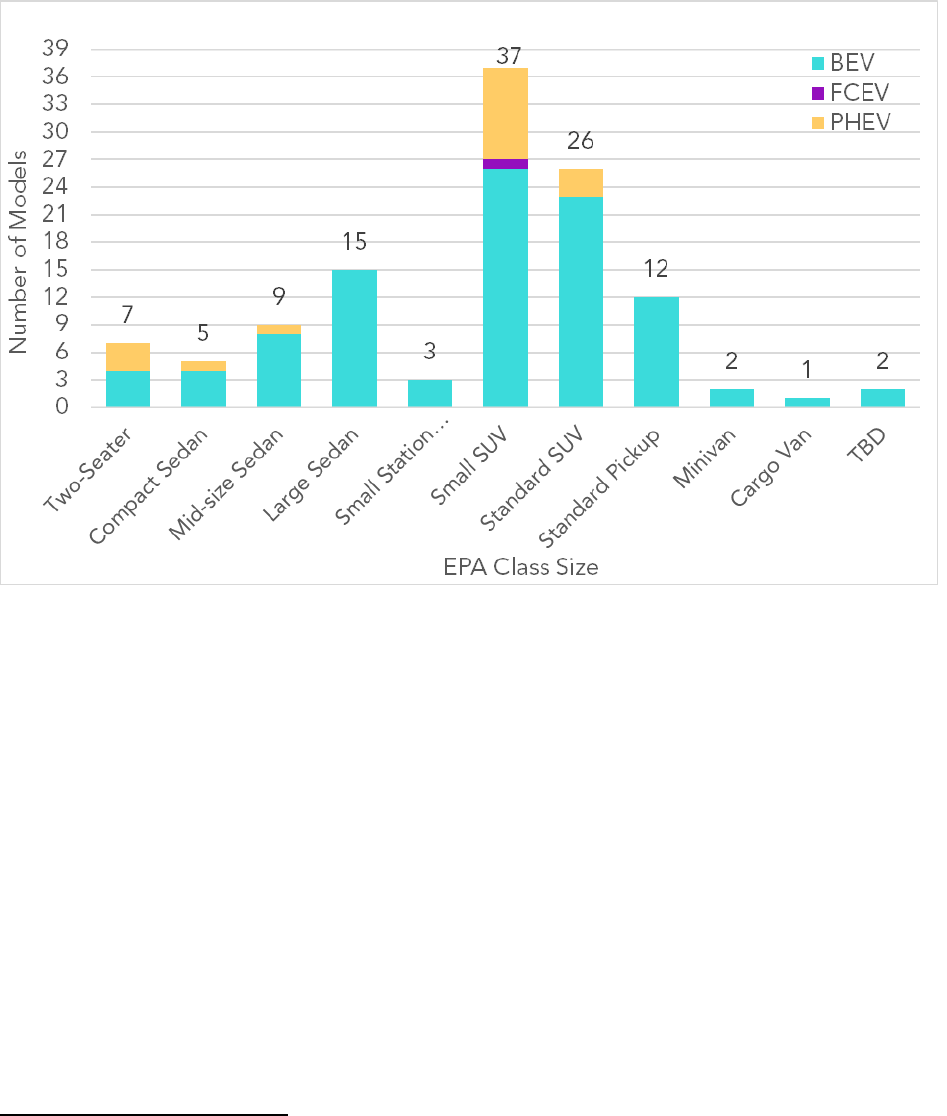

At the time of ACC adoption in 2012, there were less than 5 ZEV and PHEV models available

for sale in California. By the end of 2021, California had 60 ZEV and PHEV models in the

7

CARB 2017a, Advanced Clean Cars, Midterm Review, Reso. 17-3, May 24, 2017, Advanced Clean Cars

Midterm Review - Resolution 17-3.

8

CARB will continue to work closely with its federal agency partners as it considers whether to revise its GHG

exhaust emission standards in a future proposal

9

Infra., Chapter II.B.

10

Infra., Chapter IX; see also Apte 2019. Apte, Joshua S, Sarah E Chambliss, Christopher W Tessum, and Julian

D Marshall. 2019. A Method to Prioritize Sources for Reducing High PM2.5 Exposures in Environmental Justice

Communities in California. CARB Contract Number 17RD006. Accessed February 25, 2022.

https://ww2.arb.ca.gov/sites/default/files/classic/research/apr/past/17rd006.pdf.

7

market and had surpassed 1 million cumulative ZEVs and PHEVs sold, leading the United

States (US) in ZEV sales. Over this time, many factors helped in transforming the

transportation sector to cleaner technologies. Legal requirements in California, primarily

CARB’s ACC program, and international regulations, have required manufacturers to invest in

developing zero-emission technology. Those investments have improved ZEV technology to

meet a broader array of driver needs and complementary programs, and the associated

expansion of public infrastructure, that has driven consumer demand.

The industry has rapidly responded to evolving market pressures, consumer demands, and

regulatory requirements in California, across the United States, and around the globe.

Overall, these improvements have reduced costs for batteries, the main driver of BEV and

PHEV costs, as well as for non-battery components. This has enabled manufacturers to

accelerate plans to bring to market more long-range ZEVs in more market segments and

highly capable PHEVs. Today, every manufacturer has a public commitment to significant if

not full electrification in the next 20 years. Based on public announcements, it is expected

that nearly 120 ZEV and PHEV models will be available to consumers before the 2026 model

year.

In California, 74-percent of drivers report having at least some interest in the electric vehicle

market, and 40-percent considering going electric for their “next vehicle.”

11

This interest is

turning into growing sales, with new vehicle market share of electric drive vehicles in 2021

jumping to 12.4-percent from 7.8-percent just the year prior in California. Further,

satisfaction is high among electric vehicle owners and is likely to lead to subsequent

purchases of electric vehicle technology.

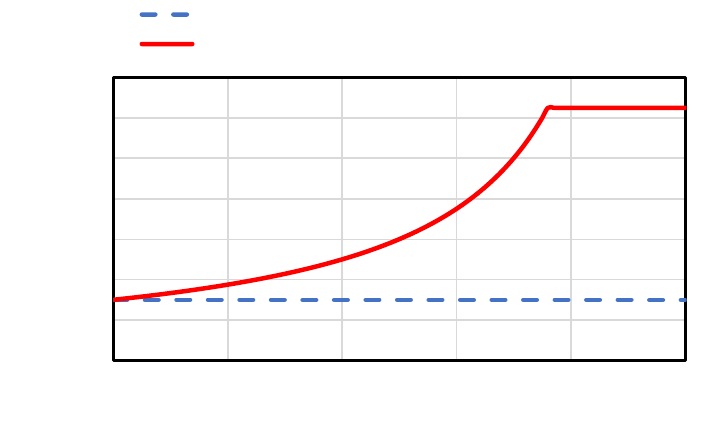

Over the long term, a transition to technology that does not rely on petroleum fuels will also

reduce costs in addition to mitigating adverse impacts on public health, the environment,

and the climate. US household expenditures on energy consumption have ranged between

4% and 8% of their disposable income, and it has been shown historically that consumers

spend higher shares of their income on energy expenditures when energy prices are higher.

12

The impact of higher energy prices can be more significant for low-income households, as

they spend larger magnitudes of their disposable income on energy expenditures. Less

dependency on conventional sources of energy, and thus reduced demand for petroleum

fuels, lessens exposure to the global energy market and lowers impacts from volatile gasoline

and diesel prices. It will also reduce attendant costs due to risks to national and global

stability and security from dependency on oil.

13

The ACC II regulation will not achieve success on its own but is one tool that works in concert

with many other complementary programs and policies that California is undertaking to

support the transition to zero-emission transportation. Sustained California policy signals and

11

Consumer Reports 2021. Consumer Reports. “Consumer Attitudes Towards Electric Vehicles and Fuel

Efficiency in California: 2020 Survey Results”, Published March 2021.

12

EIA 2014. U.S. Energy Information Administration. 2014. “Today in Energy: Consumer Energy Expenditures

are Roughly 5% of Disposable Income, Below Long-Term Average.” October 21, 2014. Accessed March 18,

2022. https://www.eia.gov/todayinenergy/detail.php?id=18471.

13

For example, U.S. EPA has cited estimates that the U.S. military spends $81 billion per year protecting global

energy supplies. EPA 2021a. U.S. Environmental Protection Agency, Revised 2023 and Later Model Year Light

Duty Vehicle GHG Emissions Standards: Regulatory Impact Analysis, EPA-420-R-21-028, December 2021, p. 3-

24, https://nepis.epa.gov/Exe/ZyPDF.cgi?Dockey=P1013ORN.pdf.

8

regulations, backed by significant financial investment in a suite of complementary policies

have been critical to accelerating demand. Since the adoption of ACC, network planning for

better placement of charging and hydrogen infrastructure has developed, along with

increased funding for these fueling stations. Public investment and regulations are working to

address barriers in support of this proposed vehicle regulation.

The Evolution of Advanced Clean Cars II

Consistent with the Board’s long-standing practice, staff have engaged in an extensive public

process in developing the Proposed Regulation, holding four public workshops in 2020 and

2021, culminating in a pre-draft regulatory proposal released in December 2021. As

discussed in Chapter XIII, the proposal reflects extensive feedback received throughout this

process.

The proposed regulations are also founded on significant positive developments in the

market. Every light-duty vehicle manufacturer has made commitments to electrify their

product line in a significant way.

14

Confidential manufacturer projections received mid-2021

confirmed these announcements, building confidence in a strong near-term market for ZEVs

and PHEVs. Furthermore, subsequent to CARB’s public workshops on its initial proposals in

2021, U.S. EPA finalized its rulemaking for 2023 through 2026 model year light-duty vehicle

greenhouse gas emission standards.

15

Its rulemaking analysis showed a minimum compliance

path that would result in 17-percent of new vehicle sales being ZEVs and PHEVs by the 2026

model year nationally.

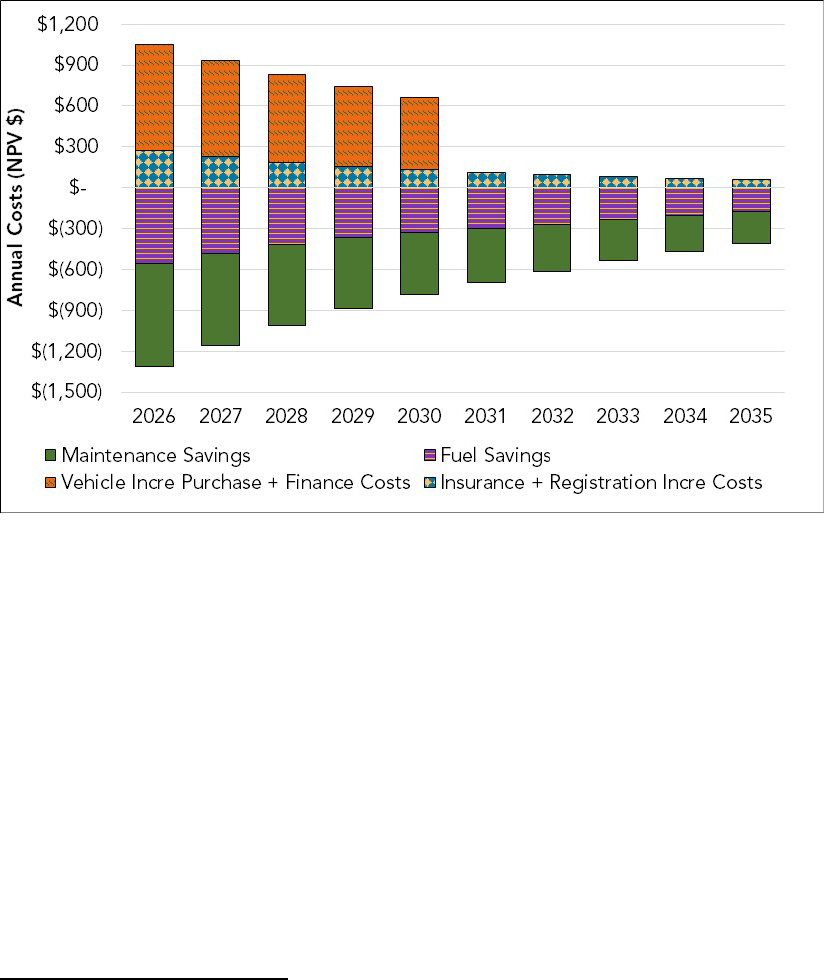

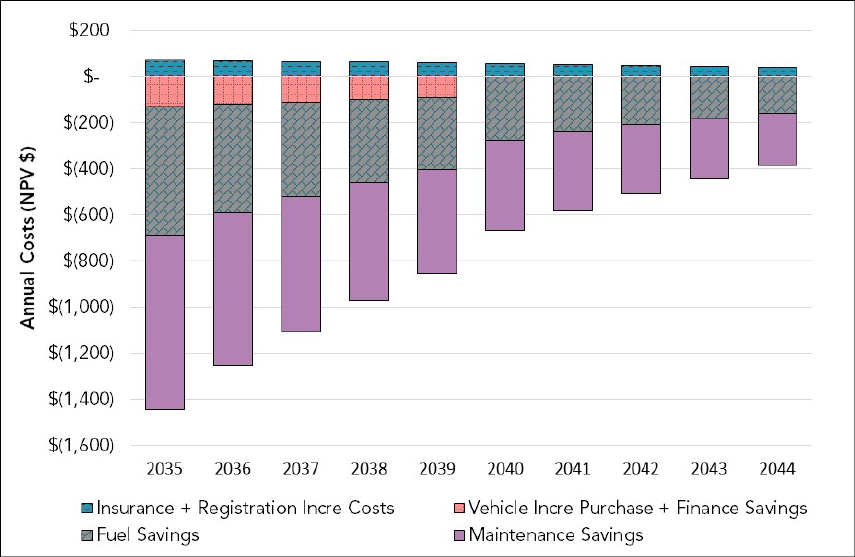

These factors, in combination with adjustments to ZEV and PHEV costs since the release of

the Draft Standardized Regulatory Impact Analysis (SRIA), meant that staff was able to

strengthen its proposal for the early years of the regulation relative to earlier regulatory

concepts. Specifically, staff was able to leverage more recent analysis from the Argonne

National Laboratory (ANL), and U.S. EPA teardown reports, and additionally added further

detail on delete costs for mechanical all-wheel drive (AWD) components. The net of these

changes has lowered BEV incremental costs throughout all the model years covered by the

proposed rule. The results show that for BEVs, operational savings will offset any incremental

costs over the 10-year period evaluated. For example, a passenger car BEV with a 300-mile

range will have initial annual savings occur in the first year for the 2026 model year

technology. For the 2035 model year technology, the initial savings are nearly immediate

and cumulative savings over ten years exceed $7,500. For a more detailed discuss of these

costs and analyses, see Chapter X and Appendices G (ACC II ZEV Technology Assessment),

and H, (ACC II LEV Technology Appendix).

Additionally, staff further bolstered the proposal since the SRIA in the area of equity and

environmental justice (EJ), already a multi-faceted effort in ACC II, and one that sits within a

larger set of actions – from incentive programs to other regulatory measures – intended to

protect priority populations. Following continued input from external stakeholders and

internal equity partners, staff are proposing to add a third category to increase affordable

access to ZEVs and PHEVs by providing an incentive for manufacturers to offer lower priced

14

A list of all manufacturer announcements can be found in Appendix G.

15

EPA 2021b. U.S. Environmental Protection Agency, “Revised 2023 and Later Model Year Light-Duty Vehicle

GHG Emissions Standards.” Federal Register 86, no. 248 (December 30, 2021): 74434.

https://www.govinfo.gov/content/pkg/FR-2021-12-30/pdf/2021-27854.pdf.

9

vehicles. This is especially important in the earlier years of the proposed ACC II program

when battery costs are higher. The EJ vehicle values are aimed at providing manufacturers

with incentive for targeted actions that would help achieve more equitable outcomes.

Summary of ZEV Regulation Proposal

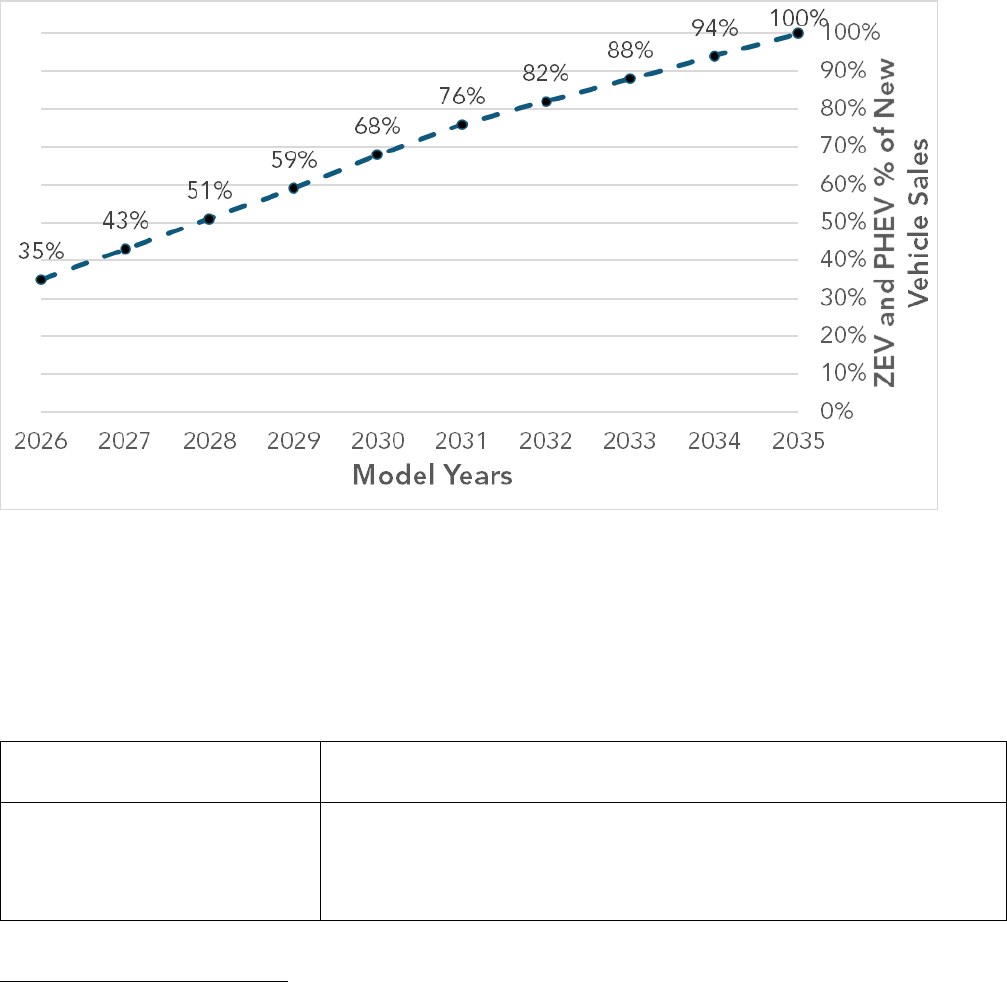

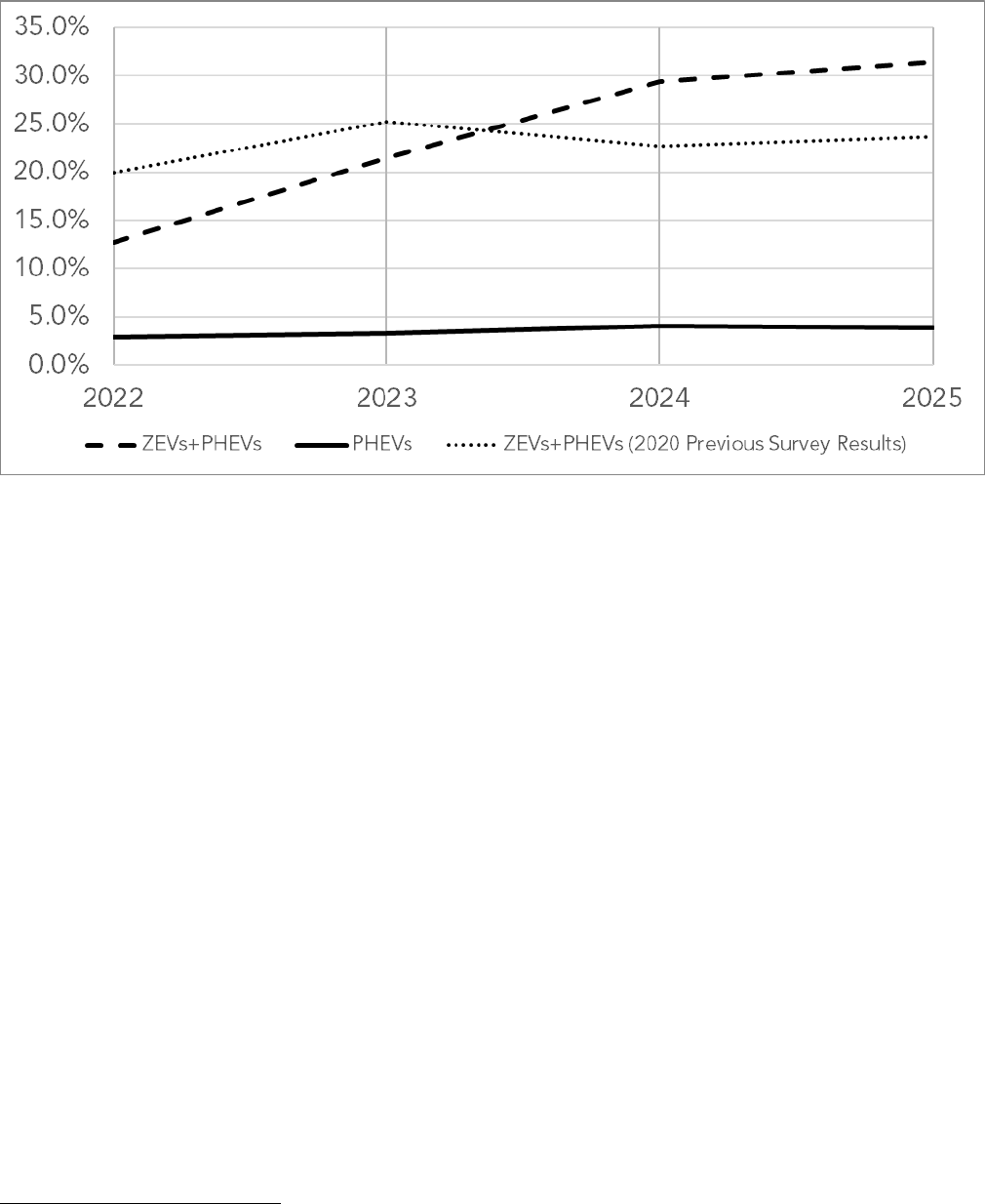

As discussed in Chapter III, below, CARB staff proposes an annual ZEV requirement that

aligns with where the market is expected to be in 2026, and that continues to ramp up

quickly to nearly 70% of new vehicles sales by 2030. Staff’s proposed ZEV stringency is

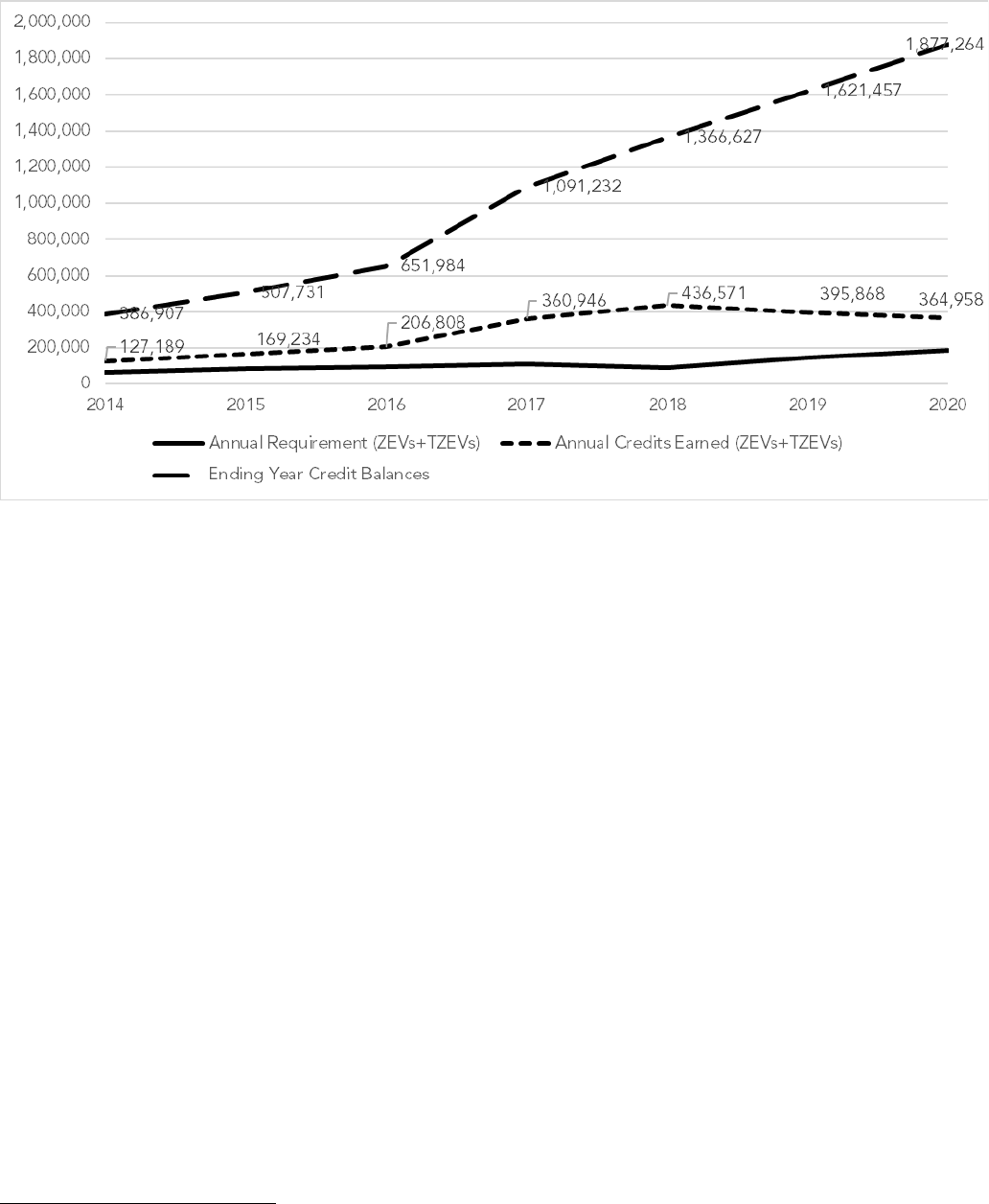

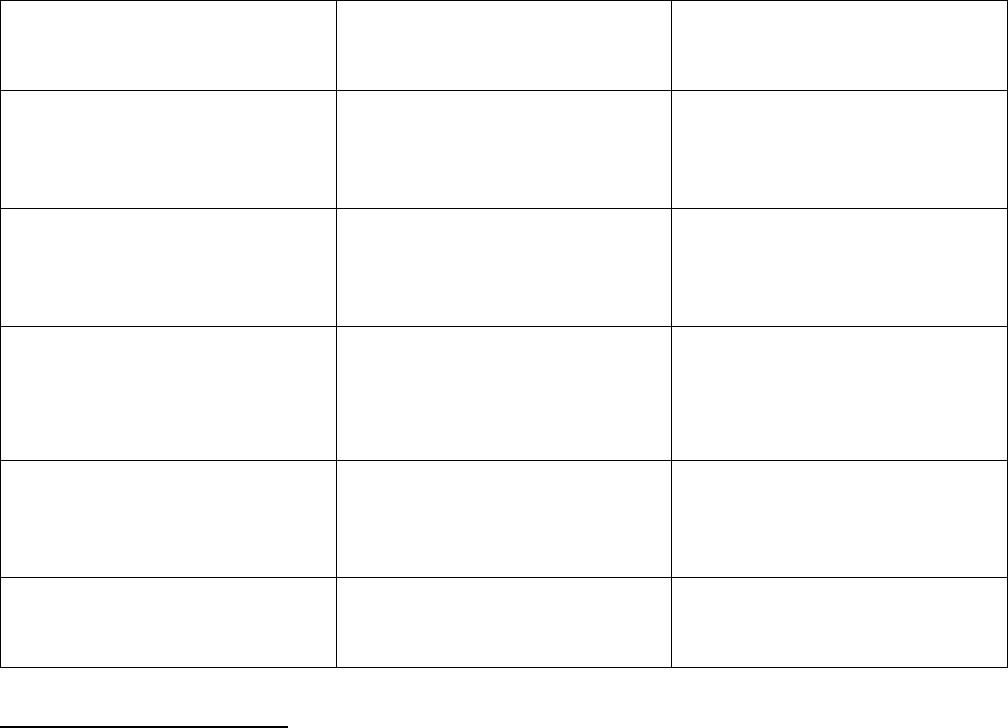

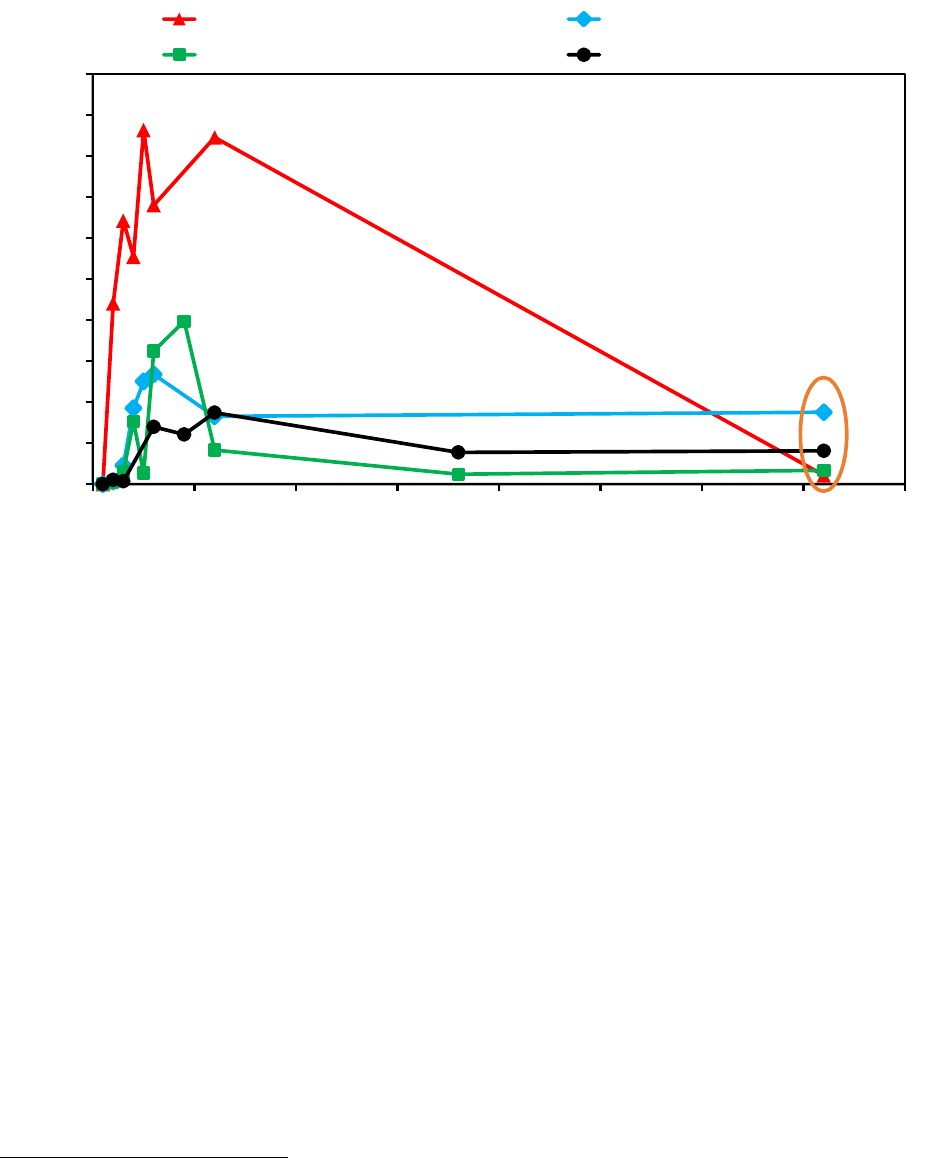

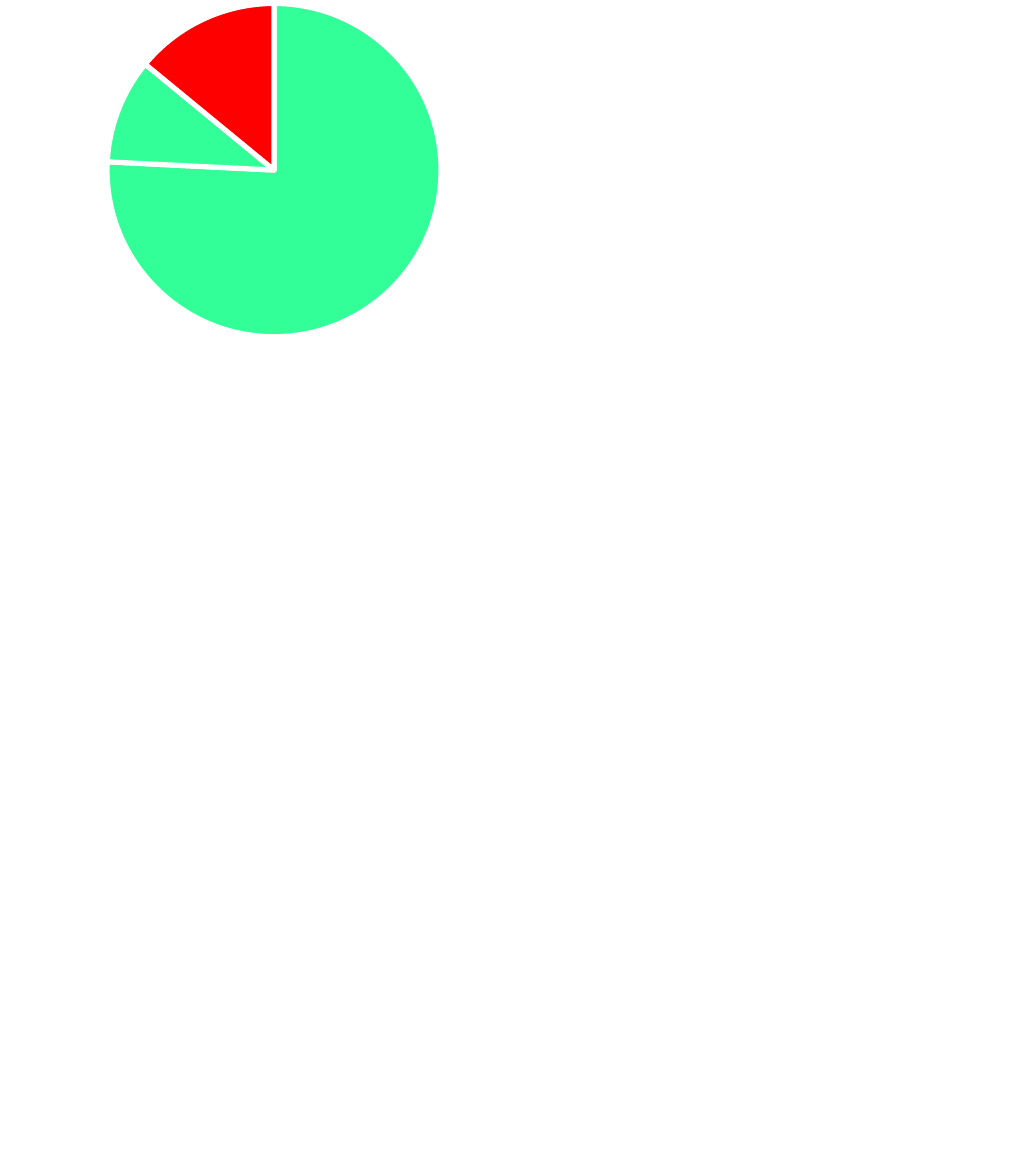

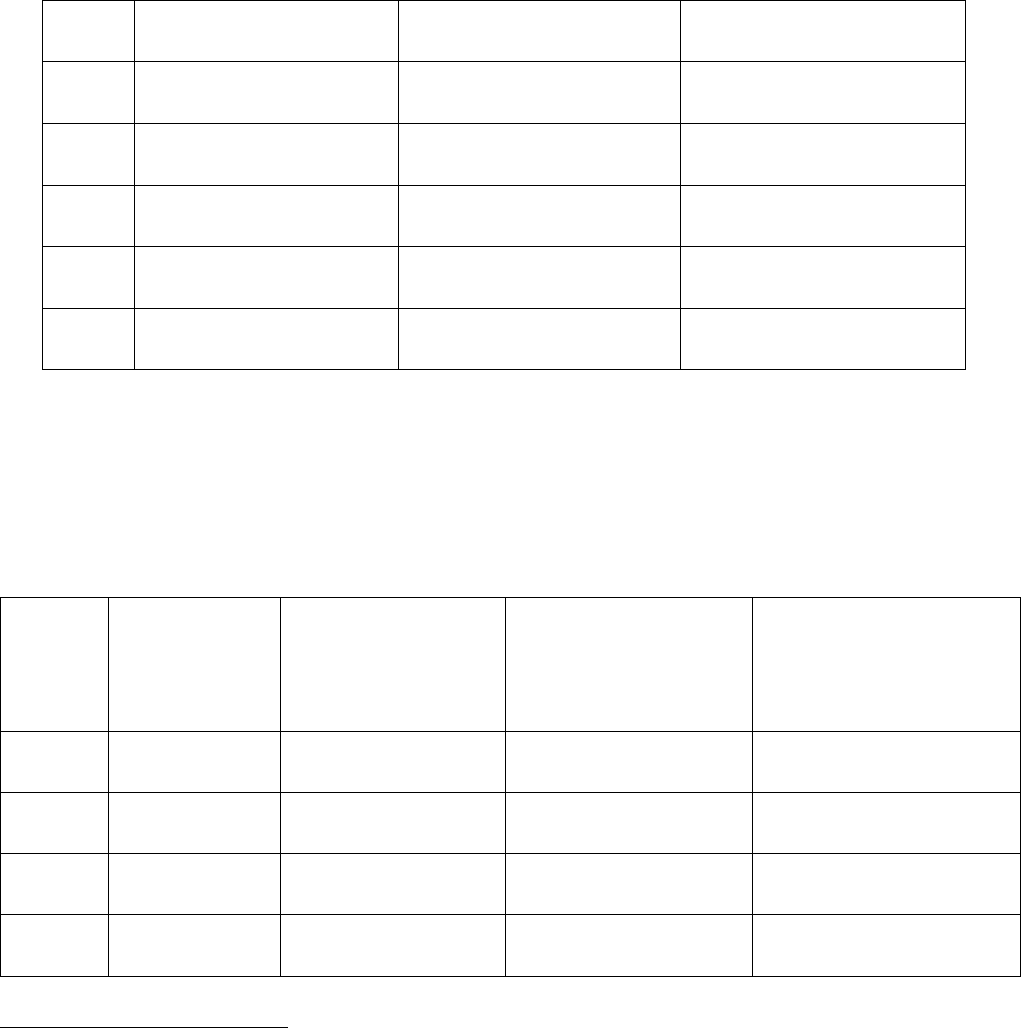

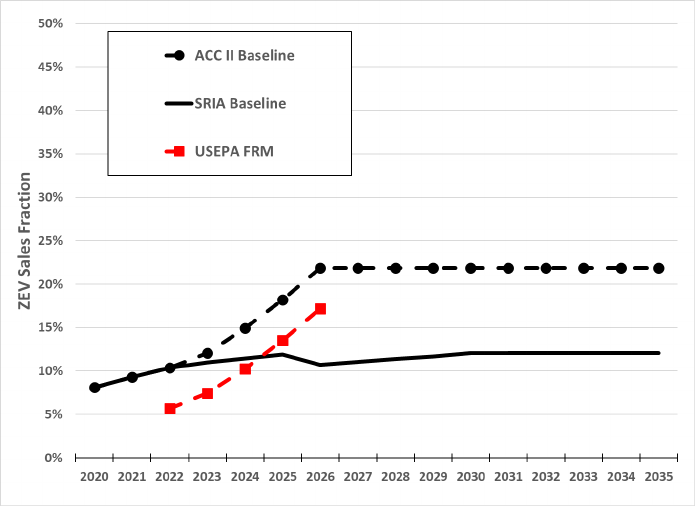

shown below in ES – Figure 1.

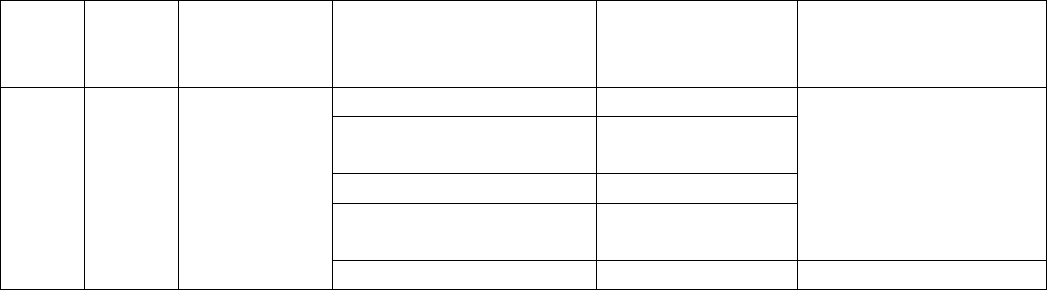

ES - Figure 1:Proposed Annual ZEV Requirement

The ZEV regulation proposal reflects a balance of stringent annual ZEV requirements,

minimum technology requirements, and appropriate flexibilities that will put California, and

the states that choose to adopt California’s ZEV regulation,

16

on a path to 100%

electrification by the 2035 model year. Below is a table summarizing staff’s ZEV regulation

proposals.

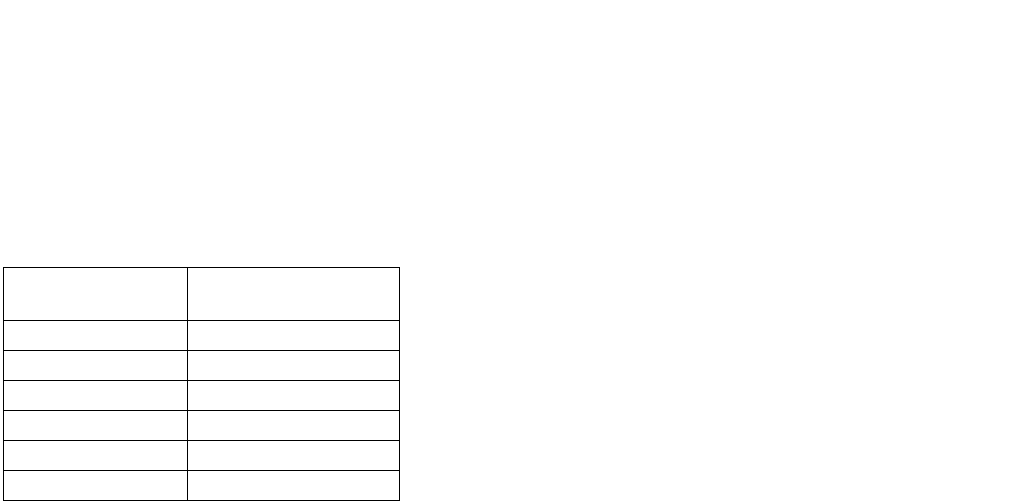

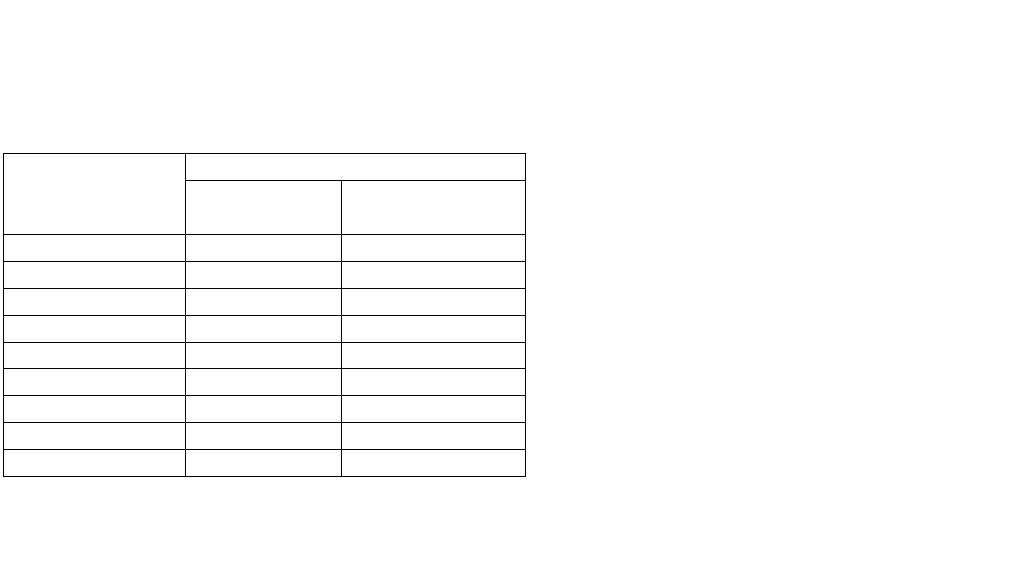

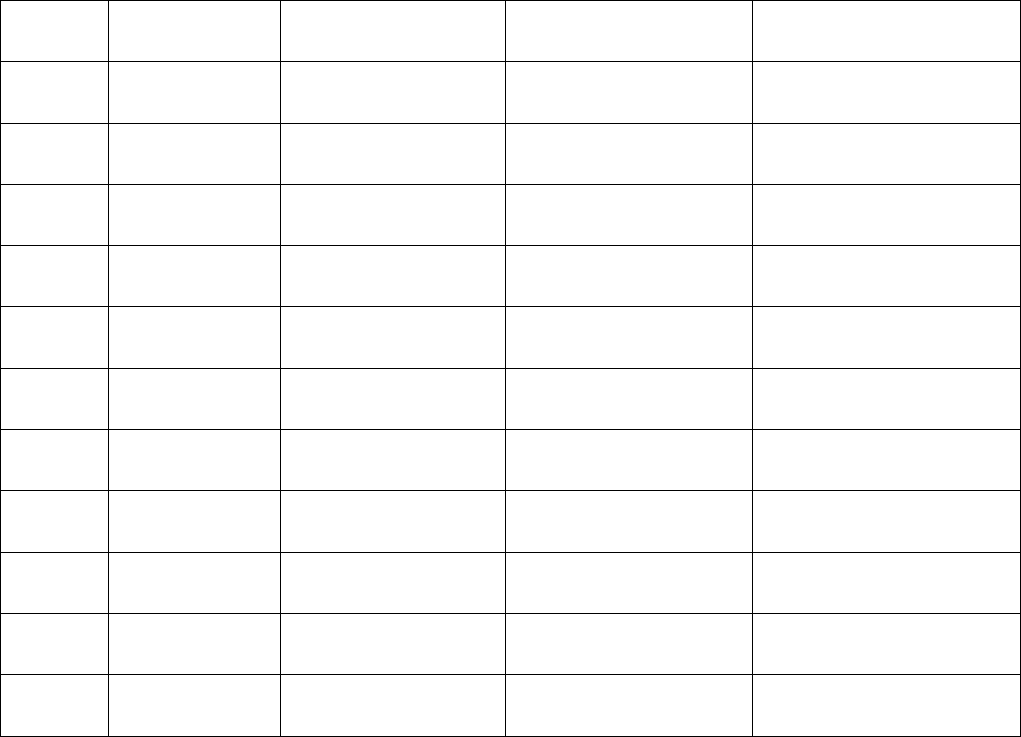

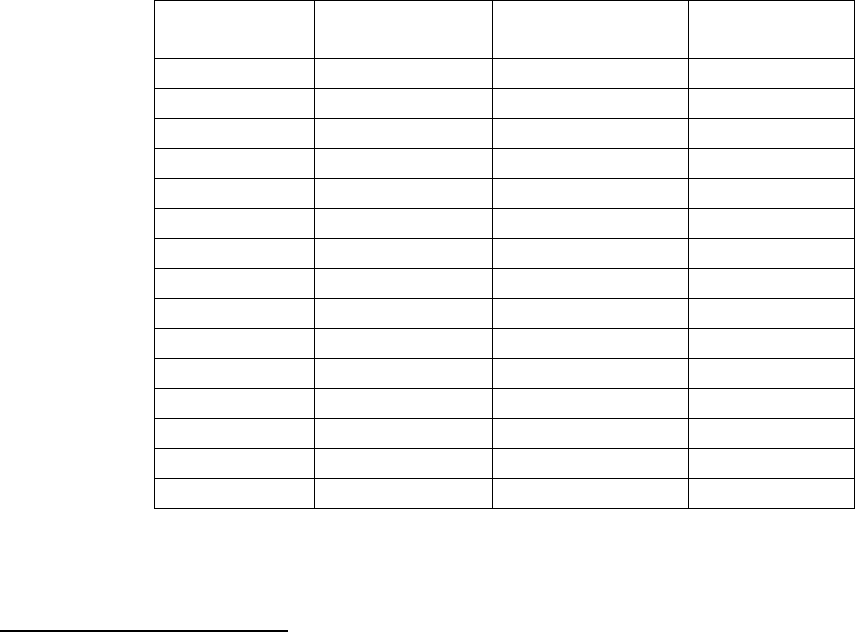

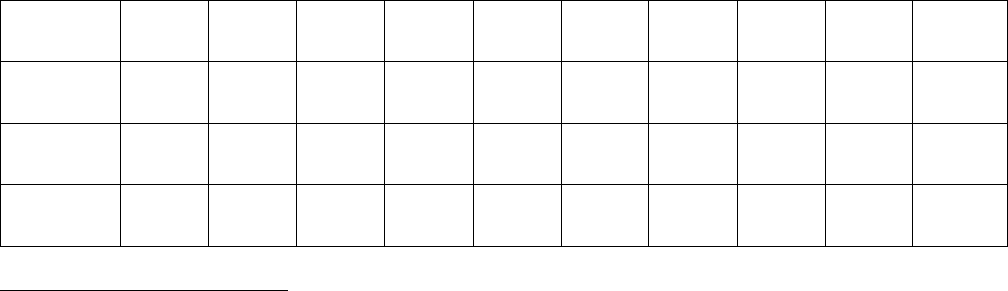

Table ES-0-1: Summary of ZEV Proposals

Proposal Category Description of Proposal

ZEV minimum

requirements

150-mile label range, propulsion-related parts warranty,

battery warranty, data standardization, charging cord, battery

label, service information

16

Other states may adopt California’s engine and motor vehicle emission standards under Section 177 of the

Clean Air Act, 42 U.S.C. § 7507. See listing of states in Section III.C.2.d).

10

PHEV

minimum requirements

50-mile label range, 40-mile US06 range, SULEV, 15-

year emissions warranty, battery warranty, charging cord,

battery label

ZEV and PHEV Vehicle

Values and Life

Counted as One Vehicle Value, 5-year value life

PHEV Phase in 2026-2028 30-mile label range, partial vehicle value

PHEV Cap 20% of annual requirement

Environmental Justice (EJ)

Vehicle Values

5% of annual requirement through 2031 MY

1. 0.5 value for ZEVs and 0.4 value for 6-passenger PHEVs

offered at 25% price discount to car share community

programs

2. 0.1 value for off-lease (<$40k MSRP) ZEV and PHEVs

delivered to CC4A and CVAP dealers

17

3. 0.1 value for low MSRP ZEVs and PHEVs (<$20k Cars, <

$27K Trucks)

Early Compliance Values 15% of annual requirement through 2028 MY

OEMs with >20% EV market share in 2024 and 2025 can

generate ACC II credits early

Historical Credit Treatment

(ACC I)

2025 MY Balance / 4 = Converted ZEV Values

2025 MY Balance / 1.1 = Converted PHEV Values

Converted ZEV and PHEV

Values

15% of annual requirement (if shortfall) through 2030 MY

Pooling

Excess values can count toward compliance, up to 25%

(2026) down to 5% (2030) of annual requirement (if shortfall)

in CA or Section 177

Allowed Deficit Can carry forward deficit for 3 years

Small Volume

Manufacturers (SVM)

Must comply 2035+ MYs

17

CC4A stands for Clean Cars For All, and CVAP stands for Clean Vehicle Assistance Program.

11

Summary of ZEV Assurance Measure Proposals

The ACC II proposal is intended to fulfill requirements and goals to reduce air pollution,

protect public health, and stabilize the climate. The long-term success of these emission

reductions depends on ZEVs and PHEVs permanently displacing all new conventional internal

combustion gasoline and diesel engine passenger vehicle sales in California by 2035 and

sustaining consumer use of these vehicles over their full useful lives to permanently eliminate

conventional vehicles’ emissions. This means that the ZEV fleet is critical to pollution control,

and if ZEVs fail to meet the drivers’ needs, a ZEV may be replaced with a new or used

conventional vehicle – a concern that has been observed in ZEV discontinuance and that

intensifies as ZEVs age and compete on the used vehicle market. CARB has long designed its

regulations and certification systems to ensure that vehicles, including their emission

controls, perform properly throughout their life. It is similarly necessary to ensure both that

ZEVs function as expected over their lifetimes and that consumers are not deterred from

purchasing them both new and used. In the ZEV regulation context, this proposal continues

that approach. To secure the emission benefits of this proposal, ZEVs must meet continuing

assurance requirements throughout their lives. Below is a summary of staff’s ZEV assurance

proposals.

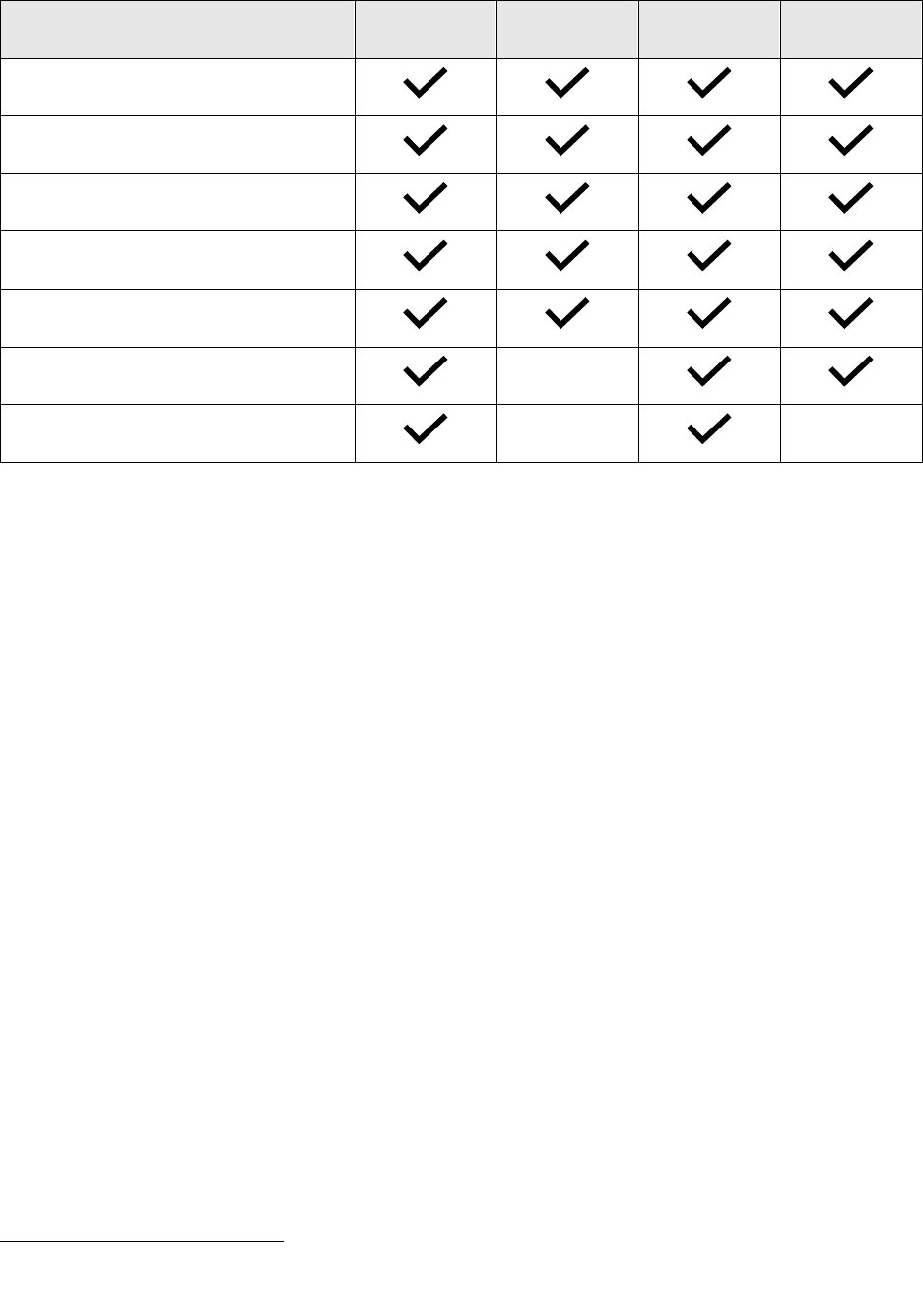

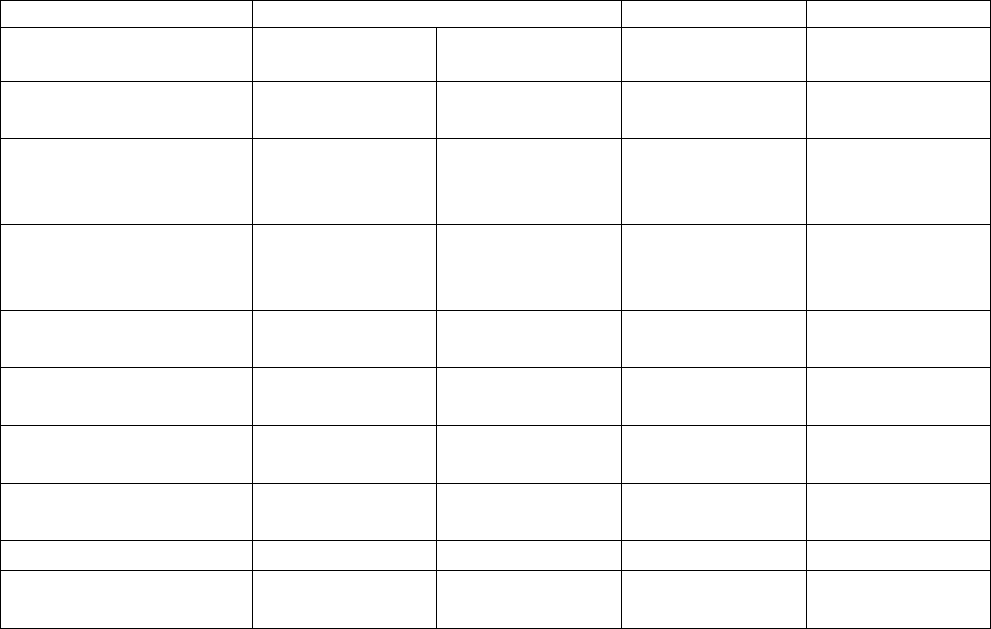

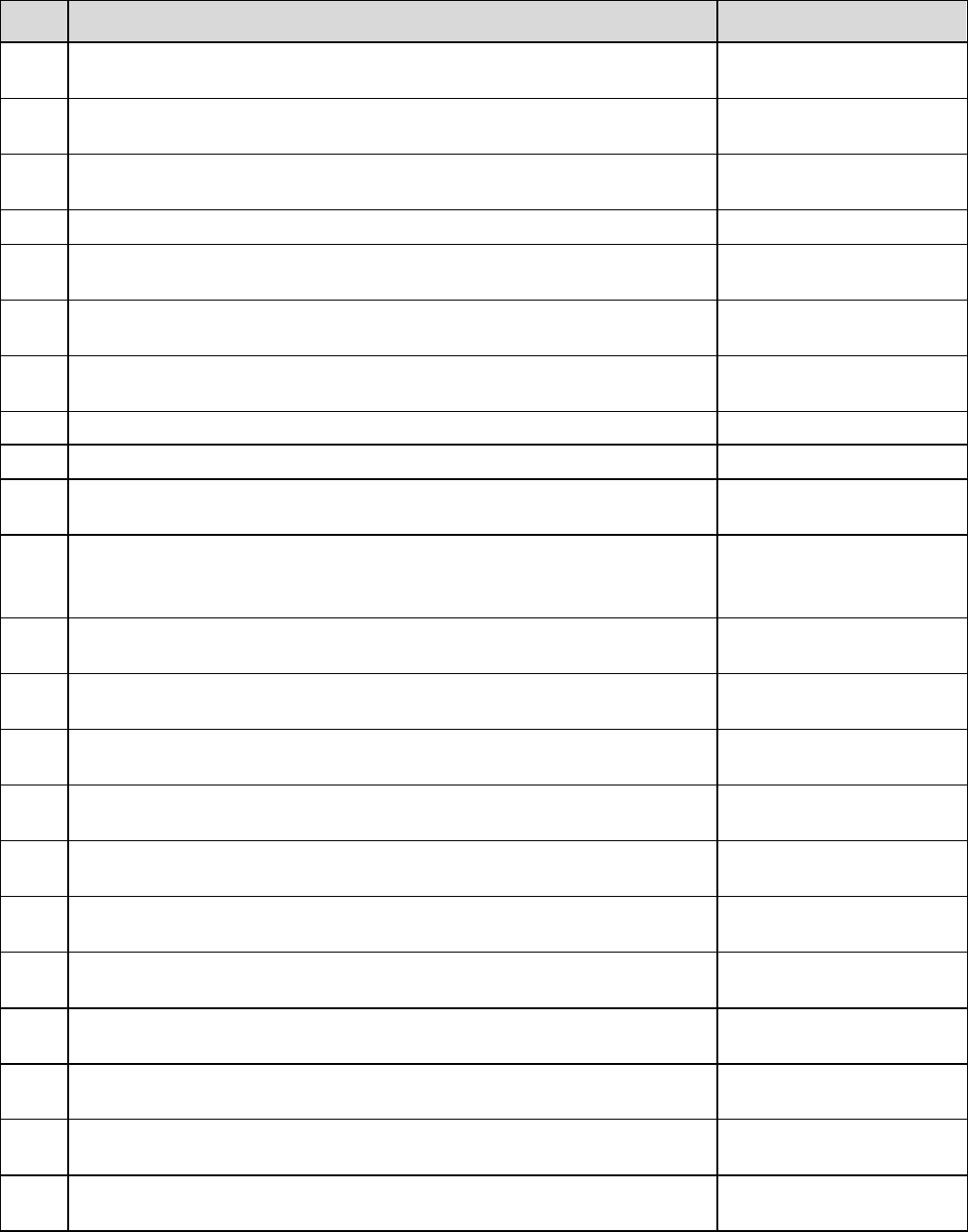

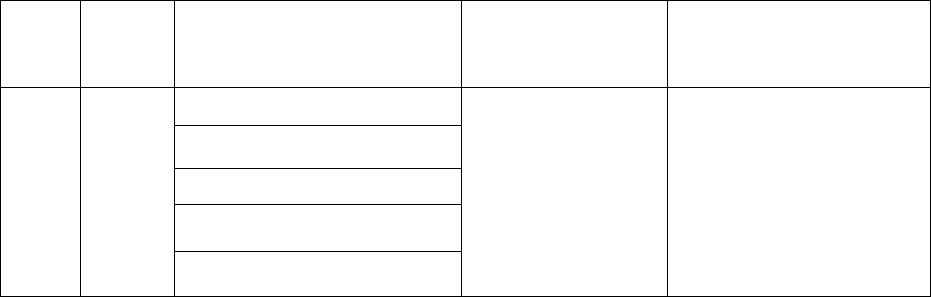

Table ES-0-2 Summary of ZEV Assurance Proposals

Proposal Description Applicable Vehicles for

2026 MY, unless noted

Data Standardization

Required data parameters,

including battery state of

health

ZEVs and PHEVs*

Durability

80% of Certified Range

Value for 10 years / 150,000

miles

ZEVs and PHEVs*

Propulsion-Related Parts

Warranty

3 years / 50,000 miles

7 years / 70,000 miles for

high priced parts

ZEVs and PHEVs*

Battery Warranty

8 years / 100,000 miles, 70%

or 75% Battery State of

Health

ZEVs and PHEVs

Service Information

Disclose repair information

to independent repair shops

ZEVs (2011 MY+) and

PHEVs*

Battery Labeling

Label all traction batteries

for recyclability and

repurposing

ZEVs, PHEVs, hybrid electric

vehicles (HEVs), and 48V

HEVs

12

*PHEVs are proposed to be required to comply with staff’s battery state of health standardization and charge

rate requirements, both of which must be accessible to the driver. PHEV are already required to comply with (1)

California Code of Regulations (CCR), title 13, section 1968.2 (On-Board Diagnostics), which covers most other

data metrics proposed for ZEVs, (2) CCR, Title 13, sections 1961.2 and 1961.4 which requires vehicles to meet

GHG and criteria exhaust emission standards over useful life (15 years or 150,000 miles, (3) CCR, title 13, section

2037 ad 2038, which requires emissions related parts warranty coverage for PHEVs, and (4) CCR, title 13,

section 1969, which requires the disclosure of service information.

Summary of LEV Criteria Proposals

The suite of proposed regulations, discussed in Chapter IV, below, guide the light-duty

vehicle segment toward 100-percent electrification by 2035, signifying that the last new

conventional ICEV will be sold in California during the implementation period of this

regulation. However, these ICEVs will remain in use on California’s roads well beyond 2035,

and PHEVs that include combustion engines will continue to be sold and used after 2035. As

such, the proposed regulation includes three primary elements aimed to mitigate the air

quality impacts of ICEVs. First, it would prevent potential emission backsliding of ICEVs that

is possible under the existing regulations by applying the exhaust and evaporative emission

fleet average standards exclusively to combustion engines. Second, it would lower the

maximum exhaust and evaporative emission rates. Third, it would reduce cold-start

emissions, by applying the emission standards to a broader range of in-use driving

conditions. The combination of these three elements would help deliver real-world emission

benefits from the remaining ICEVs that would complement the significant emission

reductions gained by more widespread deployment of ZEV technology.

18

For the medium-duty vehicle segment of ICEVs, the proposal would first provide better

emission control over a broader range of in-use driving conditions under the moving average

in-use standard for towing capable vehicles. Second, the proposal would require the fleet to

become cleaner by lowering the current fleet average standard. Third, the proposal would

clean up the highest-emitting vehicles by lowering the maximum emission rate from medium-

duty vehicles.

In addition to these substantive proposals, several conforming changes are proposed to

related regulations to maintain consistency with existing regulations and maintain existing

requirements in regulations that are not being proposed for amendment, including the

existing greenhouse gas emission regulations in California Code of Regulations (CCR), title

13, section 1961.3, that are part of the existing Advanced Clean Cars program. These

conforming amendments are described in Chapter IV, section A.7.

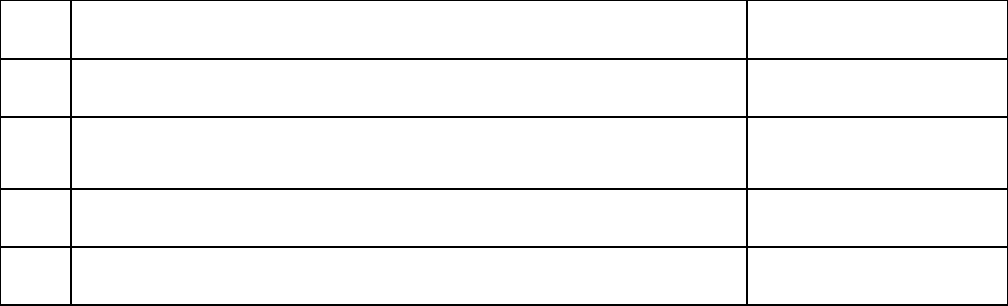

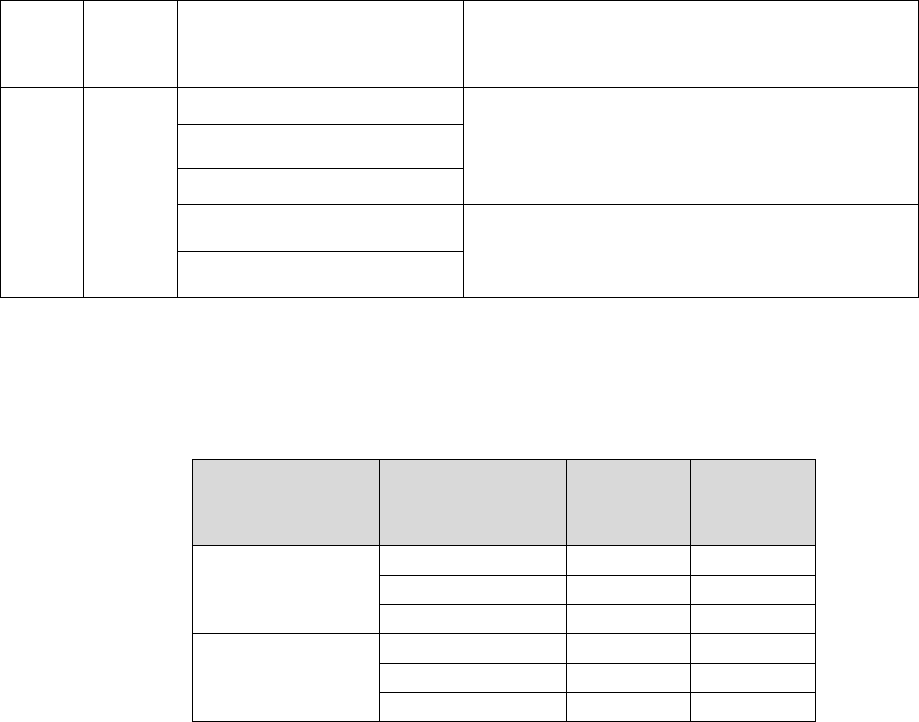

Table ES-0-3 Summary of LEV Proposals for Light-Duty Vehicles

Proposal Category Description of Proposal

NMOG+NOx Fleet

Average

- Maintain NMOG+NOx fleet average at 0.030 g/mile

- Phase-out ZEVs from NMOG+NOx fleet average

18

Although not covered by the ZEV rulemaking in this regulatory package, the Advanced Clean Trucks

Regulation requires 50 percent electrification by 2035. Title 13, CCR §1963.

13

- Phase-out NMOG+NOx emission credits given to

PHEVs for electric driving

- Eliminate dirtiest emission certification bins (ULEV125

and LEV160)

- Add new lower emission bins (SULEV15, SULEV25,

ULEV40, ULEV60)

SFTP Emission Standards

- Eliminate composite SFTP certification option

- Require all light-duty vehicles to meet FTP

NMOG+NOx emission levels on the aggressive driving

US06 cycle

- Require attestation that vehicles will meet FTP

NMOG+NOx emission levels on the SC03 cycle

Particulate Matter (PM)

Emission Standards

- Reduce US06 PM emission standard from 6 to 3

mg/mile

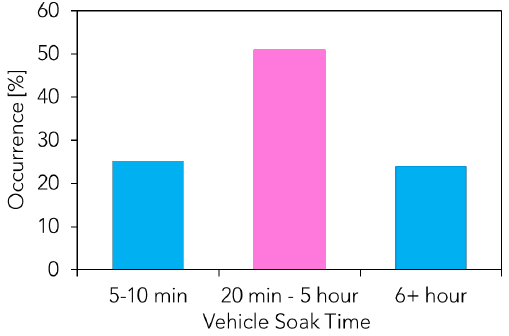

Cold-start Emission Control

- Establish new FTP emission standards to improve cold-

start emission control following partial soaks of 10

minutes to 12 hours

- New emission standards to improve cold-start

emission control during quick drive-aways on an 8

second initial idle FTP test.

Plug-in Hybrid Electric

Vehicles

- Establish new cold-start US06 emission certification

test to demonstrate compliance with new high-power

cold-start emission standards

Evaporative Emission

Control

- Reduce running loss emission standard from 0.05 to

0.01 g/mile to reduce evaporative emissions during

driving.

Table ES-0-4 Summary of LEV Proposals for Medium-Duty Vehicles

Proposal Category Description of Proposal

NMOG+NOx Fleet

Average

- Reduce fleet average to 150 mg/mile for class 2b and

175 mg/mile for class 3

- Remove ZEVs from the fleet average calculation

- Eliminate dirtiest emission certification bins for class

2b (ULEV250, ULEV200) and class 3 (ULEV400,

ULEV270)

14

- Add new lower emission certification bins for class 2b

(SULEV150, SULEV100, SULEV85, SULEV75) and for

class 3 (SULEV175, SULEV150, SULEV125, SULEV100).

SFTP Emission Standards

- Eliminate composite SFTP certification standards

- Require all Class 2b MDVs to meet FTP NMOG+NOx

emission levels on the US06 cycle

- Require all Class 3 MDVs to meet FTP NMOG+NOx

emission levels on the UC cycle

- Require attestation that SC03 emissions will be lower

than FTP certification bin standard

Particulate Matter (PM)

Emission Standards

- Eliminate composite SFTP certification option

- Require all medium-duty vehicles to meet stand-alone

PM standards for aggressive driving cycles: 8 mg/mile

for class 2b on full US06 cycle, 6 mg/mile for class 2b

on bag 2 US06 cycle, and 5 mg/mile for class 3 on UC

cycle

Moving Average Window

In-Use Standards

- Establish new PEMS standards for MDVs over 14,000

pound Gross Combined Weight Rating for better

emission control during towing

Proposal Direct Costs and Savings

Chapter X and the SRIA, discuss the economic and fiscal impacts of the ACC II proposed

regulations. The primary businesses affected by the Proposed Regulation are manufacturers

that sell on-road light-duty vehicles in the State of California. At this time, there are 17

companies that would be subject to this regulation. Also indirectly affected are California

consumers who buy new vehicles, and eventually used vehicle buyers. The cost to

manufacturers will be high per vehicle in the early years, but significantly decrease over time

by 2035. Between 2026 and 2040, the Proposed Regulation is estimated to result in

additional costs to businesses of $30.2 billion, or $2.0 billion on average per year.

In 2040, the proposed regulations are estimated to result in job gains of approximately

24,900, primarily in services, manufacturing and constructions sectors and approximately

64,700 jobs foregone predominantly in the retail and government sectors (though many of

the government sector jobs are tied to projected reductions in gas tax revenues which the

state is making separate efforts, outside of this proposal, to mitigate by considering other

revenue measures recognizing that gasoline vehicles will become rare; accordingly not all of

those losses may occur). The net job impact of the Proposed Amendments in 2040 is

estimated to be a slowing of employment growth of approximately 39,800 jobs. Overall jobs

and output impacts of the proposed regulation are small relative to the total California

economy, representing changes of no greater than 0.4 percent. Additionally, the regulations

will reduce the overall costs for transportation in California. Between 2026 and 2040, the

total impact is estimated to be a net cost-savings of $81.8 billion, or $5.9 billion on average

per year.

15

Individual vehicle consumers, for most ZEVs in the program, will see cost-savings when

considering the total cost of ownership (TCO). The results show that for BEVs, operational

savings will offset any incremental costs over the 10-year period evaluated. For example, a

passenger car BEV with a 300-mile range will have initial annual savings occur in the first year

for the 2026 model year technology. For the 2035 model year technology, the initial savings

are nearly immediate and cumulative savings over ten years exceed $7,500. These TCO

savings are even more favorable for a BEV owner who has access to a home charger.

Proposal Net Benefits

As discussed in Chapter XI and Appendix D, Emissions Inventory Methods and Results for the

Proposed Amendments, the ACC II program would increase new vehicle sales of BEVs,

FCEVs, and PHEVs and reduce emissions from the remaining new ICEVs sold. Increased use

of ZEVs penetrating the California fleet will reduce vehicle as well as upstream fuel

production emissions of GHGs, criteria pollutants (especially hydrocarbons or HC, oxides of

nitrogen or NOx, and fine particulate matter, or PM2.5), and toxics. Through the proposed

regulation, California will see a reduction in 2040 of 30.1 tons per day of NO

X

, 2.0 tons per

day of PM

2.5

, and 57.4 MMT/yr of CO

2

emissions (well-to-wheels emissions accounting for fuel

production) in 2040. The proposal will lead to an estimated 1,272 fewer cardiopulmonary

deaths; 208 fewer hospital admissions for cardiovascular illness; 249 fewer hospital

admissions for respiratory illness; and 639 fewer emergency room visits for asthma.

The proposed regulation is expected to significantly reduce GHG emission by replacing

ICEVs with ZEV technologies. The benefit of these GHG emission reductions can be

estimated using the social cost of carbon (SC-CO

2

), which provides a dollar valuation of the

damages caused by one ton of carbon pollution and represents the monetary benefit today

of reducing carbon emissions in the future. The avoided SC-CO

2

from 2026 to 2040 is the

sum of the annual well-to-tank (WTT)

19

and tank-to-wheel (TTW) GHG emissions reductions

multiplied by the SC-CO

2

in each year. The cumulative well-to-wheel (WTW) GHG emissions

reductions along with the estimated benefits range from about $10.9 billion to $46.0 billion

through 2040, depending on the chosen discount rate. The net result of these analyses shows

the proposed regulation delivers a cumulative net benefit to California of $80.7 billion and

has a benefit-cost ratio of 1.38, meaning benefits are more than costs between 2026 and

2040.

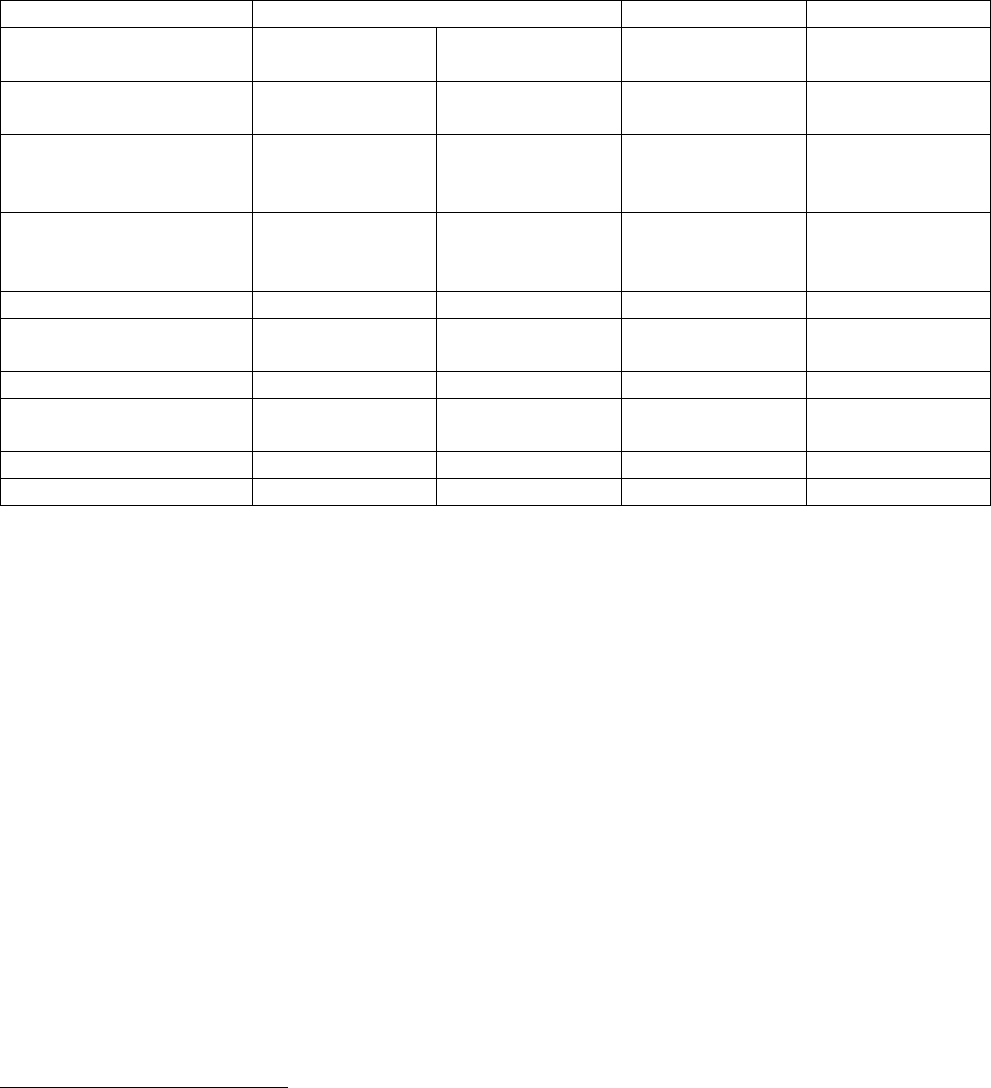

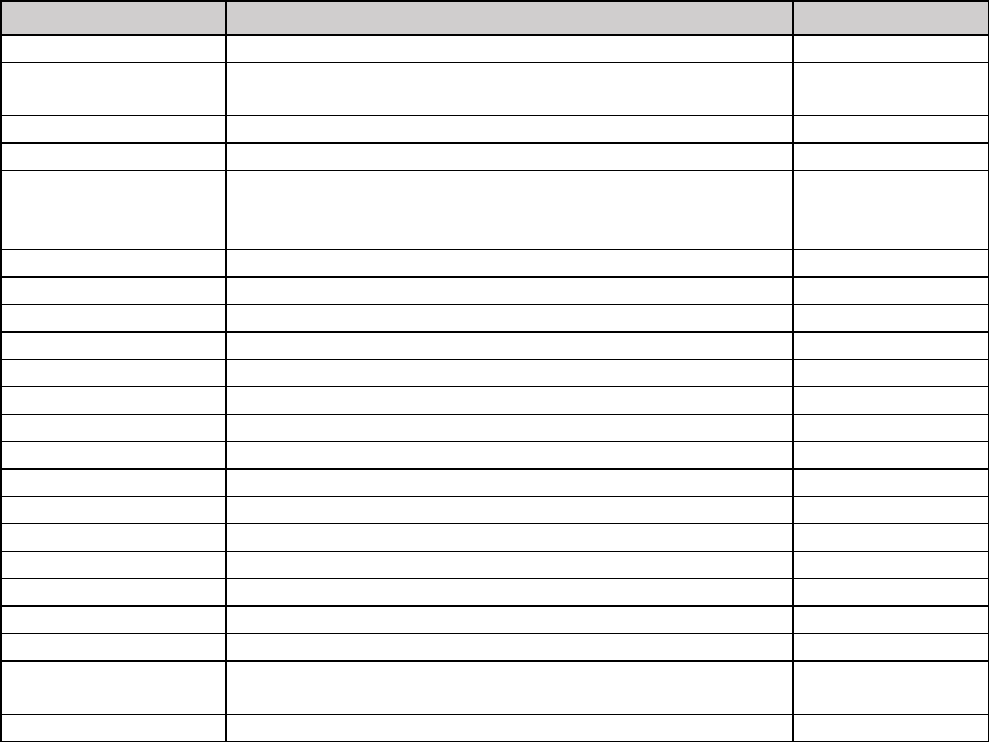

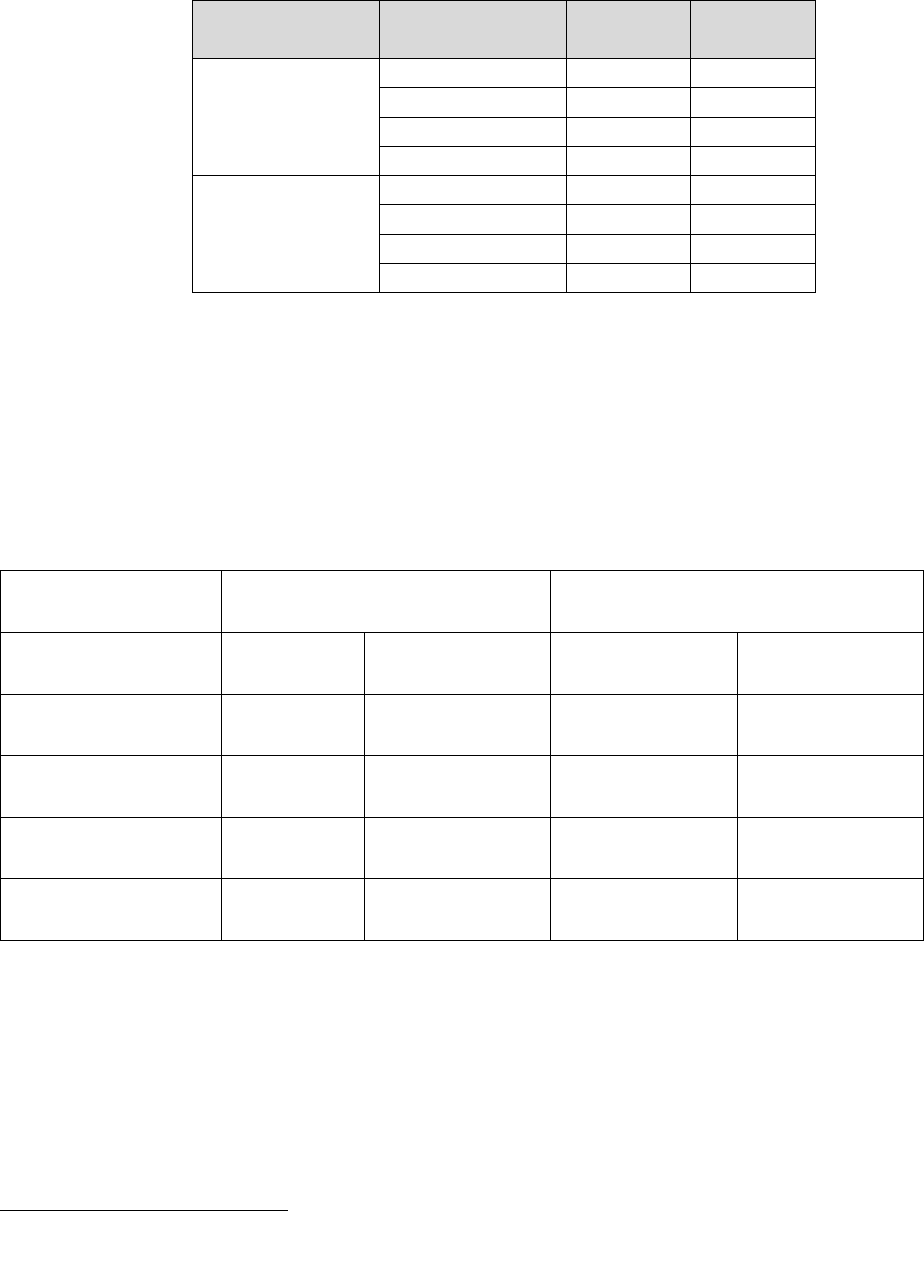

Table ES-0-5 Summary Costs and Benefits

Cumulative Costs, Benefits, and Job Impacts in 2040

Total costs to businesses:

$30.2 billion

The net job impact: decrease

in employment growth of

39,800 jobs

The total impact is a net cost-

savings of $81.8 billion

19

Connections between demand reductions for fuels and supply impacts are complex; as discussed in prior

documents for this regulation, including its SRIA, WTT estimates reflect one plausible scenario. Supply

decisions and upstream programs beyond the scope of this regulation may vary WTT figures, though overall

benefits from WTW emissions remain very large in all scenarios.

16

Total Cost of Operation Savings to Individuals

Overall, between 2026 and

2040, the TCO is estimated to

be a net cost savings,

statewide, of $81.8 billion

For the 2026 model year a

passenger car BEV with a 300-

mile range will have initial

annual savings occur in the first

year.

For the 2035 model year

technology, the initial savings

are nearly immediate and

cumulative savings over ten

years exceed $7,500.

Total Emission Benefits in 2040

(well-to-wheel emissions accounting for fuel production)

NOx (tpd) 30.1 PM

2.5

(tpd) 2.0 CO

2

(MMT/yr) 57.4

Estimated Cumulative Mortality Benefits 2026 - 2040 Statewide

1,272 fewer cardiopulmonary deaths;

208 fewer hospital admissions for cardiovascular illness;

249 fewer hospital admissions for respiratory illness; and

639 fewer emergency room visits for asthma

As shown in this staff report and accompanying analyses, the cost of the state regulations is

justified by the benefit to human health, public welfare, and the environment. The proposed

regulations will provide significant benefits for all these factors. They will reduce emissions

harmful to human health and the environment. These emission reductions will improve the

public health and welfare and protect the environment and climate for all Californians.

California Continues Advancing Clean Cars

In adopting staff’s proposal, the Board will put California will lead the nation in advancing

clean cars to the ultimate goal of 100% zero emissions, all while reducing smog-forming

emissions from new ICEVs. Additionally, staff’s ZEV assurance measures proposal includes an

innovative approach to helping ensure consumers can successfully replace their ICEVs with

new or used ZEVs that meet their needs for transportation with far fewer harmful emissions

and protect the emission benefits of the program. With Californians still experiencing the

harmful effects of smog-forming emissions and the effects of climate change, which are

expected to worsen in the coming decades, adoption of the proposed ACC II regulation is

critical and necessary.

Staff Report: Initial Statement of Reasons

Date of Release: April 12, 2022

Date of Hearing: June 9, 2022

I. Introduction and Background

California has a long history of regulating tailpipe emissions from passenger cars and trucks,

dating to the 1960s. Among the many high watermarks of these programs, in 1990 CARB

adopted an ambitious program to significantly reduce the environmental impact of light-duty

vehicles through the introduction of the Low-Emission Vehicle (LEV) regulations. The

regulations, referred to as the “LEV I” regulations, included three primary elements — (1)

tiers of exhaust emission standards for increasingly more stringent categories of low-emission

vehicles, (2) a mechanism requiring each manufacturer to phase in a progressively cleaner mix

of vehicles from year to year with the option of credit trading, and (3) a requirement that a

specified percentage of passenger cars and light-duty trucks be zero-emission vehicles (ZEV),

vehicles with no exhaust emissions. In 2012, CARB combined LEV regulations for controlling

smog-causing pollutants and greenhouse gas (GHG) emissions with ZEV regulations requiring

the manufacture of ZEVs into what is now referred to as the Advanced Clean Cars (ACC)

program for model years 2015 and beyond. CARB will continue the success of this approach

with this proposal, Advanced Clean Cars II.

The Advanced Clean Cars II (ACC II) regulatory proposal expands the existing requirements

to transition to ZEVs for almost all new car and light truck sales in California while cleaning up

any internal combustion-powered passenger vehicles that will continue to be offered for sale.

Doing so is critical to meeting California’s public health and climate goals and meeting State

and federal air quality standards. Mobile sources are the greatest contributor to emissions of

criteria pollutants and GHGs in California, accounting for about 80 percent of ozone

precursor emissions and approximately 50 percent of statewide GHG emissions, when

accounting for transportation fuel production and delivery.

20

The emission reductions from

the ACC II proposal will be critical to achieving carbon neutrality by 2045 a goal which CARB

continues to define via the draft 2022 Scoping Plan Update, which is set to be heard for the

first time by the Board in June 2022. The draft 2022 State Strategy for the State

Implementation Plan (SIP) Strategy also relies on reducing emissions of oxides of nitrogen

(NOx) from passenger vehicles to attain the latest federal ambient ozone standards by 2037

in the South Coast,

21

and reductions from these vehicles are critical to attaining or

maintaining compliance with federal standards as a general matter.

Internal combustion engine vehicles (ICEV), the majority of which are fueled by petroleum-

based fuels, are the dominant type of passenger car and trucks sold in California today, and

will continue to be through the first years of Advanced Clean Cars II. ZEVs, most commonly

battery electric vehicles (BEV) and hydrogen fuel cell electric vehicles (FCEV), have no

exhaust (or tailpipe) emissions and therefore are a clear solution to several public health and

environmental threats. ZEVs reduce mobile source emissions that contribute to unhealthy

20

CARB 2021a. 2020 Mobile Source Strategy. Released September 2021.

(https://ww2.arb.ca.gov/sites/default/files/2021-09/Proposed_2020_Mobile_Source_Strategy.pdf, accessed

January 31, 2022)

21

CARB 2022a. “Draft 2022 State Strategy for the State Implementation Plan”

1

regional ozone and particulate matter levels and reduce local exposure to toxics. ZEVs also

reduce demand for petroleum production, delivery, and combustion that is destabilizing the

climate and directly impacting public health. While ZEVs do still have upstream emissions

that are associated with the production of the electricity and hydrogen used to fuel them

(which are accounted for in the analysis of this proposal), the criteria pollutants and carbon

intensity of transportation electricity and hydrogen are already cleaner than gasoline in

California and are aggressively becoming even cleaner under state laws mandating

renewable sources of fuel and energy production along with CARB’s upstream regulatory

programs.

The proposed regulation will drive the sales of ZEVs and the cleanest-possible plug-in hybrid-

electric vehicles (PHEV) to 100-percent in California by the 2035 model year, all while

reducing smog-forming emissions from new ICEVs. Additionally, the proposed charging and

ZEV assurance measures, which include proposals to set minimum warranty requirements,

durability requirements, increase serviceability, and streamline battery labeling, will help

ensure consumers can successfully replace their ICEVs within California households with new

or used vehicles that meet their needs for transportation with far fewer harmful emissions

and protect the emission benefits of the program.

A. Regulatory History

Staff’s proposal builds upon many decades of CARB regulations seeking to reduce emissions

from light-duty passenger cars and trucks. Each of those regulations ultimately yielded

significant public benefits.

In 1990, CARB established the LEV regulation which contained aggressive exhaust emission

regulations for light-duty passenger cars and trucks and the first requirement for

manufacturers to build ZEVs.

Building upon the success of the LEV regulation, CARB adopted

the second phase of the regulations. These amendments, known as LEV II, set more stringent

fleet average non-methane organic gas (NMOG) requirements for model years 2004 through

2010 for passenger cars and light-duty trucks. Separately, in 2004 following the adoption of a

new state law (Assembly Bill (AB) 1493, statutes of 2002, chapter 200, Pavley), CARB

approved a landmark greenhouse gas (GHG) tailpipe standard, more commonly known as

“the Pavley regulation” for the statute’s author, to require automakers to control GHG

emissions from new passenger vehicles beginning with the 2009 model year. These were the

first regulations in the nation to control greenhouse gas emissions from motor vehicles, one

of the largest contributors to climate change emissions in the state.

The ZEV regulation has been adjusted numerous times since its 1990 inception to account for

changes in market response and technology development. Through this time, manufacturers

continued to develop technology and test pilot vehicles in limited use applications. In 2009,

staff concluded that even widespread market adoption of advanced conventional

technologies, like non-plug-in hybrid-electric vehicles (HEV), would be inadequate to meet

California’s then-current 2050 GHG targets

22

of reducing emissions by 80-percent below

1990 levels. Staff determined that ZEVs would need to comprise nearly 100-percent of new

vehicle sales between 2040 and 2050, and broad commercial markets for ZEVs would need

22

CARB, 2009a. “White Paper: Summary of Staff’s Preliminary Assessment of the Need for Revisions to the Zero

Emission Vehicle Regulation”. (PDF)

2

to launch in the 2015 to 2020 timeframe. The Board heard staff’s findings at its December

2009 hearing and adopted Resolution 09-66,

23

reaffirming its commitment to meeting

California’s long-term air quality and climate change reduction goals through

commercialization of ZEV technologies.

Continuing its leadership role in the development of innovative and groundbreaking emission

control programs and advancing ZEV technologies, California developed the ACC program,

which was finalized with Board action in 2012. The ACC program incorporated three

elements that combined the control of smog-causing pollutants and GHG emissions into a

single coordinated package of requirements for model years 2015 through 2025, assuring

the development of environmentally superior vehicles that will continue to deliver the

performance, utility, and safety vehicle owners have come to expect. These three elements

included the LEV III regulations to reduce criteria pollutants and GHG emissions and another

phase of ZEV requirements.

24

When the Board adopted ACC in 2012, it committed to conducting a comprehensive

midterm review (MTR) of three elements within the ACC program: 1) the ZEV regulation, 2)

the 1 milligram per mile particulate matter (PM) standard, and 3) the light-duty vehicle GHG

standards for 2022 and later model years. Staff’s ACC review was conducted at the same

time as staff also participated in a related midterm evaluation by the United States

Environmental Protection Agency (U.S. EPA) of the federal light-duty vehicle greenhouse gas

standards for the 2022 through 2025 model years. Following completion of the MTR, the

Board concluded the following, among other things, at its March 2017 hearing:

• California’s GHG tailpipe standards remained appropriate and achievable for the 2022

through 2025 model years

• California’s ZEV requirements as adopted in 2012 are appropriate and will remain in

place to develop the market

• Complementary policies are needed and should be expanded to help support an

expanding ZEV market

• California’s PM standard is feasible but further action is needed to ensure robust

control

• Staff are directed to immediately begin rule development for more stringent standards

for the 2026 and subsequent model years

The federal program was subsequently significantly modified under successive federal

administrations, with the latest standards becoming effective on February 28, 2022.

25

CARB’s

work, however, continued in response to the findings of the 2017 MTR. Following the

Board’s direction in 2017, staff developed the proposed ACC II regulations. CARBs efforts

have been accelerated by the growing magnitude of the climate and air quality crisis, and by

23

CARB 2009b. Resolution 09-66. December 9, 2009. (https://www.arb.ca.gov/board/res/2009/res09-66.pdf,

accessed on January 31, 2022)

24

Although the Clean Fuels Outlet regulation update was adopted by the Board as part of the ACC package, it

was not finalized in response to Assembly Bill 8 (AB 8, stats. 2013, ch. 401), which included dedicated funding

for hydrogen fueling infrastructure to support the market launch of FCEVs.

25

U.S. EPA, Revised 2023 and Later Model Year Greenhouse Gas Emission Standards, 86 Fed. Reg. 74,434,

Dec. 30, 2021. The federal government also took actions intended to prevent enforcement of certain model

years of CARB’s ACC program under the federal Clean Air Act and other law; those actions have since been

reconsidered and do not bear directly upon ACC II or limit CARB’s ability to propose these regulations.

3

resulting direction from the Governor. Governor Newsom signed Executive Order N-79-20

26

establishing a goal that 100 percent of California sales of new passenger car and trucks be

ZEVs by 2035. Staff’s proposal aims to further curb criteria, toxic, and GHG emission

reductions through increased LEV program stringency, requirements to ensure emissions are

reduced under real-world operating conditions, and by accelerating the transition to ZEVs

through both increased stringency of ZEV requirements and associated actions to support

wide-scale adoption and use beginning with the 2026 model year. The proposals go beyond

the existing state and federal GHG emission standards, which have been adopted by CARB

and U.S. EPA, respectively, and which will remain in effect pending any further revision.

27

The success of emission controls and electrification within the light-duty sector, along with

growing private and public sector support for electrification across the board, has enabled

similar regulations to be adopted in the medium- and heavy-duty sectors. Some medium-

duty vehicles have the option to certify using the light duty regulations or heavy-duty

regulations; therefore, it is important to know the regulatory landscape for this category.

CARB has finalized a comprehensive update to the California emission standards and other

emission-related requirements for heavy-duty engines and vehicles, referred to as the

“Heavy-Duty Omnibus Regulation.”

28

The Heavy-Duty Omnibus Regulation is aimed at

ensuring real-world emissions performance on the road, not just in the laboratory. In addition

to more stringent criteria pollutant standards for heavy-duty engines, CARB also adopted the

Advanced Clean Trucks (ACT) regulation. The ACT Regulation

29

will accelerate the market for

zero-emission medium- and heavy-duty vehicles in applications that are well suited for their

use. Medium- and heavy-duty vehicle manufacturers will be required to start producing and

selling a modest number of ZEVs beginning with the 2024 model year with ZEV sales

increasing through the 2030 model year. CARB is also in the process of proposing an

Advanced Clean Fleets (ACF) regulation which will accelerate adoption of ZEV vehicles in

important uses, and which proposes phasing out new combustion vehicles amongst the

vehicle classes it would cover by 2040.

II. The Problem the Proposal is Intended to Address

The California Legislature has directed CARB to “systematically attack the serious problem

caused by motor vehicles [as] the major source of air pollution in many areas of the state.”

30

26

GO 2020. Governor Gavin Newsom. Executive Order N-79-20. Released September 23, 2020.

https://www.gov.ca.gov/wp-content/uploads/2020/09/9.23.20-EO-N-79-20-Climate.pdf, accessed January 31,

2022

27

CARB will continue to work closely with its federal agency partners as it considers whether to revise its GHG

exhaust emission standards in a future proposal

28

CARB 2020a. Initial Statement of Reasons: Proposed Amendments to the Exhaust Emissions Standards and

Test Procedures for 2024 and Subsequent Model Year Heavy-Duty Engines and Vehicles, Heavy-Duty On-Board

Diagnostic System Requirements, Heavy-Duty In-Use Testing Program, Emissions Warranty Period and Useful

Life Requirements, Emissions Warranty Information and Reporting Requirements, and Corrective Action

Procedures, In-Use Emissions Data Reporting Requirements, and Phase 2 Heavy-Duty Greenhouse Gas

Regulations, and Powertrain Test Procedures. Released June 23, 2020.

(https://ww2.arb.ca.gov/sites/default/files/barcu/regact/2020/hdomnibuslownox/isor.pdf, accessed January 31,

2022)

29

CARB 2019a. Initial Statement of Reasons: Advanced Clean Trucks Regulation. Released October 22, 2019.

(https://ww2.arb.ca.gov/sites/default/files/barcu/regact/2019/act2019/isor.pdf, accessed January 31, 2022.)

30

Health and Saf. Code, § 39003.

4

Air pollution presents multiple threats to public health and welfare, and CARB is mandated to

meet those threats in many ways. CARB is responsible for controlling emissions from

vehicles

31

, for preparing the state implementation plan required by the federal Clean Air

Act

32

, and regulating sources of the greenhouse gases that are causing global warming.

33

California must significantly reduce emissions of ozone and particulate matter on schedules

that are developed to ensure the air we all breath meets National Ambient Air Quality

Standards (NAAQS), set by U.S. EPA, and the California Ambient Air Quality Standards, set

by CARB, that limit pollution to levels necessary to protect public health. The most recent

federal ozone NAAQS standard is a level of 70 parts per billion (ppb), with a required

attainment date in the South Coast Air Basin by 2037. The federal PM requirements also

require action in California for attainment, with a deadline of 2024 for the 35 ug/m3 24-hour

standard and 2025 for the 12 ug/m3 annual standard. In California, NOx is a critical

precursor to ozone and secondary PM formation. Exposure to ozone and fine particulate

matter (PM2.5) is associated with increases in premature death, hospitalizations, visits to

doctors, use of medication, and emergency room visits due to exacerbation of chronic heart

and lung diseases and other adverse health conditions. Accordingly, ZEVs and reduced

emissions from conventional vehicles are a leading measure supporting the State SIP

Strategy.

To evaluate the kinds of strategies necessary, and the pace of action needed, to address the

complex, wide-reaching problem of air pollution from motor vehicles and other mobile

sources, CARB developed the 2020 Mobile Source Strategy.

34

As with the prior 2016 Mobile

Source Strategy, the updated Strategy informs policy decisions for specific measures in the

State Implementation Plan (SIP) required by the federal Clean Air Act, the Climate Change

Scoping Plan, and Community Emission Reduction Plans to protect vulnerable communities

from disparate pollution impacts. Although feasibility assessments and regulatory stringency

requirements are established in separate rulemakings, the Mobile Source Strategy provides

important context on how to mitigate multiple pollutants when considering all mobile

sources in California as a top-down assessment of the magnitude of change needed to be

achieved across a portfolio of programs. The need to continue reducing pollution from

conventional passenger vehicles while simultaneously scaling up requirements for ZEVs on

California’s roads, including within this regulatory proposal along with other efforts, are

important outcomes of the Mobile Source Strategy and integral to these proposed

regulations.

The State Strategy for the State Implementation Plan provides the framework for meeting

the federal and State health-based ambient air quality standards.

35

The California Global Warming Solutions Act of 2006, Assembly Bill 32 (Nuñez, Chapter 488,

Statutes of 2006, requires CARB “to achieve the maximum technologically feasible and cost-

effective greenhouse gas emission reductions”

36

Senate Bill 32 requires CARB to ensure that

31

Health and Saf. Code, §§ 39002, 39667

32

Health and Saf. Code, § 39602

33

Health and Saf. Code, § 38510.

34

CARB 2021a.

35

CARB 2017b. CARB Staff Report - Revised Proposed 2016 State Strategy for the State Implementation Plan,

March 2017. https://ww3.arb.ca.gov/planning/sip/2016sip/rev2016statesip.pdf Accessed January 20, 2022.

36

HSC 38560; see also 38510.

5

California’s statewide emissions of GHG emissions are reduced to at least 40 percent below

the level of statewide GHG emissions in 1990 by 2030.

37

In December 2017, CARB adopted

the Scoping Plan Update, known as California’s 2017 Climate Change Scoping Plan, to

provide the strategy to meet California’s 2030 target for reducing GHG emissions.

38

It too

includes zero-emission passenger cars and light trucks as a key component of the strategy to

meet California’s long-term goals for a sustainable climate and transportation system.

Subsequently, Executive Order B-55-18

39

established a statewide goal of achieving carbon

neutrality no later than 2045. In support of reducing vehicle emissions, Governor Newsom

signed Executive Order N-79-20

40

establishing a goal that 100 percent of California sales of

new passenger car and trucks be ZEVs by 2035.

CARB also recognizes that the proposed regulations must have multiple approaches to meet

the complex, multi-dimensional public health, welfare, and climate problem of motor vehicle

pollution. To meet this objective, CARB incorporated numerous market-based flexibilities

and mechanisms into the proposal. These include averaging, banking, and trading provisions

for meeting the emission and ZEV standards.

A. Need for Emission Reductions

Cars, trucks, and other mobile sources contribute a significant amount of smog-forming NOx

(a precursor to ozone formation, sometimes referred to as smog) and the largest portion of

GHG emissions in California.

41

As shown in the baseline conditions of the updated 2020

Mobile Source Strategy, on-road light-duty vehicles accounted for 13-percent of the total

NOx emissions statewide in 2017. In the South Coast Air Basin specifically, light-duty vehicles

comprised 18 percent of the 2017 NOx emissions inventory. Also as shown in the 2020

Mobile Source Strategy, light-duty vehicles comprise 28 percent of the GHG emissions in

California,

42

or about 70-percent of the direct emissions from vehicles and equipment. The

indirect or upstream emissions from fuel production (for all transportation modes) are 7-

percent for refineries, 4.1-percent for oil and gas extraction, 0.9-percent for pipelines, and

0.7-percent for agriculture activities to produce fuel. When coupled with the direct emissions

from all transportation sources, the total GHG emissions from mobile sources and their fuel

production represent more than 50-percent of the total statewide GHG inventory. The 2020

Strategy reinforced the conclusions of the 2016 Mobile Source Strategy: transitioning to

zero-emission technology for every on- and off-road mobile sector is essential for meeting

37

Pavley, ch. 249, stats. 2016; HSC 38566

38

CARB 2017c. California Air Resources Board. California's 2017 Climate Change Scoping Plan Update.

https://ww2.arb.ca.gov/sites/default/files/classic/cc/scopingplan/scoping_plan_2017.pdf November 2017.

Accessed January 31, 2022.

39

GO 2018. Governor Jerry Brown. Executive Oder to Achieve Carbon Neutrality, EO B-55-18. Released

September 10, 2018. https://www.ca.gov/archive/gov39/wp-content/uploads/2018/09/9.10.18-Executive-

Order.pdf, accessed January 31, 2022

40

GO 2020.

41

CARB 2021a.

42

CARB 2021a; this remains consistent with the more recent CARB GHG Emission Inventory Report for 2019

emissions. CARB 2021b. California Greenhouse Gas Emissions for 2000 to 2019.

https://ww3.arb.ca.gov/cc/inventory/pubs/reports/2000_2019/ghg_inventory_trends_00-19.pdf

6

near- and long-term emission reduction goals mandated by statute, with regard to both

ambient air quality and climate requirements.

43

The Draft 2022 State Strategy for the State Implementation Plan

44

builds on emission

reductions from the proposed regulations, which are critical to meeting air quality standards.

If the state cannot demonstrate it can attain these standards via enforceable plans it may face

various federal sanctions or regulatory burdens, further heightening this need. It is part of