TO STUDY DATA OF E-BANKING

OPERATIONS AT KOTAK MAHINDRA BANK

A Project Submitted to

University of Mumbai for partial completion of the degree of

Bachelor’s in commerce (BANKING & INSURANCE)

Under the Faculty of Commerce

By

HARIT BHATIA

Under the Guidance of

Mr. NIRAV GODA

THAKUR COLLEGE OF SCIENCE AND COMMERCE

Thakur Village, Kandivali (E), Mumbai 400101

APRIL 2021

Certificate

This is to certify that Mr HARIT BHATIA has worked and duly completed his Project Work

for the degree of bachelor’s in commerce

(Banking & Insurance) under the Faculty of Commerce and his project is entitled, “To

STUDY DATA Of E-Banking Operations At Kotak Mahindra Bank” under my supervision.

I further certify that the entire work has been done by the learner under my guidance and that

no part of it has been submitted previously for any Degree or Diploma of any University.

It is his own work and facts reported by his personal findings and investigations.

NAME & NAME &

SIGNATURE OF GUIDE SIGNATURE OF EXTERNAL

Date of submission: 03/04/2021

Declaration by Learner

I the undersigned Mr HARIT BHATIA hereby, declare that the work embodied in this project

work titled “ TO STUDY DATA Of E-Banking Operations At Kotak Mahindra Bank forms

my own contribution to the research work carried out under the guidance of Mr. NIRAV

GODA, result of my own research work and has not been previously submitted to any other

University for any other Degree/ Diploma to this or any other University.

Wherever reference has been made to previous works of others, it has been clearly indicated

as such and included in the bibliography.

I, hereby further declare that all information of this document has been obtained and

presented in accordance with academic rules and ethical conduct.

Name and Signature of the learner

Certified by

Name and signature of the Guiding Teacher

Acknowledgment

I would like to acknowledge the following as being idealistic channels and fresh dimensions

in the completion of this project.

I take this opportunity to thank the University of Mumbai for giving me the chance to do this

project.

I would like to thank my Principal, DR. Mrs. C.T. CHAKRABORTY for providing the

necessary facilities required for completion of this project.

I take this opportunity to thank our Coordinator, _Mr. NIRAV GODA, for his moral support

and guidance.

I would also like to express my sincere gratitude towards my project guide

MR. NIRAV GODA whose guidance and care made the project successful.

I would like to thank my College Library, for having provided various reference books and

magazines related to my project.

Lastly, I would like to thank each and every person who directly or indirectly helped me in the

completion of the project especially my Parents and Peers who supported me throughout my

project.

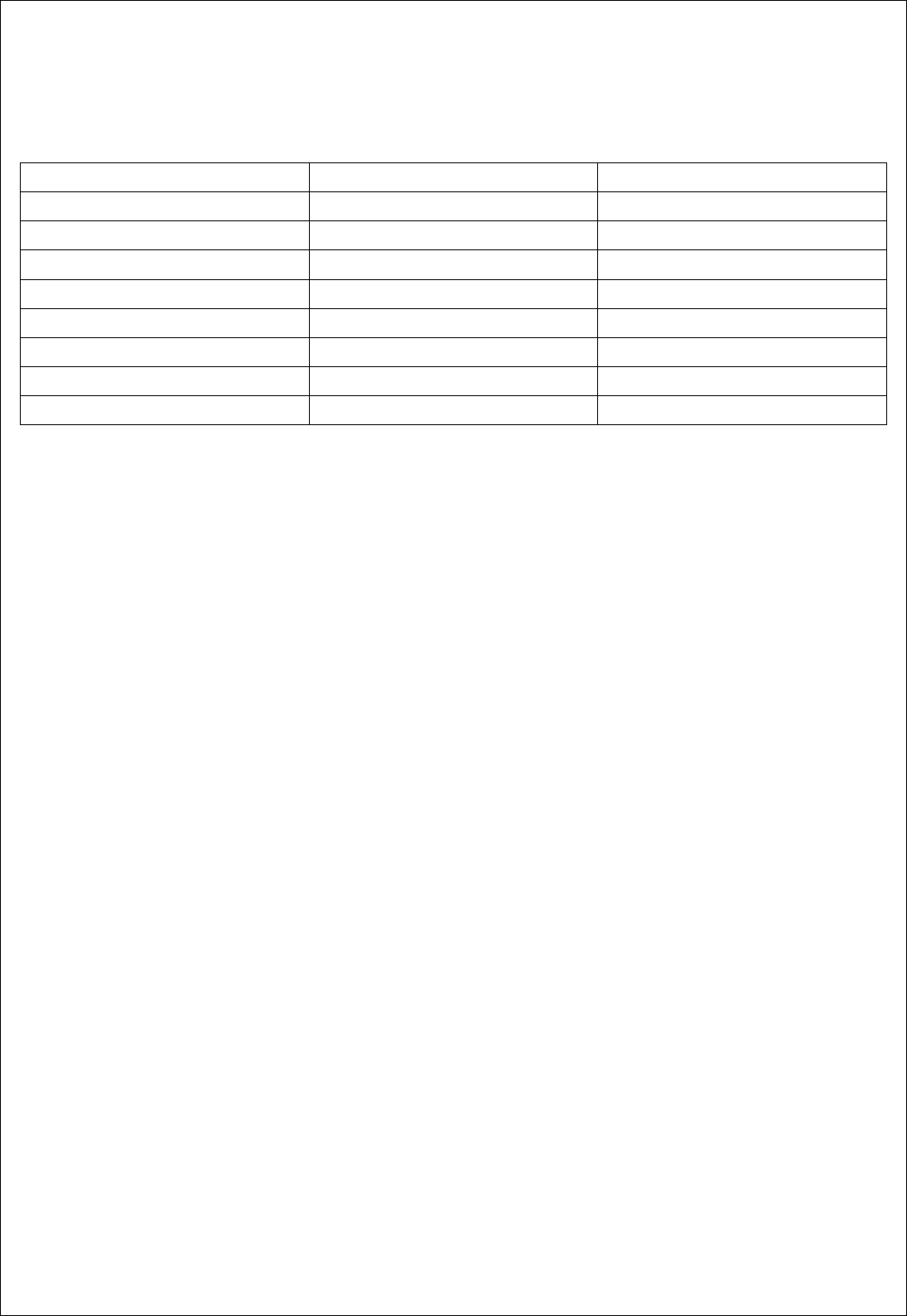

INDEX

Chapter No.

Title of the Chapter

Page No.

1

Introduction

5-57

2

Research Methodology

58-61

3

Literature Review

62-68

4

Data Analysis

69-76

5

Conclusion

78-78

6

Limitation of Study

78-78

7

Recommendation

78-78

8

Bibliography

79-79

INTRODUCTION

Banks have traditionally been in the forefront of harnessing technology to

improve their products, services and efficiency. They have, over a long time,

been using electronic and telecommunication networks for delivering a wide

range of value-added products and services. The delivery channels include

direct dial – up connections, private networks, public networks etc and the

devices include telephone, Personal Computers including the Automated Teller

Machines, etc. With the popularity of PCs, easy access to Internet and World

Wide Web (WWW), Internet is increasingly used by banks as a channel for

receiving instructions and delivering their products and services to their

customers.

This form of banking is generally referred to as Internet Banking, although the

range of products and services offered by different banks vary widely both in

their Content and sophistication. Broadly, the levels of banking services offered

through INTERNET can be categorized in to three types:

(i) The Basic Level Service is the banks websites which disseminate information

on different products and services offered to customers and members of public

in general. It may receive and reply to customers‟ queries through e-mail.

(ii) In the next level are Simple Transactional Websites which allow customers to

submit their instructions, applications for different services, queries on their

account balances, etc, but do not permit any fund-based transactions on their

accounts

(iii) The third level of Internet banking services are offered by Fully Transactional

Websites which allow the customers to operate on their accounts for transfer of

funds, payment of different bills, subscribing to other products of the bank and

to transact purchase and sale of securities, etc.

The above forms of Internet banking services are offered by traditional banks,

as an additional method of serving the customer or by new banks, who deliver

banking services primarily through Internet or other electronic delivery channels

as the value-added services. Some of these banks are known as “virtual‟ banks

and may not have any physical presence in a country despite offering different

banking services. From the perspective of banking products and services being

offered through Internet. Internet banking is nothing more than traditional

banking services delivered through an electronic communication backbone, viz,

Internet.

But, in the process it has thrown open issues which have ramifications beyond

what a new delivery channel would normally envisage and hence, has compelled

regulators, world over to take note of this emerging channel.

Features Of E-Banking

1. It removes the traditional geographical barriers as it could reach out to

customers of different countries / legal jurisdiction. This has raised the question

of jurisdiction of law / supervisory system, to which such transactions should be

subjected.

2. It has added a new dimension to different kinds of risks traditionally

associated with banking, heightening some of them and throwing new risk

control challenges.

3. Security of banking transactions, validity of electronic contract, customers

privacy, etc., which have all along been concerns of both bankers and

supervisors have assumed different dimensions given that Internet is a public

domain, not subject to control by any single authority or group of users.

4. It poses a strategic risk of loss of business to those banks who do not respond

in time, to this new technology, being the efficient and cost-effective delivery

mechanism of banking services.

5. A new form of competition has emerged both from the existing players and

new players of the market who are not strictly banks. The Regulatory and

Supervisory concerns in e-banking arise mainly out of the distinctive features

outlined above.

These concerns can be broadly addressed under three broad categories, viz

(i) Legal and regulatory issues,

(ii) Security and technology issues and

(iii) Supervisory and operational issues. Legal issues cover those relating to the

jurisdiction of law, validity of electronic contract including the question of

repudiation, gaps in the legal / regulatory environment for electronic commerce.

On the question of jurisdiction, the issue is whether to apply the law of the area

where access to Internet has been made or where the transaction has finally taken

place.

Security of e-banking transactions is one of the most important areas of concerns

to the regulators. Security issues include questions of adopting internationally

accepted state of the art minimum technology standards for access control,

encryption / decryption (minimum key length etc), firewalls, verification of

digital signature, Public Key Infrastructure (PKI) etc. The regulator is equally

concerned about the security policy for the banking industry, security awareness

and education. The supervisory and operational issues include risk control

measures, advance warning system, Information technology audit and re-

engineering of operational procedures. The regulator would also be concerned

with whether the nature of products and services offered are within the

regulatory framework and whether the transactions do not camouflage money-

laundering operations.

The Central Bank may have its concern about the impact of Internet banking on

its monetary and credit policies. As long as Internet is used only as a medium

for delivery of banking services and facilitator of normal payment transactions,

perhaps, it may not impact monetary policy However, when it assumes a stage

where private sector initiative produces electronic substitution of money like e-

cheque, account-based cards and digital coins, its likely impact on monetary

system cannot be overlooked. Even countries where e-banking has been quite

developed, its impact on monetary policy has not been significant. In India, such

concern, for the present is not addressed as the e-banking is still in its formative

stage.

HISTORY OF BANKING SECTOR

Banking in India originated in the last decades of the 18th century. The first

banks were The General Bank of India, which started in 1786, and Bank of

Hindustan, which started in 1790; both are now defunct. The oldest bank in

existence in India is the State Bank of India, which originated in the Bank of

Calcutta in June 1806, which almost immediately became the Bank of Bengal.

This was one of the three presidency banks, the other two being the Bank of

Bombay and the Bank of Madras, all three of which were established under

charters from the British East India Company. For many years, the Presidency

banks acted as quasi-central banks, as did their successors. The three banks

merged in 1921 to form the Imperial Bank of India, which, upon India's

independence, became the State Bank of India.

NATIONALISATION

Despite the provisions, control and regulations of Reserve Bank of India, banks

in India except the State Bank of India or SBI, continued to be owned and

operated by private persons. By the 1960s, the Indian banking industry had

become an important tool to facilitate the development of the Indian economy.

At the same time, it had emerged as a large employer, and a debate had ensued

about the nationalization of the banking industry. Indira Gandhi, then Prime

Minister of India, expressed the intention of the Government of India in the

annual conference of the All-India Congress Meeting in a paper entitled "Stray

thoughts on Bank Nationalization." The meeting received the paper with

enthusiasm. Thereafter, her move was swift and sudden. The Government of

India issued an ordinance and nationalized the 14 largest commercial banks with

effect from the midnight of July 19, 1969. Jayaprakash Narayan, a national

leader of India, described the step as a "masterstroke of political sagacity."

Within two weeks of the issue of the ordinance, the Parliament passed the

Banking Companies (Acquisition and Transfer of Undertaking) Bill, and it

received the presidential approval on 9 August 1969. A second dose of

nationalization of 6 more commercial banks followed in 1980. The stated reason

for the nationalization was to give the government more control of credit

delivery. With the second dose of nationalization, the Government of India

controlled around 91% of the banking business of India. Later, in the year 1993,

the government merged New Bank of India with Punjab National Bank. It was

the only merger between nationalized banks and resulted in the reduction of the

number of nationalized banks from 20 to 19. After this, until the 1990s, the

nationalized banks grew at a pace of around 4%, closer to the average growth

rate of the Indian economy.

POST- INDEPENDENCE

The partition of India in 1947 adversely impacted the economies of Punjab and

West Bengal, paralyzing banking activities for months. India's independence

marked the end of a regime of the Laissez-faire for the Indian banking. The

Government of India initiated measures to play an active role in the economic

life of the nation, and the Industrial Policy Resolution adopted by the

government in 1948 envisaged a mixed economy. This resulted into greater

involvement of the state in different segments of the economy including banking

and finance. The major steps to regulate banking included: The Reserve Bank

of India, India's central banking authority, was nationalized on January 1, 1949

under the terms of the Reserve Bank of India (Transfer to Public Ownership)

Act, 1948 (RBI, 2005b) In 1949, the Banking Regulation Act was enacted which

empowered the Reserve Bank of India (RBI) "to regulate, control, and inspect

the banks in India.

LIBERALISATION

In the early 1990s, the then Narasimha Rao government embarked on a policy

of liberalization, licensing a small number of private banks. These came to be

known as New Generation tech savvy banks and included Global Trust Bank

(the first of such new generation banks to be set up), which later amalgamated

with Oriental Bank of Commerce, Axis Bank (earlier as UTI Bank), ICICI Bank

and HDFC Bank. This move, along with the rapid growth in the economy of

India, revitalized the banking sector in India, which has seen rapid growth with

strong contribution from all the three sectors of banks, namely, government

banks, private banks and foreign banks. The next stage for the Indian banking

has been set up with the proposed relaxation in the norms for Foreign Direct

Investment, where all Foreign Investors in banks may be given voting rights

which could exceed the present cap of 10%, at present it has gone up to 74%

with some restrictions.

The new policy shook the Banking sector in India completely. Bankers, till this

time, were used to the 4-6-4 method (Borrow at 4%; Lend at 6%; Go home at 4)

of functioning. The new wave ushered in a modern outlook and tech-savvy

methods of working for traditional banks. All this led to the retail boom in India.

People not just demanded more from their banks but also received more.

Currently, banking in India is generally mature in terms of supply, product range

and reach-even though reach in rural India still remains a challenge for the

private sector and foreign banks. In terms of quality of assets and capital

adequacy, Indian banks are considered to have clean, strong and transparent

balance sheets relative to other banks in comparable economies in its region.

The Reserve Bank of India is an autonomous body, with minimal pressure from

the government. The stated policy of the Bank on the Indian Rupee is to manage

volatility but without any fixed exchange rate-and this has mostly been true.

With the growth in the Indian economy expected to be strong for quite some

time-especially in its services sector-the demand for banking services, especially

retail banking, mortgages and investment services are expected to be strong.

One may also expect M&As, takeovers, and asset sale.

GROWTH OF BANKING AND DEVELOPMENT IN INDIA

The world’s second largest populated country, India, is the apple of the eye for

the world now. The world economies are seeing it as their potential market. This

has been going on since quite some time now, ever since 1991 reforms of

liberalization, globalization and privatization. Indian markets in urban areas

have grown appreciably and are on the verge of saturation, so corporates have

started tapping rural markets, since more than 60 per cent of India’s population

lives in rural areas. India has been considerably shielded from the global

recession. Firstly, we are not very dependent on the exports for our GDP and

have a good consumer base in India. Secondly, we are a saving prone economy,

unlike western economies which are consumption prone. Thirdly, when banks

across the world are falling like a pyramid of playing cards; we are safe, steady

and strong, with our banks which have acted like a strong backbone of our

economy during present turmoil. And just like the FMCG sector, there is

tremendous growth potential in the banking sector, because firstly, the rural

masses have the habit of saving and spending only when needed. Secondly, their

small credit requirements for agriculture, cottage industry and marriages etc.

According to research carried out by the Reserve Bank of India (RBI), on an all

India basis, 59 per cent of the adult population in the country has bank accounts

and 41 per cent don’t. In rural areas, the coverage of banks is 39 per cent, against

60 per cent in urban areas. There is only one bank for a population of 13000.

Within the retail segment, housing loans grew by 20% CAGR during the same

period and consisted ~10% of the total bank credit.

Thus, the banks, which had a big challenge on the unsecured loan front, had at

the same time a bigger opportunity in the mortgage-backed security portfolio.

Abundant liquidity in the banking system during FY10 has been ensured

through secular growth in deposits, low credit demand and prudent borrowing

schedule issued by the government to maintain a balanced growth. According

to a research report, despite the huge borrowings of Rs 4,510 bn by the

government in FY10, the money held in reverse repo by banks remained

considerably high. This will provide an opportunity to the banks to utilize the

money in the most efficient and effective way to the benefit of both the

customers and the economy, comprising various stakeholders. Having talked

about comfortable liquidity and the much-wanted stability in the banking

system, one can expect that bond yields will remain in a higher range and would

not fall significantly.

Other reasons which are likely to support this fact include:

• Lower than expected government borrowings

• Reduced global risk premium

• Higher credit growth. This brings another opportunity for the banks to earn

higher income. Besides the favourable condition for liquidity and high bond

yield, it is expected that the Net Interest Margin (NIM) will not expand much.

The banks need to have higher incremental CD ratio, improvement in spreads

and stable yield on investments to improve NIMs. Banks are expected to have a

low cost of deposits owing to a stable interest rate scenario and ample liquidity

in the system. In the past few years, fee income has been the major contributor

of revenue for private sector banks. Private sector banks have leveraged those

areas to achieve the above, which public sector banks have not been able to, viz.,

transaction- related services and third-party products sales, among others, to

increase this non-fund-based income. Thus, we can very well say that the current

situation has provided a lot of opportunities and challenges to the existing banks.

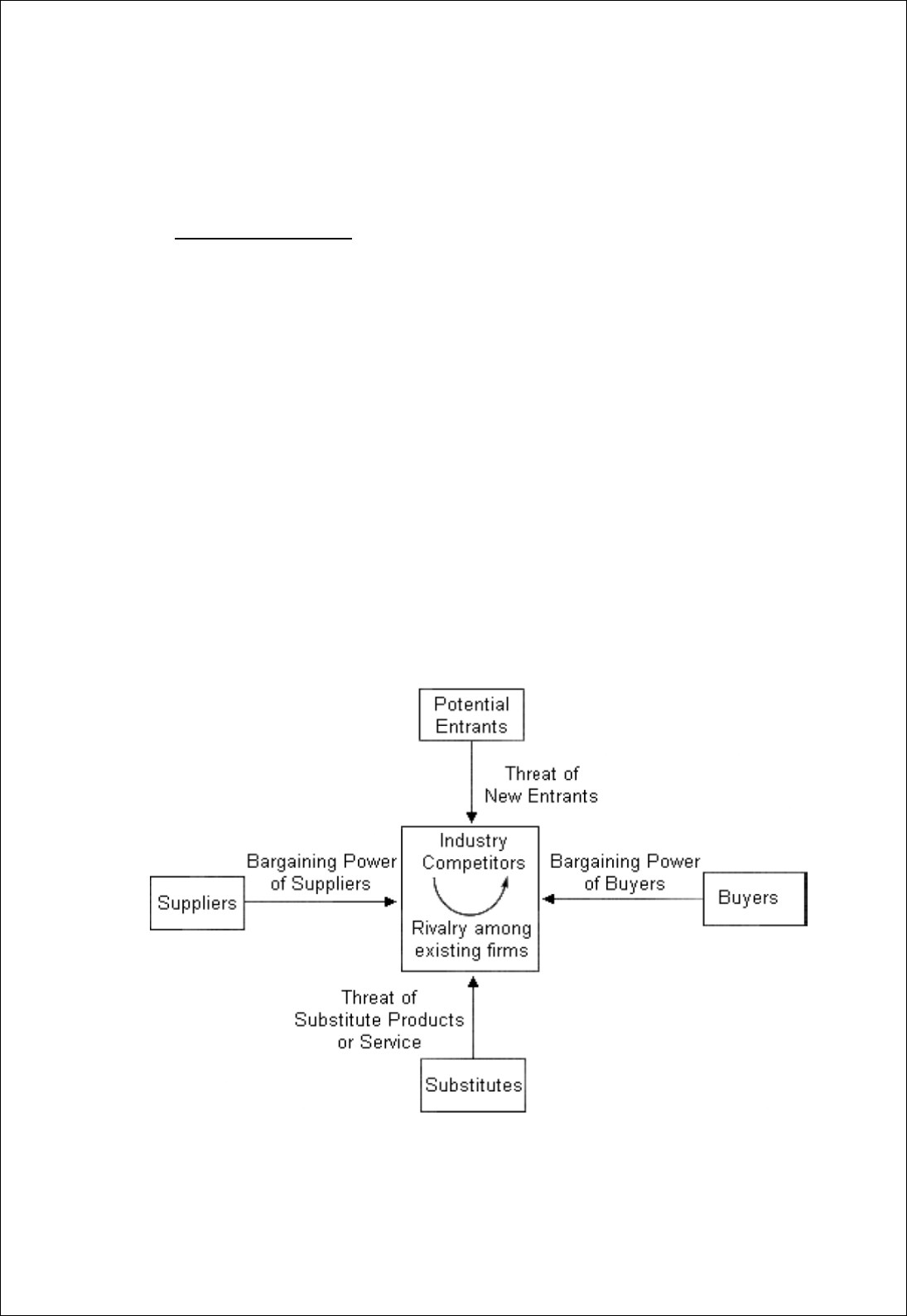

PORTER’S FIVE FORCES ANALYSIS

1. Threat of New Entrants. The average person cannot come along and start

up a bank, but there are services, such as internet bill payment, on which

entrepreneurs can capitalize. Banks are fearful of being squeezed out of the

payments business because it is a good source of fee-based revenue. Another

trend that poses a threat is companies offering other financial services. What

would it take for an insurance company to start offering mortgage and loan

services? Not much. Also, when analysing a regional bank, remember that the

possibility of a mega bank entering into the market poses a real threat.

2. Power of Suppliers. The suppliers of capital might not pose a big threat, but

the threat of suppliers luring away human capital does. If a talented individual

is working in a smaller regional bank, there is the chance that person will be

enticed away by bigger banks, investment firms, etc.

3. Power of Buyers. The individual does not pose much of a threat to the

banking industry, but one major factor affecting the power of buyers is relatively

high switching costs. If a person has a mortgage, car loan, credit card, checking

account and mutual funds with one particular bank, it can be extremely tough

for that person to switch to another bank. In an attempt to lure in customers,

banks try to lower the price of switching, but many people would still rather

stick with their current bank. On the other hand, large corporate clients have

banks wrapped around their little fingers. Financial institutions - by offering

better exchange rates, more services, and exposure to foreign capital markets -

work extremely hard to get high-margin corporate clients.

4. Availability of Substitutes. As you can probably imagine, there are plenty

of substitutes in the banking industry. Banks offer a suite of services over and

above taking deposits and lending money, but whether it is insurance, mutual

funds or fixed income securities, chances are there is a non-banking financial

services company that can offer similar services. On the lending side of the

business, banks are seeing competition rise from unconventional companies.

Sony, General Motors and Microsoft all offer preferred financing to customers

who buy big ticket items. If car companies are offering 0% financing, why

would anyone want to get a car loan from the bank and pay 5-10% interest?

5. Competitive Rivalry. The banking industry is highly competitive. The

financial services industry has been around for hundreds of years, and just about

everyone who needs banking services already has them. Because of this, banks

must attempt to lure clients away from competitor banks. They do this by

offering lower financing, preferred rates and investment services. The banking

sector is in a race to see who can offer both the best and fastest services, but this

also causes banks to experience a lower ROA. They then have an incentive to

take on high-risk projects. In the long run, we are likely to see more

consolidation in the banking industry. Larger banks would prefer to take over

on merge with another bank rather than spend the money to market and advertise

to people.

INTRODUCTION OF KOTAK MAHINDRA BANK

Kotak Mahindra Bank is an Indian financial service firm established in 1985. It

was previously known as Kotak Mahindra Finance Limited, a non-banking

financial company. In February 2003, Kotak Mahindra Finance Ltd, the group's

flagship company was given the licence to carry on banking business by the

Reserve Bank of India (RBI). Kotak Mahindra Finance Ltd. is the first company

in the Indian banking history to convert to a bank. Today it has more than 363

branches, 20,000 employees and 10,000 crore in revenue. Mr. Uday Kotak is

Executive Vice Chairman & Managing Director of Kotak Mahindra Bank Ltd.

In July 2011 Mr. C. Jayaram and Mr. Dipak Gupta, whole time directors of the

Bank, were appointed Joint Managing Directors of Kotak Mahindra Bank. Dr.

Shankar Acharya is the chairman of board of Directors in the company. The

Bank has its registered office at Nariman Bhavan, Nariman Point, Mumbai

Kotak Mahindra bank reached the top 100 most trusted brands of India in The

Brand Trust Report published by Trust Research Advisory in 2011.

Kotak Mahindra Bank Ltd Kotak Mahindra Bank Ltd is a one stop shop for all

banking needs. The bank offers personal finance solutions of every kind from

savings accounts to credit cards, distribution of mutual funds to life insurance

products. Kotak Mahindra Bank offers transaction banking, operates lending

verticals, manages IPOs and provides working capital loans. Kotak has one of

the largest and most respected Wealth Management teams in India, providing

the widest range of solutions to high net worth individuals, entrepreneurs,

business families and employed professionals.

Kotak Mahindra Old Mutual Life Insurance Ltd Kotak Mahindra Old Mutual

Life Insurance Ltd is a Company that combines its international strengths and

local advantages to offer its customers a wide range of innovative life insurance

products, helping them take important financial decisions at every stage in life

and stay financially independent. The company covers over 3 million lives and

is one of the fastest growing insurance companies in India Kotak Securities Ltd

Kotak Securities is one of the largest broking houses in India with a wide

geographical reach. Kotak Securities operations include stock broking and

distribution of various financial products including private and secondary

placement of debt, equity and mutual funds. Kotak Securities operate in five

main areas of business: Stock Broking (retail and institutional) Depository

Services Portfolio Management Services Distribution of Mutual Funds

Distribution of Kotak Mahindra Old Mutual Life Insurance Ltd product Kotak

Mahindra Capital Company (KMCC) Kotak Investment Banking (KMCC) is a

full-service investment bank in India offering a wide suite of capital market and

advisory solutions to leading domestic and multinational corporations, banks,

financial institutions and government companies. Our services encompass

Equity & Debt Capital Markets, M&A Advisory, Private Equity Advisory,

Restructuring and Recapitalization services, Structured Finance services and

Infrastructure Advisory & Fund Mobilization Kotak Mahindra Prime Ltd

(KMPL) Kotak Mahindra Prime Ltd is among India's largest dedicated

passenger vehicle finance companies.

KMPL offers loans for the entire range of passenger cars, multi-utility vehicles

and pre-owned cars. Also on offer are inventory funding and infrastructure

funding to car dealers with strategic arrangements via various car manufacturers

in India as their preferred financier. Kotak International Business Kotak

International Business specialises in providing a range of services to overseas

customers seeking to invest in India. For institutions and high net worth

individuals outside India, Kotak International Business offers asset management

through a range of offshore funds with specific advisory and discretionary

investment management services. Kotak Mahindra Asset Management

Company Ltd (KMAMC) Kotak Mahindra Asset Management Company offers

a complete bouquet of asset management products and services that are designed

to suit the diverse risk return profiles of each and every type of investor.

KMAMC and Kotak Mahindra Bank are the sponsors of Kotak Mahindra

Pension Fund Ltd, which has been appointed as one of six fund managers to

manage pension funds under the New Pension Scheme (NPS). Kotak Private

Equity Group (KPEG) Kotak Private Equity Group helps nurture emerging

businesses and mid-size enterprises to evolve into tomorrow's industry leaders.

With a proven track record of helping build companies, KPEG also offers

expertise with a combination of equity capital, strategic support and value added

services.

What differentiates KPEG is not merely funding companies, but also having a

close involvement in their growth as board members, advisors, strategists and

fund-raisers. Kotak Realty Fund Kotak Realty Fund deals with equity

investments covering sectors such as hotels, IT parks, residential townships,

shopping centres, industrial real estate, health care, retail, education and

property management. The investment focus here is on development projects

and enterprise level investments, both in real estate intensive businesses.

VISION STATEMENT

The Global Indian Financial Services Brand

Our customers will enjoy the benefits of dealing with a global Indian brand that

best understands their needs and delivers customized pragmatic solutions across

multiple platforms. We will be a world class Indian financial services group.

Our technology and best practices will be bench-marked along international

lines while our understanding of customers will be uniquely Indian. We will be

more than a repository of our customers' savings. We, the group, will be single

window to every financial service in a customer's universe.

The Most Preferred Employer in Financial Services

A culture of empowerment and a spirit of enterprise attract bright minds with an

entrepreneurial streak to join us and stay with us. Working with a home grown

professionally managed company, which has partnerships with international

leaders, gives our people a perspective that is universal as well as unique.

The Most Trusted Financial Services Company

We will create an ethos of trust across all our constituents. Adhering to high

standards of compliance and corporate governance will be an integral part of

building trust.

Value Creation

Value creation rather than size alone will be our business driver.

THEIR BUSINESSES

Kotak Mahindra Bank Ltd

Kotak Mahindra Bank Ltd is a one stop shop for all banking needs. The bank

offers personal finance solutions of every kind from savings accounts to credit

cards, distribution of mutual funds to life insurance products. Kotak Mahindra

Bank offers transaction banking, operates lending verticals, manages IPOs and

provides working capital loans. Kotak has one of the largest and most respected

Wealth Management teams in India, providing the widest range of solutions to

high net worth individuals, entrepreneurs, business families and employed

professionals.

Kotak Mahindra Old Mutual Life Insurance Ltd

Kotak Mahindra Old Mutual Life Insurance Ltd is a Company that combines its

international strengths and local advantages to offer its customers a wide range

of innovative life insurance products, helping them take important financial

decisions at every stage in life and stay financially independent. The company

covers over 3 million lives and is one of the fastest growing insurance

companies in India

Kotak Securities Ltd

Kotak Securities is one of the largest broking houses in India with a wide

geographical reach. Kotak Securities operations include stock broking and

distribution of various financial products including private and secondary

placement of debt, equity and mutual funds.

Kotak Securities operate in five main areas of business:

Stock Broking (retail and institutional)

Depository Services

Portfolio Management Services

Distribution of Mutual Funds

Distribution of Kotak Mahindra Old Mutual Life Insurance Ltd products

Kotak Mahindra Capital Company (KMCC)

Kotak Investment Banking (KMCC) is a full-service investment bank in India

offering a wide suite of capital market and advisory solutions to leading

domestic and multinational corporations, banks, financial institutions and

government companies. Our services encompass Equity & Debt Capital

Markets, M&A Advisory, Private Equity Advisory, Restructuring and

Recapitalization services, Structured Finance services and Infrastructure

Advisory & Fund Mobilization

Kotak Mahindra Prime Ltd (KMPL)

Kotak Mahindra Prime Ltd is among India's largest dedicated passenger vehicle

finance companies. KMPL offers loans for the entire range of passenger cars,

multi-utility vehicles and pre-owned cars. Also on offer are inventory funding

and infrastructure funding to car dealers with strategic arrangements via various

car manufacturers in India as their preferred financier.

Kotak International Business

Kotak International Business specialises in providing a range of services to

overseas customers seeking to invest in India. For institutions and high net worth

individuals outside India, Kotak International Business offers asset management

through a range of offshore funds with specific advisory and discretionary

investment management services.

Kotak Mahindra Asset Management Company Ltd (KMAMC)

Kotak Mahindra Asset Management Company offers a complete bouquet of

asset management products and services that are designed to suit the diverse risk

return profiles of each and every type of investor. KMAMC and Kotak

Mahindra Bank are the sponsors of Kotak Mahindra Pension Fund Ltd, which

has been appointed as one of six fund managers to manage pension funds under

the New Pension Scheme (NPS).

Kotak Private Equity Group (KPEG)

Kotak Private Equity Group helps nurture emerging businesses and mid-size

enterprises to evolve into tomorrow's industry leaders. With a proven track

record of helping build companies, KPEG also offers expertise with a

combination of equity capital, strategic support and value added services. What

differentiates KPEG is not merely funding companies, but also having a close

involvement in their growth as board members, advisors, strategists and fund-

raisers.

Kotak Realty Fund

Kotak Realty Fund deals with equity investments covering sectors such as

hotels, IT parks, residential townships, shopping centres, industrial real estate,

health care, retail, education and property management. The investment focus

here is on development projects and enterprise level investments, both in real

estate intensive businesses.

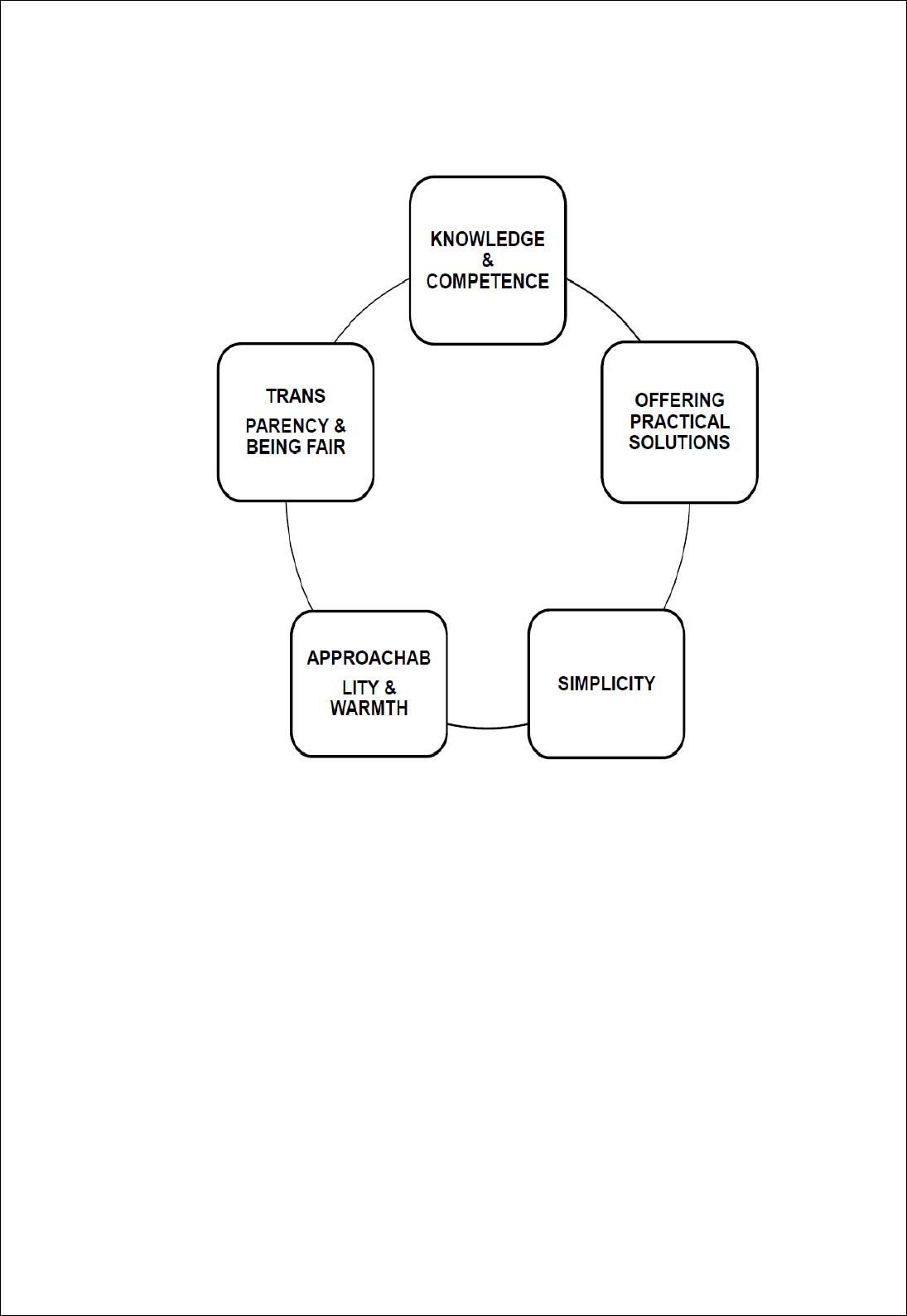

KOTAK’S SPIRIT OF SERVICE

The launch of SPIRIT OF SERVICE QUALITY INITIATIVE has ignited a

renewed sense of service at Kotak bank. It is a new mantra that takes spirit to

great heights. The above 5 pillars help to incorporate it.

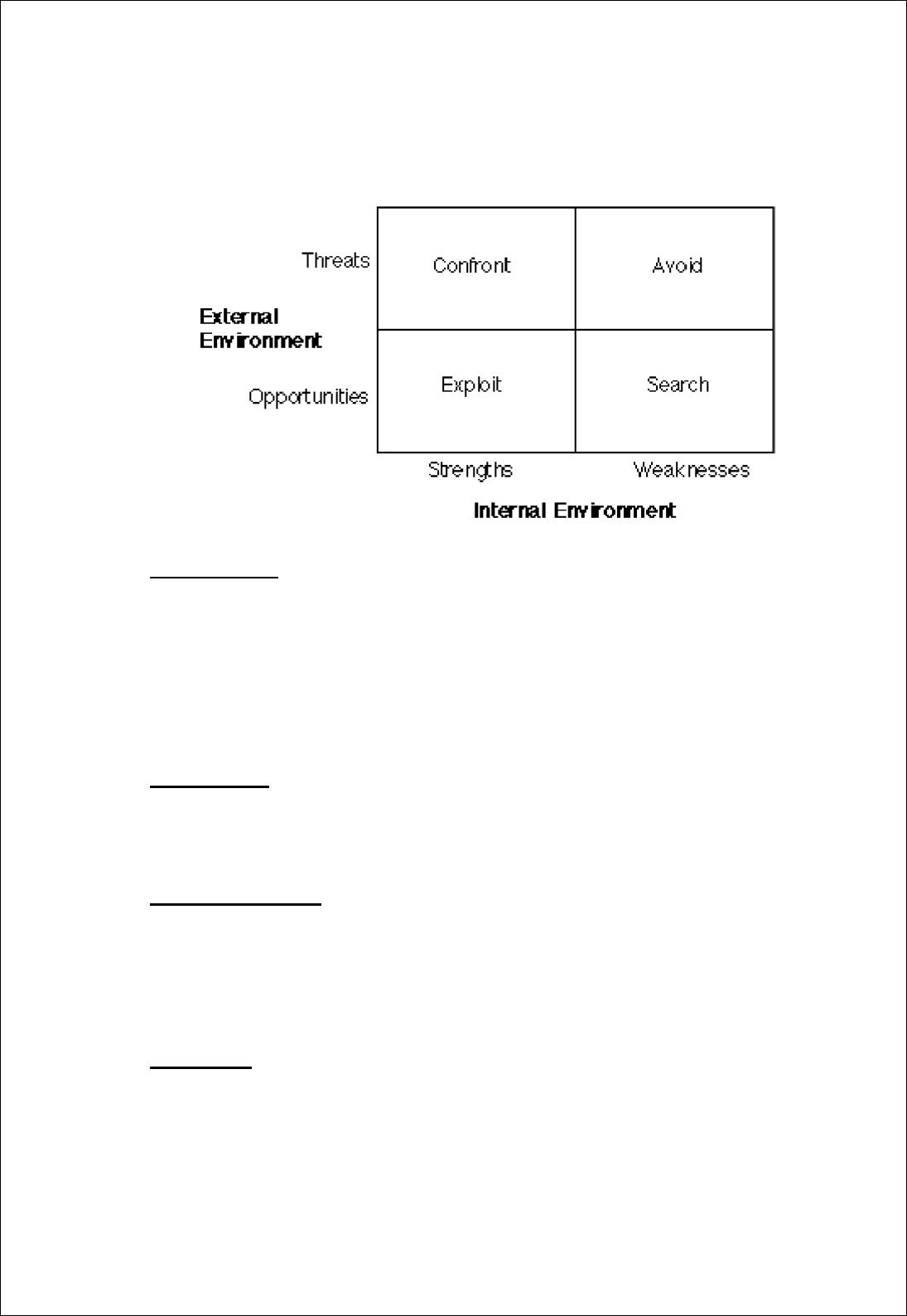

SWOT ANALYSIS OF KOTAK MAHINDRA BANK

STRENGHTS:

1) Innovative financial product of diverse categories

2) Kotak Mahindra Finance Ltd. is the first company in the Indian banking

history to convert into a bank

3) Of, For, By the customers

4) Has over 20,000 employees

5) Customer account base of over 2.7 million

WEAKNESS:

1) Low publicity and marketing as compared to other premium banks in the

urban area

OPPORTUNITIES:

1) Explore opportunities abroad by International banking

2) Kotak has launched SPIRIT OF SERVICE campaign. Through this

campaign it can secure higher and higher levels of CUSTOMER

SATISFACTION, LOYALTY ETC.

THREATS:

1) Heavy weight corporate like TATA & SONS, RELIANCE CAPITAL,

L&T, ADITYA BIRLA, BAJAJ FINSERV, and MUTHOOT FINANCE are

trying very hard and leaving no stone unturned to acquire banking license

2) Competitors: ICICI, SBI, AXIS, BOB, HSBC etc.

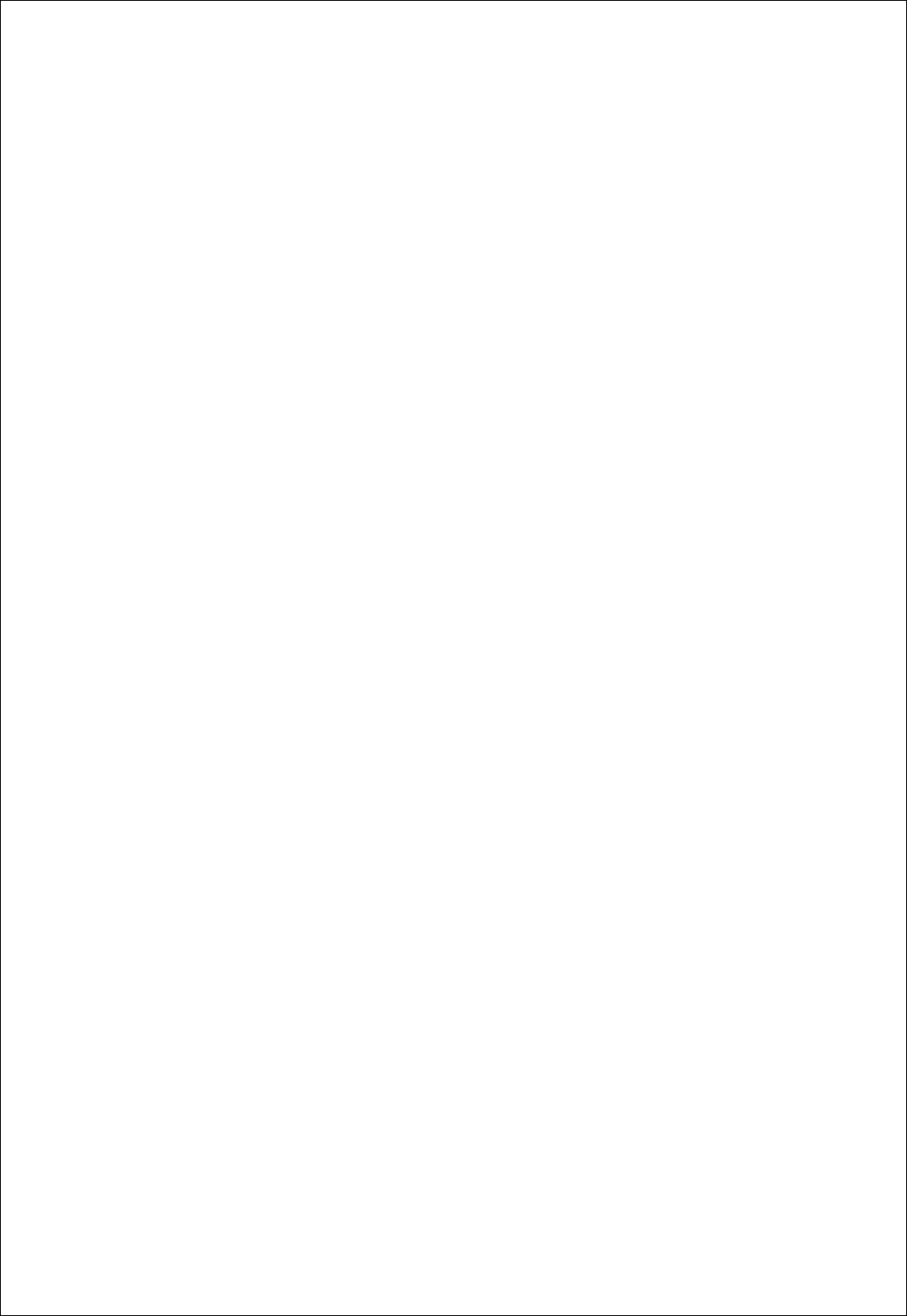

E-BANKING IS ELECTRONIC BANKING

“Internet banking (or E-banking) means any user with a personal computer and

a browser can get connected to his banks website to perform any of the virtual

banking functions. In internet banking system the bank has a centralized

database that is web enabled”.

E-BANKING SERVICES & PRODUCTS

Internet banks offer a variety of features and perks, rushing to lure online

customers. The race is on to increase market share and creates customer loyalty

with features that make online banking friendlier, more useful, and less

expensive. E-Banking lures customers with convenience.

THE THREE BROAD FACILITIES THAT E-BANKING OFFERS ARE:

• Convenience- Complete your banking at your convenience, in the comfort of

your home or at any place you can access the Net

• No more Qs - There are no queues at an online bank

• 24/7 service- Bank online 24 hours a day, 7 days a week and 52 weeks a year

Below is a detailed review of features found in Internet banking around the

world.

ONLINE APPLICATIONS:

Consumers can begin their banking relationship with an online application. No

need to waste time driving to a local branch to begin a banking relationship.

Consumers can fill out and submit electronically all necessary information

needed to open a checking, savings account or even a fixed deposit. When the

application is submitted, the bank will mail you a signature card for its records

and request you to mail or wire your initial funds. Firms like American Express

enable customers applying for an account to fund their new account

electronically via a credit card or cheque from another banking institution. There

are some firms such as Wingspan and USA BancShares.com that enable

customers to digitally sign their applications.

ACCOUNT ACCESS:

Internet banking customers now have the ability to view their accounts online,

including checking, savings, loans and credit cards. No need to wait for your

monthly statements or wait in queue for the next available customer service

representative. Account access enables customers to view most recent activity

on accounts, including cleared checks, deposits, ATM transactions and balances

as of previous day’s activities. Customers no longer have to hold on to the

cleared checks, since their bank will store them for them online.

ACCOUNT TRANSFERS:

Internet banking customers have the ability to transfer funds to and from their

accounts online. With a simple online form, customers can move money from a

checking account to a savings account and vice versa within the safety and

convenience of their home without having to visit the ATM. Funds transferred

online are updated in less than three hours. In addition, customers can set up

recurring transfers to accounts. A recurring transfer will take place on the

customer specified date, with a specified amount.

BILL PAYMENT:

Online bill payment enables customers to pay anyone, friends or family, as well

as a pay their bills electronically. As an add on feature to Internet banking, bill

payment enables customers to send paper checks to anyone or an electronic

check to any institution that accepts electronic bill payments. To use bill

payment, customers are required to set up their payees online. Customers then

have the ability to set up recurring, automatic payments to a specific biller on a

specified day or just a one-time payment. Arrange payments three to five days,

before the due date, to ensure timely delivery. It is important to note that not all

banks provide bill payment as a free feature

AUTOMATED TELLER MACHINE:

ATM is designed to perform the most important function of bank. It is operated

by plastic card with its special features. The plastic card is replacing cheque,

personal attendance of the customer, banking hour’s restrictions and paper based

verification. There are debit cards. ATMs used as spring board for Electronic

Fund Transfer. ATM itself can provide information about customers account

and also receive instructions from customers - ATM cardholders. An ATM is

an Electronic Fund Transfer terminal capable of handling cash deposits, transfer

between accounts, balance enquiries, cash withdrawals and pay bills. It may be

on-line or off-line. The on-line ATN enables the customer to avail banking

facilities from anywhere. In off-line the facilities are confined to that particular

ATM assigned. Any customer possessing ATM card issued by the Shared

Payment Network System can go to any ATM linked to Shared Payment

Networks and perform his transactions.

CREDIT-DEBIT CARD:

The Credit Card holder is empowered to spend wherever and whenever he wants

with his Credit Card within the limits fixed by his bank. Credit Card is a post-

paid card. Debit Card, on the other hand, is a prepaid card with some stored

value. Every time a person uses this card, the Internet Banking house gets money

transferred to its account from the bank of the buyer. The buyers account is

debited with the exact amount of purchases. An individual has to open an

account with the issuing bank which gives debit card with a Personal

Identification Number (PIN). When he makes a purchase, he enters his PIN on

shops PIN pad. When the card is slurped through the electronic terminal, it dials

the acquiring bank system - either Master Card or VISA that validates the PIN

and finds out from the issuing bank whether to accept or decline the transactions.

The customer can never overspend because the system rejects any transaction

which exceeds the balance in his account. The bank never faces a default

because the amount spent is debited immediately from the customer’s account.

SMART CARDS:

Banks are adding chips to their current magnetic stripe cards to enhance security

and offer new service, called Smart Cards. Smart Cards allow thousands of times

of information storable on magnetic stripe cards. In addition, these cards are

highly secure, more reliable and perform multiple functions. They hold a large

amount of personal information, from medical and health history to personal

banking and personal preferences. Apart from this ALERTS, SMS BANKING,

MOBILE BANKING, PHONE BANKING, are also part of E-banking.

BENEFITS OF E-BANKING

24/7 CUSTOMER SERVICE:

Although it is easy to yield to the temptation of allowing the Internet to replace

expensive branch personnel and overhead, many banks have found that an

customer service staff ready at any hour is well worth the expense. This can be

especially true as customer’s transition to online banking and need help learning

the features. Offering telephone and email contacts are a basic level of service.

Offering live chat assistance is the exceptional level.

ACCESS TO OLD TRANSACTIONS:

Choices made in designing the Internet interface may include how much history

will be available online. Some banks have chosen to show only 30-45 days,

while others offer a history of six months or a year.

CATEGORIZE TRANSACTIONS AND PRODUCE REPORTS:

Functionality is king as online banking customers using these features enjoy a

Web interface that delivers the utility of a money management software

application.

EXPORT YOUR BANKING DATA:

Most banks offering the management interface also allow easy downloading of

financial information into files that can be imported into Microsoft Money and

Intuit's Quicken.

INTERACTIVE GUIDES & TOOLS TO HELP SELECTION OF

PROPER PRODUCT:

Although online, interactive guides through a bank's products, adds complexity

to the programming it also serves the bank by assisting potential customers in

choosing new products or services. Interactive Tools to design a savings plan,

choose a mortgage, obtain online insurance quotes all tied to applications These

tools help remove some of the mystery involved in so many account options and

costs.

LOAN STATUS AND CREDIT CARD ACCOUNT INFORMATION:

Bank customers are familiar with reviewing their checking account information,

but many banks are adding the ability to look at one's loan status and credit card

information as well. Access to as many accounts held at the bank seems to be

the goal.

VIEW DIGITAL COPIES OF CHECKS:

This, again, is removing a down side to online banking. It makes images of

checks available as replacement for sending out cancelled checks or sheets of

printed check images.

ONLINE FORMS FOR ORDERING CHECKS, STOP PAYMENT, ETC.

Convenience is popular and if a customer visits his or her online account

frequently it only makes sense to allow the ability to reorder checks or perform

certain other commands through the same interface. These features and many

others help customers save time, simplify their lives and provide greater value

than conventional banking.

E- BANKING THREATS FACED BY INDIVIDUALS

1) HACKING: Hacking means finding out weaknesses in an established system

and exploiting them. A computer hacker is a person who finds out weaknesses

in the computer and exploits it. Hackers may be motivated by a multitude of

reasons, such as profit, protest, or challenge. The subculture that has evolved

around hackers is often referred to as the computer underground, but it is now

an open community.

2) VIRUSES: Computer Virus is a malicious software program written

intentionally to enter a computer without the user's permission or knowledge. It

has the ability to replicate itself, thus continues to spread. Some viruses do little

but replicate, while others can cause severe harm or adversely affect program

and performance of the system. A virus should never be assumed harmless and

left on a system.

3) DENIAL-OF-SERVICE ATTACK (DOS): A denial-of-service attack (DOS

attack) or distributed denial-of-service attack (DOS attack) is an attempt to make

a computer or network resource unavailable to its intended users. Although the

means to carry out, motives for, and targets of a DOS attack may vary, it

generally consists of the concerted efforts of a person, or multiple people to

prevent an Internet site or service from functioning efficiently or at all,

temporarily or indefinitely. Perpetrators of DOS attacks typically target sites or

services hosted on high-profile web servers such as banks, credit card payment

gateways, and even root name servers. One common method of attack involves

saturating the target machine with external communications requests, such that

it cannot respond to legitimate traffic, or responds so slowly as to be rendered

effectively unavailable. Such attacks usually lead to a server overload. In

general terms, DOS attacks are implemented by either forcing the targeted

computer(s) to reset, or consuming its resources so that it can no longer provide

its intended service or obstructing the communication media between the

intended users and the victim so that they can no longer communicate

adequately. When the DOS Attacker sends many packets of information and

requests to a single network adapter, each computer in the network would

experience effects from the DOS attack.

4) IDENTITY THEFT: It is a form of stealing another person's identity in which

someone pretends to be someone else by assuming that person's identity,

typically in order to access resources or obtain credit and other benefits in that

person's name. The victim of identity theft (here meaning the person whose

identity has been assumed by the identity thief) can suffer adverse consequences

if they are held accountable for the perpetrator's actions. Organizations and

individuals who are duped or defrauded by the identity thief can also suffer

adverse consequences and losses, and to that extent are also victims.

5) PHISHING: It is a way of attempting to acquire information such as usernames,

passwords, and credit card details by masquerading as a trustworthy entity in an

electronic communication. Communications purporting to be from popular

social web sites, auction sites, online payment processors or IT administrators

are commonly used to lure the unsuspecting public. Phishing is typically carried

out by e-mail spoofing or instant messaging and it often directs users to enter

details at a fake website whose look and feel are almost identical to the

legitimate one. Phishing is an example of social engineering techniques used to

deceive users, and exploits the poor usability of current web security

technologies.

6) SPAM: Spam is the use of electronic messaging systems (including most

broadcast media, digital delivery systems) to send unsolicited bulk messages

indiscriminately. While the most widely recognized form of spam is e-mail

spam, the term is applied to similar abuses in other media: instant messaging

spam, Usenet newsgroup spam, Web search engine spam, spam in blogs, wiki

spam, online classified ads spam, mobile phone messaging spam, Internet forum

spam, junk fax transmissions, social networking spam, television advertising

and file sharing network spam. The spam messages in India are about 3.6 trillion

per year.

7) KEY LOGGING: Software implanted in the customer's computer that records

all the keystrokes of the customer, providing a complete record of user IDs,

passwords, pin codes, account numbers and transactions. Sometimes this is

integrated with additional rogue software, and usually it sends the information

it has collected to the hacker.

8) PHARMING: It is a hacker's attack aiming to redirect a website's traffic to

another, bogus website. Pharming can be conducted either by changing the hosts

file on a victim’s computer or by exploitation of a vulnerability in DNS server

software. In January 2008, Symantec reported a drive-by pharming incident

directed against a Mexican bank in which the DNS settings on a customer's

home router were changed after receipt of an e-mail that appeared to be from a

legitimate Spanish-language greeting card company.

9) CROSS-SITE SCRIPTING (XSS): It is a type of computer security

vulnerability typically found in Web applications that enables attackers to inject

client-side script into Web pages viewed by other users. A cross-site scripting

vulnerability may be used by attackers to bypass access controls such as the

same origin policy.

10) COOKIE POISONING: Cookie Poisoning attacks involve the modification of

the contents of a cookie (personal information stored in a Web user's computer)

in order to bypass security mechanisms. Using cookie poisoning attacks,

attackers can gain unauthorized information about another user and steal their

identity.

E-BANKING FRAUD CASES IN INDIA

1] YOUTH ARRESTED FOR NET-BANKING FRAUD

MUMBAI: A 23-year-old, who had opened a fictitious account and siphoned off Rs 4 lakh

through net-banking, was arrested by the cyber police station on Monday. Pradeep Kanere was

picked up after the Bank of Baroda tipped off the cyber police officials that a person who had

an account that was under surveillance had come to the bank.

Kanere has been charged with cheating and forgery and cops are looking for his associates who

have withdrawn a huge amount from a private company using a similar modus operandi. The

complaint was filed by Kayesh Shah of Energy Park Boilers Private Limited. Shah told police

that the company had an account with the Bank of Baroda and the bank had given him net-

banking facility. His brothers, Uday and Kartik, were also directors of the company but only

he had access to the net-banking password, he added

.

Recently, while he was going through the account statement, he was shocked to see some

transactions that he never done. "Between August 10 and August 18, around Rs 3.92 lakh was

withdrawn through net-banking,'' a police officer said. Shah immediately brought it to notice

of bank officials who started probing the accounts where the amount was credited.

Shah also approached the cyber police station at Bandra-Kurla Complex and lodged a

complaint. Kanere walked into the bank's Vile Parle branch on Monday, saying he had lost an

ATM card and needed to close the accounts. "The bank officials kept him engaged in

documentation and informed the police. Officials are trying to trace his associates and find out

how he decoded the password,'' an official said.

2] POLICE PROBE INTERNET BANKING FRAUD

KHAR: Police is probing an internet banking fraud to the tune of Rs 68,000, allegedly by a

Delhi-based hacker, police said. "Anil Bansal, in his complain to the police, said that his wife's

account in a private bank was hacked within a span of two days on June 21 and 22 of Rs

68,000," police said.

"Bansal, also carried out his own investigations and found that one Ganesh Agrawal staying in

Kirti Nagar, Delhi had allegedly made these transactions," police said, and added that the

detective crime branch was gathering all details about the accused.

3] NIGERIAN 'KINGPIN' ARRESTED IN MULTI-CRORE ONLINE BANKING

FRAUD

KOLKATA: Beware before clicking a mail sent by any unknown person. You could be a victim

of 'sphygmograph' - a hi-tech e-fraud - and within days fraudsters may empty your bank

account. On Thursday the anti-bank fraud squad of Kolkata Police, led by Soumya Banerjee,

unearthed a racket operated by group of Nigerians. One of the kingpins, Felix Nudubisieigs,

has been arrested from Puduchhery, say police. Investigators say that Felix, who has been in

India since 2006, is one of the masterminds of the racket which has swindled crores of rupees

from people in the last year alone.

In the past few months Kolkata Police has been receiving peculiar complaints from people that

their money has been withdrawn or transferred to some unknown account. Alind Jain was one

among the victims. A resident of Moradabad, he said that Rs 40,000 was withdrawn from his

account and transferred to an account of private bank at Shakespeare Sarani. He suspected his

e-banking password had been compromised but could not say how.

Investigators were stunned when they finally unravelled the modus operandi. The scamsters

used to send lucrative mails randomly across the country. The mails could be in different forms.

You could get a job offer from a multinational company. Or a lottery or even a greetings. When

a recipient clicked on the mail, a Trojan virus would penetrate their system.

It remains dormant when the victim logs out of the mail account. When he logs back in, the

virus starts copying every stroke on the keyboard and the details of the mail and sends to the

mother server operated by the fraudsters.

Investigators said that soon after getting the copied details, the fraudsters start monitoring the

victim's mail. If he logs into his bank account online to check his balance, the racketeers get

every detail, including the password. If the victim's account balance is lucrative then transfer

the money to another account opened in a fictitious name. The racket was so smart that

businessmen were conned into paying directly into the fraud account. For instance, if someone

got a mail from his business partner for a payment, the fraudsters would spy on it and use the

stolen details to send a fake mail asking that the money be deposited in such and such account.

Police said that the clever fraudsters recruited scores of Indians to open account in fictitious

names to conceal the direct involvement of the Nigerians. They asked the recruited youths to

open as many accounts in different banks as they could. "The foot soldiers got a cut of the

amount transferred to the account. Soon after a few fraudulent transactions, the gang used to

ask the account holder to shut it and open another one," said an officer. The racket generally

used routed each fraud transaction through five to six accounts before withdrawing the money.

Investigators have spotted more than 20 such accounts in Tripur, Chennai and other cities in

south India. Police have sealed several accounts containing crores of rupees swindled from

different people across the country India and are now looking for the victims. Felix landed in

India on a student visa and later joined the fraud racket, said police. "He was produced before

a Tripur court on Thursday and will be bring to Kolkata on transit remand," said joint

commissioner of police, crime, Damayanti Sen

4] CHARTERED ACCOUNTANT LOSES RS 1.41 LAKH IN NET BANKING FRAUD

A chartered accountant employed with a Gurgaon-based MNC and resident of VasantKunj in

New Delhi alleged that he was fleeced of Rs.1.31 lakh through internet banking fraud.

According to victim Harsh Mehta, 27, the money was siphoned off from his salary account in

the Gurgaon branch of Standard Chartered Bank. He also claimed to have lost Rs 10,654 on

his credit card.

Shuttling between Delhi and Gurgaon to get a police complaint registered since Friday, the

KPMG employee said his phone was first hacked and a onetime password (OTP) obtained from

the bank. A case is yet to be registered and Mehta claimed that neither the mobile company nor

the bank is helping him. I do use internet banking but such a thing has never happened before.

The hacker also got the bank SMS alert service deactivated, so I could not get messages

notifying me of transactions,” Mehta claimed. On January 19 around 5 pm, I received an

SMS from Airtel giving an ID for changing my SIM number.

After that, there was no signal on my mobile. I was surprised as I had never made such a

request. I contacted the Airtel customer care officer and he assured me that nothing would

happen and they will keep a check,” he said. The next morning, I received an email from the

bank showing unknown transactions to the tune of Rs.1.31 lakh. The accused must have hacked

my phone first, requested the bank for OTP, activated my SIM on his phone and then

transferred funds to his account. As the bank limit was of Rs.1 lakh per day, the accused

transferred the amount till midnight.

After that, he shifted the remaining balance of Rs 31,000. My credit card was also used for

Rs.10,650, the victim added.

5] ENGINEERING STUDENT LOSES RS 5 LAKH: SMS FRAUD

An engineering student here lost Rs 5 lakh to SMS fraudsters who lured him by promising Rs

5.5 crore lottery money. According to police, the student received the message on his mobile

stating that he had won 7 lakh Sterling Pounds (around Rs 5.5 Crore) and he had to pay Rs

5,10,399 to receive price money.

He paid the entire amount in three instalments. After the payment, the sender of the SMS went

incommunicado. Based on a complaint filed by the student, the Madurai City Central Crime

Branch registered a case. Police has advised the people not to get fooled by such SMS. They

also warned people against disclosing bank account numbers to strangers.

6] VODAFONE TO RETURN RS 59,000 TO NET BANKING FRAUD VICTIM

Though Vodafone has returned about Rs 59,000 in net banking fraud case after three months,

but the real culprit who made the transactions one after the other using different Internet

Protocol (IP) addresses is yet to be identified and arrested.

On May 13, Pawan Kumar Singhal, a resident of Sector 11, complained to the police that a sum

of Rs 98,000 had been fraudulently withdrawn on the intervening night from his IDBI account

through net banking. The account contained around Rs 3 lakh.

On learning about the fraud, he immediately informed the bank’s office at Mumbai to close net

banking facility. Singhal retired as General Manager of Haryana Dairy in 2005 and now has

been working as a chartered accountant.

The police registered the FIR on May 20 under Section 406 (for criminal breach of trust), 420

and relevant sections of Cyber Act. As per information provided by IDBI bank to the police,

the money was withdrawn through 28 transactions, each of Rs 3,500, and deposited in 28

Vodafone customers‟ accounts. The bank had also informed that the transactions were made

through 90 IP addresses, which failed in some cases too.

The Panchkula police further wrote to Vodafone about closing the accounts, but it was too late

by then. The company was able to save about Rs 59,000, which was returned to the police

through a cheque. The cheque has come in the name of investigating officer instead of the

complainant. So the police is planning to send it back with a request to reissue it in Singhal’s

name.

E-BANKING: PRECAUTIONS

1) CHANGE YOUR PASSWORD REGULARLY: Users must change their

password after the first log-in for online banking. Besides, keep changing your

password at regular intervals. Needless to say, don't disclose your password to

anyone, not even the banking staff.

2) AVOID USING CYBER CAFES FOR BANKING PURPOSES: Avoid

using the Internet banking facility from cyber cafes, libraries or from systems

installed in public places. But in case it is an absolute necessity, you must clear

the browser cache and delete the temporary files on the PC you've accessed the

Internet from.

3) DON'T USE PERSONAL DETAILS IN THE PASSWORD: Avoid using

your date of birth, telephone number, address or name in your password. This

practice makes your account more vulnerable to being hacked as your password

can be easily guessed by just about anyone. Besides, do not leave your computer

unattended while you are logged in to the bank site.

4) DON’T LET YOUR BROWSER MEMORIZE YOUR DETAILS: Never

let your computer remember your passwords, names, etc. Always disable the

browser's option of storing usernames and passwords.

5) DON'T E-MAIL CREDIT CARD AND ACCOUNT DETAILS: Make it a

thumb rule not to send credit card or account details via e-mail to anybody, or

in response to an e-mail.

6) SHOP AT REPUTED SITES ONLY: While shopping online, please wait for

a second and check if the website is an established one and a reputed name in

the online shopping domain. Always check if the shopping site has a well

established permanent address.

7) LOG OFF WHEN FINISHED: Always log off after Internet banking once

you are done with it. You need to log out from the website and do not shut off

the window in order to log off from the session.

8) CHECK THE ACCOUNT: Whenever you make a transaction, immediately

check your account and see if the right amount has been deducted or added to

it. In case there is any misappropriation, inform the concerned bank

immediately.

9) DON'T FOLLOW THE LINKS: Always reject any e-mail that asks you to

follow a link to the website of your bank. You may end up revealing your

personal details on a fake bank website, from which hackers steal information.

10) DESTROY THE RECEIPTS: Do not keep documents and receipts related to

your online translations. They usually carry confidential personal financial

information. You had better destroy or shred such documents or receipts to stop

them from falling into the wrong hands.

11) DON'T SHARE YOUR PERSONAL INFORMATION ON WEBSITES:

You shouldn't give your e-mail address at websites without knowing how it will

be used. Besides, do not share your personal information like date of birth, etc,

on the Internet unnecessarily because it can be used by others to unlock or

generate your account password.

SWOT ANALYSIS OF E-BANKING

STRENGHTS:

• Customer access to information 24 hours a day

• Timely access to information

• Ability to offer a customer more than one method of retrieving information

• Sophisticated technology systems

• Diversity helps to capture different types of market.

• The ability to cut internal cost due to advanced technology

• Increased efficiency due to automation

• Increased accuracy of banking transaction

• Convenience

WEAKNESS:

• High cost of service

• Continual wants of customers wants and needs

• Initial investment in technology will be expensive.

OPPORTUNITIES:

• The ability to have a larger customer base

• Global expansion -This is an enormous market which will be a great

opportunity in the future

• The ability to take advantage of the growing opportunity of internet

banking.

• Can achieve customer loyalty and satisfaction

THREATS:

• Continuously changing technology.

• Uncertainty of the banking industry.

• Competition from the lower price operation.

• Possible failure of product due to non-acceptance of customers.

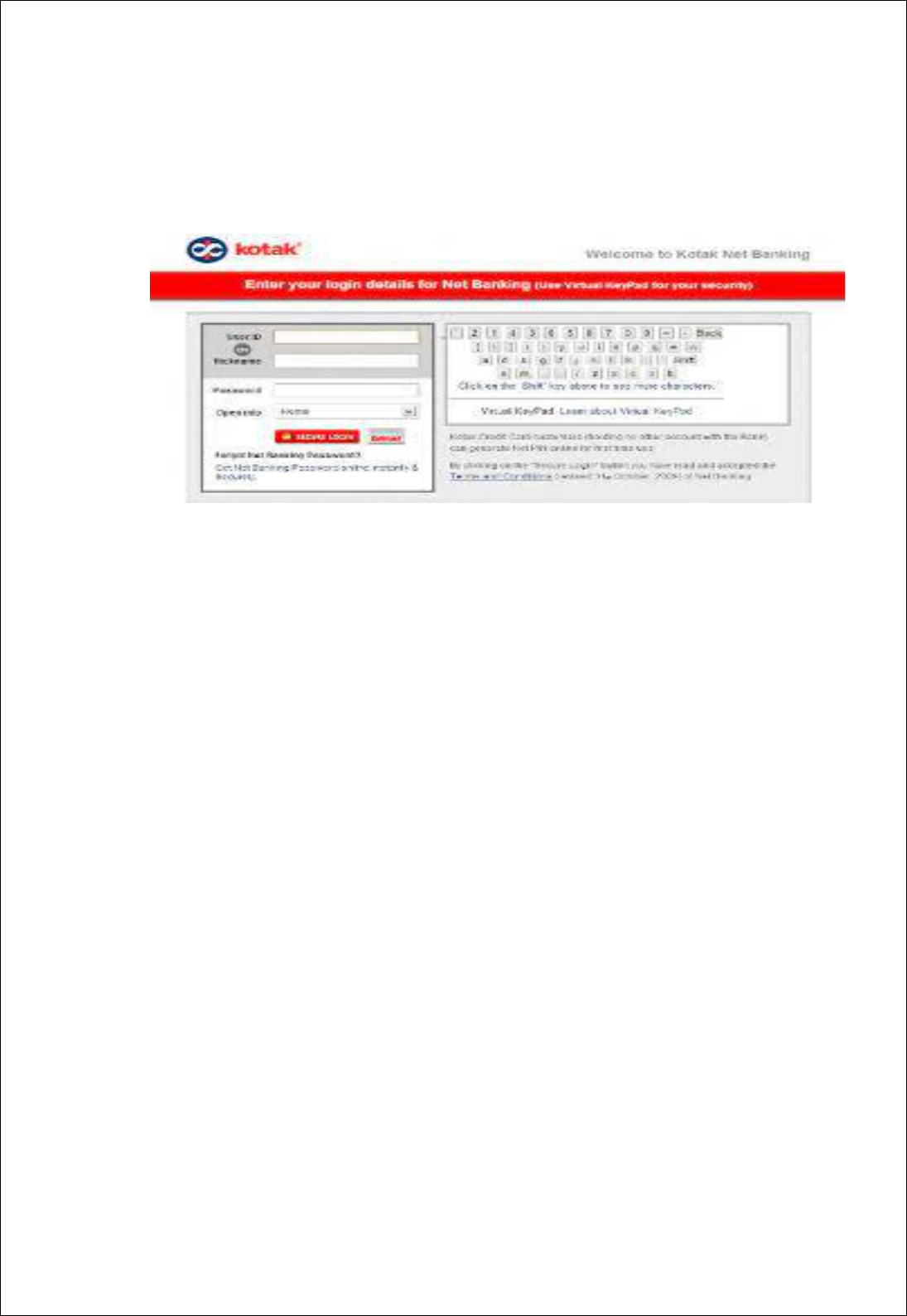

KOTAK MAHINDRA BANK E-BANKING IS

CONVINIENCE-BANKING

In today's day and age time is money. All of us work hard and have a busy

schedule. Doing our banking should be easy, quick and convenient and should

not add to your worries. At Kotak Mahindra Bank, they realize this and have

specially tailored a wide range of value added products and services to make our

money work for us. These, coupled with the highest standards of customer

values, make customers life easier & simpler. Following are various E-

BANKING OPERATIONS carried out by KOTAK BANK. 1) Net Banking

Helps to View details across Accounts, Term Deposits and Demat Accounts -

24x7 Kotak Mahindra Bank's

Net Banking service brings us the timeless world of instant banking. It is quick

and easy, available to us 24X7 and it's absolutely free! Key Features Bank 24X7

- anywhere, anytime Move Money - Within our own Kotak Accounts, to

someone else's Kotak Account, to another bank via NEFT (National Electronic

Funds Transfer/ RTGS (Real Time Gross Settlement) and Demand Draft. We

have the option to 'Pay Now', 'Pay at a later date' or 'Schedule Regular

Payments'. We even have the option to 'Save' the Transaction and pay when

desired. We can even view all your 'Completed Transactions' along with the

status.

We can book a Term Deposit and can do a premature withdrawal online. We

can add a Beneficiary and Multiple accounts can be mapped for a beneficiary

for Transfer Type. (E.g. - NEFT / RTGS etc). Beneficiaries added at other

channels like branch too, will be available for the customer on Net Banking to

make a transfer to. View details across Accounts, Term Deposits and Demat

Accounts. We can Pay our utility bills , VISA Credit Card bills, Recharge

Prepaid Mobile phones and DTH accounts and even pay your Direct tax through

Kotak BillPay Net Banking Features

What all can you do online?

1)Net Banking gives us a host of services, giving us a complete control of our

accounts: View account balance, account activity, place standing instructions

and cheque status Open a Term Deposit Transfer funds online between

your/third party accounts with Kotak Mahindra Bank or any other bank account

via RBI's NEFT or RTGS system Place request for a cheque book, Debit Card

PIN , payment gateway registration and lots more Pay your Utility Bills on

Kotak BillPay Safe online shopping with Kotak Netc@rd View securities

available for Demat View current Mutual Fund holdings, Buy and redeem

Mutual Funds online

2) Kotak Payment Gateway Instant, convenient and secure way of shopping and

making payments online. Kotak Payment Gateway enables us to shop online at

over 5000 websites, make utility bill payments across more than 60 companies

and 42 cities, Following are some of the websites through which you can shop

online. www.bigcinemas.com www.airtel.in www.yatra.com www.vodafone.in

www.makemytrip.com shopping.indiatimes.com Kotak Payment Gateway is an

internet-based facility using which we can pay online merchants by debiting

your selected Bank account. We can pay insurance premium, pay for magazine

subscriptions, make donations to charitable and religious institutions, transfer

money to Kotak Securities for margin money, settlement transfer or IPO

funding. Online Shopping This service enables us to make purchases across

various online shopping sites offering gifts, flowers, airline tickets, exclusive

designer wear, jewellery, latest electronic gadgets / household items,

subscription to books / periodicals, registration to matrimonial, educational sites

or astrology services and much more. Online Trading This service enables us to

transfer money instantly to your account with Kotak Securities, for funding your

margin money or funding our IPO account. An account with Kotak Securities

enables us to buy / sell securities online. This gives us the power of anywhere,

anytime trading.

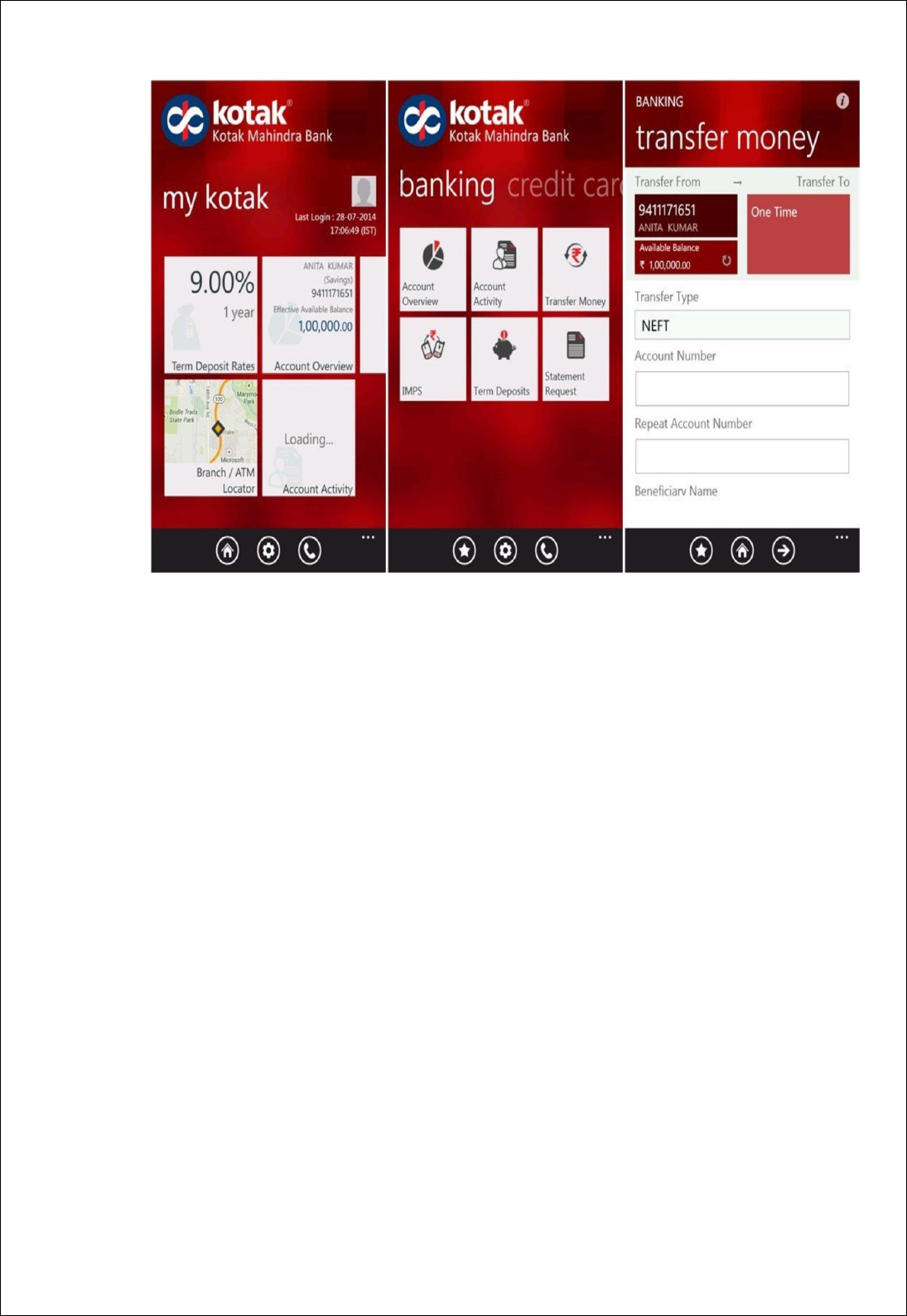

3) Mobile Banking Experience New-Age Banking. Its all about convenience

banking on our mobile phone. Now, we can experience the benefits of online

banking anywhere and anytime, without the need for a computer. All this

convenience comes to us in a secure and user-friendly application for phones

and tabs on the iOS and Android platforms.

4) Unstructured Supplementary Service Data (USSD) It helps to take command

of our bank account from our GSM mobile phone even without a GPRS

connection. Experience the benefits of banking on the move using USSD.

5) SMS Banking Carry your bank on your phone! Kotak Mahindra Bank's SMS

Banking service enables us to access our bank account, investment account and

demat account on our Mobile Phone. We get latest updates on our account

balance, salary credits, large debits, large credits, holding value and much more,

on our mobile anytime, anywhere. It is quick and easy, available to you 24X7

and it's absolutely free! Key Features We can access our bank account on our

Mobile Phone We can get latest updates of our account balance, salary credits,

and more

6) Alerts We can get Alerts on our mobile or by email for events that we would

like to keep track of. We can subscribe for automatic updates for our account

either on our mobile phone or email address. These alerts are sent on occurrence

of a particular transaction. For example, if the balance in your account falls

below the required Average Quarterly Balance, we get are informed through

ALERTS. Key Features Get automatic updates of our account on either our

mobile or email Get immediate update on a large debit or large credit in to our

account List of Alerts Given below are the Alerts that KOTAK offers: Large

Debit Alert Large Credit Alert Balance below Average Quarterly Balance Alert

Periodic Bank Account Balance - Daily/Weekly (Sent every Monday) Standing

Instruction (SI) Failure Alert

7) Phone Banking Kotak bank’s 24 hr customer service centre is at our service!

Our nearest Kotak Mahindra Bank branch is on your phone. They have a 24-

hour Customer Contact Center to offer us personalized service round the clock.

Just pick up the phone and please call their Center. Whether it is something as

urgent as a stop payment, cash or cheque pickup or we simply want to know our

balance, just give them a call. Their toll free number gives you access to our

account, from anywhere...anytime. And what's more, this facility comes to us

absolutely free of cost! The aim is to save time of customers as they do not have

to visit the branch every now & then for such tasks and facilitates great ease &

convenience. Key Features Quick and easy access from anywhere PIN based

security Customer Care Officers available 24 x 7

8) CARDS Simple. Transparent. Powerful. Secure. Credit Cards NRI Royale

Card, Delight Platinum Card, Fortune Gold Card, Corporate Card etc Debit

Cards Business Class - Gold Debit Card Classic Debit Card Gold Debit Card

Platinum Debit Card Best Compliments Card It lets our loved ones choose their

own gift or shop or enjoy at any place that accepts Visa cards, be it a shopping

mall, a restaurant or a multiplex. Kotak netc@rd Kotak netc@rd is a single use

limited validity online card created by us, from our bank account, at the time of

online shopping and cannot be used after your first payment. It combines the

benefit of using your bank account and the universal acceptance of a VISA Card

in a highly secure environment. It is a one-time credit card. It is a VIRTUAL

CREDIT CARD. It is offered only by Kotak Mahindra bank Kotak World

Travel Card Kotak Mahindra Bank brings us the Kotak World Travel Card, a

prepaid travel card that allows us to forget the hassles of carrying foreign

currency and traveller’s cheques. Now we can be free of the inconvenience of

encashment, potential of misplacement / theft and issues of universal

acceptability

9) ATM Network Their strategically located and constantly growing ATM

network brings the bank within our easy reach. The state of the art touch screen

Kotak Mahindra Bank ATMs are part of the Visa/Plus and Cash net ATM

network. That means you can withdraw cash from their ATM Network with any

International and Domestic Visa/Visa Electron/Plus Credit Cards/Debit Cards.

Key Features Access your account anytime anywhere State of the art Touch

Screen ATMs Affiliated to the VISA network Access any ATM in the country

absolutely free Services available 24-hour access to cash Transfer funds

between accounts View Account Balances and Mini Statement Pin Change

option

10) Cash Deposit Machine Cash Deposit Machine (CDM) is self-service

terminal that enables us to deposit cash without any manual intervention of the

branch officer. Now no need to fill deposit slips and stand in long queues at the

cash counter. Deposit cash through the simple and fast CDM installed in the

branch and we can get instant credit in our account. To use the CDM, we need

to have Kotak Bank Debit Card or know the Kotak Bank's account number in

which we wish to deposit the money. Key Features Instant credit in CASA

account. Immediate receipt. No need to fill cash deposit slips. No need to stand

in long queues. No need to sort and arrange cash denomination wise

11) Cheque Deposit Kiosk Cheque Deposit Kiosk (CDK) is a self-service

terminal that enables us to deposit cheque without any manual intervention of

the branch officer. Now there is no need for us to fill deposit slips and stand in

long queues at the counter. We can deposit our cheque through the simple and

fast CDK installed in the branch. To use the CDK, we need to have 'Kotak

Bank's account' number in which you wish to deposit the cheque. Key Features

Immediate receipt. No need to fill cheque deposit slips. No need to stand in long

queues

12) ASBA: (APPLICATION SUPPORTED BY BLOCK ACCOUNT)

Investing in IPO/FPO/Rights Issue is now simple and convenient through the

new this facility. Key Features Easy to apply in IPO/FPO/Rights Issue over

Phone / Net Banking Enjoy continued Returns on Blocked Amount Place

multiple bids Option to revise/withdraw the bid ASBA facility can also be

availed by High Net-worth Individuals, Corporate, Institutional Investors,

Promoters etc*, along with Retail Investors

13) E-tax: VAT, TDS, CST can be paid online, on monthly basis.

14) OTHERS: Demat services, Funds transfer between own accounts, Third

party transfers to accounts maintained at any branch of KOTAK, Group

Transfers to accounts in KOTAK BANKS, Inter Bank Transfers to accounts

with other Banks, Online standing instructions for periodical transfer for the

above, Request for Issue of Demand Draft, Request for opening of new

accounts, Request for closure of Loan Accounts, Home insurance, Health

insurance, Travel insurance, Motor insurance Card protection plan

MOBILE BANKING FEATURES

a) Banking Services Check balances of your savings & current accounts View

past transactions View / open term deposits Request for account statement,

cheque book or Debit Card PIN Transfer funds (own accounts, Kotak third

party, NEFT, RTGS or IMPS) Make payments without the need to register a

beneficiary through One Time Payment

b) Credit Card View summary of our Credit Cards Pay our Credit Card bills

View statements and unbilled transactions Request for ATM PIN, report loss or

damage of card Balance Transfer Convert transactions to EMIs Request add-on

cards Setup auto debit for our credit card bill payments

c) Bill Pay your bills Make instant payments to our registered billers

d) My Kotak My Kotak is a unique feature, where we can personalize our Home

Page to get all the information of our choice in one place. We can also choose

to view certain information without logging in with MPIN (Mobile Banking

PIN)

e) Service Requests Request for bank account statement Request for cheque

book Status enquiry of your cheque Stop cheque request for Debit Card PIN

Report loss of card Switch primary account of your Debit Card Stop cheque

payment.